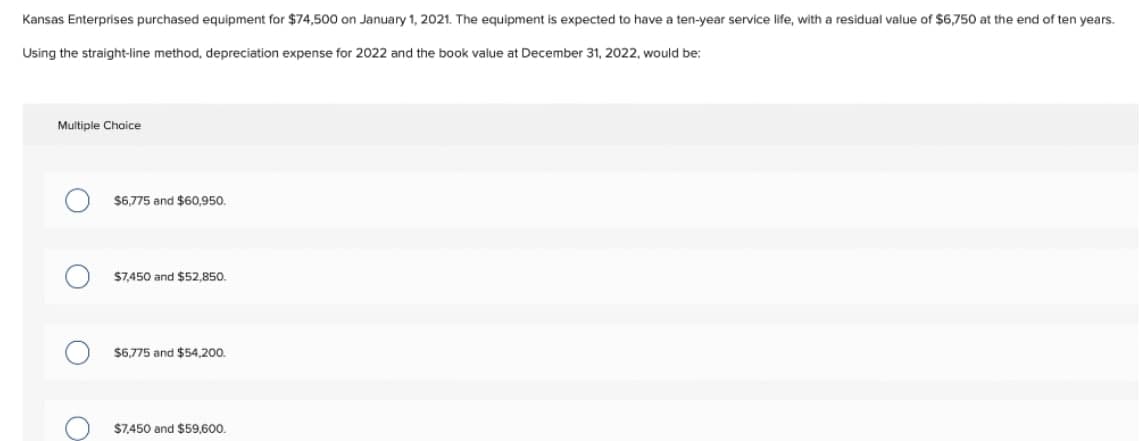

Kansas Enterprises purchased equipment for $74,500 on January 1, 2021. The equipment is expected to have a ten-year service life, with a residual value of $6,750 at the end of Using the straight-line method, depreciation expense for 2022 and the book value at December 31, 2022, would be: Multiple Choice $6,775 and $60,950. $7,450 and $52,850. $6,775 and $54,200.

Q: 8. On January 1, 20x1, ABC Bank extended a P1,000,000 loan to XYZ. Principal is due on December 31,…

A: Loan on Jan 01-2001 1000000 Principal Due on 31.12.2005 Rate of Interest 10% On…

Q: One of the bulk raw beverages, which Blanchard buys, is gin. Assume that the cost of purchasing…

A: The question is related to Inventory Management. The Economic Order Quantity is that level of…

Q: ou decide that you will issue floating rate bonds on 15 May 2021. The bonds have a face value of…

A: Issuance of floating rate Bond and payment of interest, where interest rate id linked with BBSW

Q: Burger Chef acquired a delivery truck on March 1, 2021, for $31,600. The company estimates a…

A: Formula: Depreciation per mile = ( Asset cost - Salvage value ) / Estimated miles

Q: Required: (a) Calculate Direct materials price and quantity variances. (b) Calculate Direct labour…

A: Introduction : The discrepancy between the standard cost of materials generated from production…

Q: G. The following information is taken from the adjusted on December 31, 200F: P 118,0C 2,60 420,00…

A: Income Statement (Functional Format) Particular Amount Amount Net sales 412400 Cost of…

Q: Addison, Inc. uses a perpetual inventory system. Below is information about one inventory item for…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: Which of the following statements relating to analysis of business documents or transactions is/are…

A: The question is related to Basic of Accounting.

Q: Pre pare a statement of cash flow using the indirect method

A: Net increase (decrease) in cash 55700 Beginning cash balance 48600 Ending cash balance…

Q: Adams Company established a predetermined variable overhead cost rate at S10.00 per direct labor…

A: Formula: Variable overhead cost variance = ( Standard cost - Actual cost ) x Actual hours

Q: University Printers has two service departments (Maintenance and Personnel) and two operating…

A: Lets understand the basics. Step method of cost allocation is as the name suggest allocate cost step…

Q: Unit IV question 13

A: ORIOLE CORP Cash Flow Statement (Indirect Method) For the year ended December 31 Cash Flow…

Q: Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two…

A: Answer - Working Note- Statement of Divisional Income Particular AC Division SO…

Q: sh of $13 per share. Mar. 9 6,000 preferred shares were issued for cash

A: A journal entry is an accounting entry that is used to record a business transaction in the…

Q: Miami Solar manufactures solar panels for industrial use. The company budgets production of 4,500…

A: Budgets are prepared to estimate the expected revenue and expenses. The direct labor budget can be…

Q: Altstadt Inc. sells a product for $50 per unit. The variable cost is $20 per unit, and fixed costs…

A: (a) Contribution margin per unit = Selling price - Variable cost per unit Contribution margin per…

Q: What are the stages of an audit from beginning to end.

A: The Auditing is an independent examination of financial statements of an organization whether Profit…

Q: 1) A monthly depreciation expense of $600 is recorded on a truck that was purchased for $27 000 and…

A: Formula: Depreciation rate = ( Annual depreciation expense / Depreciable value ) x 100

Q: Which of the following would be considered a cash outflow for investing activities? a. cash paid to…

A: The correct option is: (d) Cash paid to purchase equipment

Q: I it IV question 14

A: The question is related to Cash Flow Statement. Cash Flow Statement is summary of cash receipts and…

Q: Inventory records for Dunbar Incorporated revealed the following Number of Units Cost 430 420 Unit…

A: Introduction: LIFO: LIFO stands for Last in First out. Which means last received inventory to be…

Q: Larkspur Company reports the following costs and expenses in May. Factory utilities $16,000…

A: Period costs mean costs other than the product costs. These costs are not incurred on the production…

Q: 10 lbs. @ $4 per Ibs. Produced 4,1 3 hrs. @ $21 perhr. Materials purchased 51 Etion 3,620 units 42…

A: Material price variance refers to the concept which computes the difference between the actual and…

Q: Davie classified investments with original maturities of three months or less as cash equivalents.…

A: Cash and cash equivalents are the most liquid current assets found on a business's balance sheet.…

Q: Required: a. Complete the income statements for both divisions and the corporation as a whole.…

A: Solution:- You have the information of partial income statement and selected financial ratios for…

Q: What is the reason why there are still several discrepancies that can be found in the disbursement…

A: Disbursement voucher as the name itself suggests is the voucher which has been used by the company…

Q: On March 12, Medical Waste Services provides services on account to Grace Hospital for $10,700,…

A: There are three golden rules in accounting for recording the transaction : Debit what comes in ,…

Q: An entity acquired an operating license from the local council to operate a night club for ten years…

A: Yearly amortization of license = R150 00010 years = R15,000

Q: below is selected ed to at 31, reports fihancial

A: From the given info we will first prepare income statement for Dec 2020…

Q: Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year…

A: cash flow from investing activities includes the inflow and out flow of all the cash from the…

Q: Is it really vital for a manufacturing company to prepare a budgeted income statement and balance…

A: A planned income statement anticipates profits, sales, and costs for the upcoming year or months.…

Q: QUESTION 14 If you are in the highest tax bracket. your tax rate on long-term capital gains is O a.…

A: The correct answer for the above mentioned question is given in the following steps for your…

Q: Large trucks are an important piece of the logistics chain. However, there were 333,000 large truck…

A: Given Large trucks are an important piece of the logistics chain. However, there were 333,000 large…

Q: 3. Machinery, computers, and human skills and abilities are part of an organization's a. Environment…

A: Every business runs for the purpose of generating profit. Investment of resources is important for…

Q: On March 1, 20x1, ABC assigned its P4,000,000 accounts receivable to XYZ Bank in exchange for a…

A: Introduction The formula in computing the Equity on Assigned Accounts of ABC is shown below. Equity…

Q: Tanck Industries manufactures and sells three different models of wet dry shop vacuum cleaners.…

A: Contribution margin per unit = Selling price per unit - Variable cost per unit

Q: Debit Credit Cash $31,000 Accounts Receivable 7,400 Prepaid Insurance 21,000 Accounts Payable…

A:

Q: Below are the financial statements for Aspirations Pty Ltd. Statement of Financial Position at 30…

A: Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational…

Q: Almaden Hardware Store sells two product categories, tools and paint products. Information…

A: The accounting standards state that inventories should be reflected at a lower cost or net…

Q: he followin

A: A trial balance is a mix of balance sheet items and P&L items and hence all accounts that are…

Q: Which of the following statements is CORRECT relative to posting with the use of special journals?…

A: The accounting transactions are recorded in the receipt or invoice form, this is first step for…

Q: Quantity Cost $126 31 54 Net Realizable Value $157 26 44 Product Revolvers 14 27 Spurs Hats 11

A: Formula: Inventory value = Quantity x Lower of cost or NRV

Q: FINANCIAL POSITION: RATIO 2021 2020 2019 Current ratio CR= CR= CR = (CR)= 723,796/12,281,092…

A: A fall in the current ratio typically indicates inventory management issues, inadequate or weak…

Q: Cari Tank (CT) produces and sells water tanks for the Regional market. The following are estimates…

A: Break even (units)=Fixed annual costSelling Price-Variable cost per unit Sale at desired profit…

Q: Nhyiraba Limited lease a building worth R4 million to Quintin Limited under an operating lease for…

A: IAS 40 Investment Property applies to the accounting for property (land and/or buildings) held to…

Q: During Year 11, Pacilio Security Services experienced the following transactions: Paid the sales…

A: CFS stands for Cash Flow Statement which states the financial condition of the business as well as…

Q: What major trends in taxation income sources will have an impact on the firm? What action has the…

A: The taxation income is the income on which the company or the recipient of the income have to pay…

Q: Eagleson Company's quality cost report is to be based on the following data: Net cost of scrap…

A: Costs of quality are those costs which allows an organisation to determine the extent of usage of…

Q: Sheridan Homes Ltd., a private company reporting under ASPE, reported the following for the year…

A: Cash Flow Statement (Partial) For the year ended December 31, 2021 Amount (In $) Amount (In…

Q: Explain how a plantwide overhead rate, using a unit-based driver, can produce distorted product…

A: The plantwide overhead rate is a standard overhead rate used by a corporation to distribute all…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.Hunter Company purchased a light truck on January 2, 2019 for 18,000. The truck, which will be used for deliveries, has the following characteristics: Estimated life: 5 years Estimated residual value: 3,000 Depreciation method for financial statements: straight-line method Depreciation for income tax purposes: MACRS (3-year life) From 2019 through 2023, each year, Hunter had sales of 100,000, cost of goods sold of 60,000, and operating expenses (excluding depreciation) of 15,000. The truck was disposed of on December 31, 2023, for 2,000. Required: 1. Prepare an income statement for financial reporting through pretax accounting income for each of the 5 years, 2019 through 2023. 2. Prepare, instead, an income statement for income tax purposes through taxable income for each of the 5 years, 2019 through 2023. 3. Compare the total income for all 5 years under Requirements 1 and 2.On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was estimated at 2,000. The equipment will be depreciated over 10 years using the double-declining balance method. Counting the year of acquisition as one-half year, Mundo should record 2019 depredation expense of: a. 7,680 b. 9,000 c. 9,600 d. 10,000

- Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?Kam Company purchased a machine on January 2, 2019, for 20,000. The machine had an expected life of 8 years and a residual value of 300. The double-declining-balance method of depreciation is used. Required: 1. Compute the depreciation expense for each year of the assets life and book value at the end of each year. 2. Assuming that the company has a policy of always changing to the straight-line method at the midpoint of the assets life, compute the depreciation expense for each year of the assets life. 3. Assuming that the company always changes to the straight-line method at the beginning of the year when the annual straight-line amount exceeds the double-declining-balance amount, compute the depreciation expense for each year of the assets life.

- At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.

- Depreciation Methods Sorter Company purchased equipment for 200,000 on January 2, 2019. The equipment has an estimated service life of 8 years and an estimated residual value of 20,000. Required: Compute the depreciation expense for 2019 under each of the following methods: 1. straight-line 2. sum-of-the-years-digits 3. double-declining-balance 4. Next Level What effect does the depreciation of the equipment have on the analysis of rate of return?Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of zero. Bliss uses the straight -line method of depreciation. At the beginning of the sixth year, the assets book value is 200,000 and Bliss changes the estimate of the assets life to 25 years, so that 20 years now remain in the assets life. Explain how this change will be accounted for in Blisss financial statements, and compute the current and future annual depreciation expense.