CVP: Before- and After-Tax Targeted Income Head-Gear Company produces helmets for bicycle racing. Currently, Head-Gear charges a price of $240 per helmet. Variable costs are $96.00 per helmet, and fixed costs are $1,158,000. The tax rate is 25 percent. Last year, 14,000 helmets were sold. Required: 1. What is Head-Gear's net income for last year? 2. What is Head-Gear's break-even revenue? In your computations, round the contribution margin ratio to two decimal places. 3. Suppose Head-Gear wants to earn before-tax operating income of $915,600. How many units must be sold? Round to the nearest whole unit. units

CVP: Before- and After-Tax Targeted Income Head-Gear Company produces helmets for bicycle racing. Currently, Head-Gear charges a price of $240 per helmet. Variable costs are $96.00 per helmet, and fixed costs are $1,158,000. The tax rate is 25 percent. Last year, 14,000 helmets were sold. Required: 1. What is Head-Gear's net income for last year? 2. What is Head-Gear's break-even revenue? In your computations, round the contribution margin ratio to two decimal places. 3. Suppose Head-Gear wants to earn before-tax operating income of $915,600. How many units must be sold? Round to the nearest whole unit. units

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter16: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

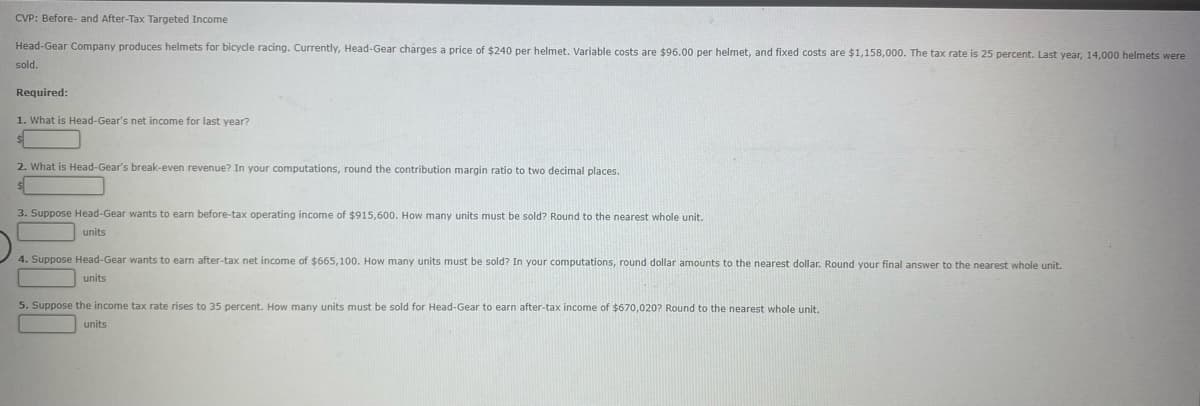

CVP: Before- and After-Tax Targeted Income

Head-Gear Company produces helmets for bicycle racing. Currently, Head-Gear charges a price of $240 per helmet. Variable costs are $96.00 per helmet, and fixed costs are $1,158,000. The tax rate is 25 percent. Last year, 14,000 helmets were

sold.

Required:

1. What is Head-Gear's net income for last year?

2. What is Head-Gear's break-even revenue? In your computations, round the contribution margin ratio to two decimal places.

3. Suppose Head-Gear wants to earn before-tax operating income of $915,600. How many units must be sold? Round to the nearest whole unit.

units

4. Suppose Head-Gear wants to earn after-tax net income of $665,100. How many units must be sold? In your computations, round dollar amounts to the nearest dollar. Round your final answer to the nearest whole unit.

units

5. Suppose the income tax rate rises to 35 percent. How many units must be sold for Head-Gear to earn after-tax income of $670,020? Round to the nearest whole unit.

Units

Transcribed Image Text:CVP: Before- and After-Tax Targeted Income

Head-Gear Company produces helmets for bicycle racing. Currently, Head-Gear charges a price of $240 per helmet, Variable costs are $96.00 per helmet, and fixed costs are $1,158,000. The tax rate is 25 percent. Last year, 14,000 helmets were

sold.

Required:

1. What is Head-Gear's net income for last year?

2. What is Head-Gear's break-even revenue? In your computations, round the contribution margin ratio to two decimal places.

3. Suppose Head-Gear wants to earn before-tax operating income of $915,600. How many units must be sold? Round to the nearest whole unit.

units

4. Suppose Head-Gear wants to earn after-tax net income of $665,100. How many units must be sold? In your computations, round dollar amounts to the nearest dollar. Round your final answer to the nearest whole unit.

units

5. Suppose the income tax rate rises to 35 percent. How many units must be sold for Head-Gear to earn after-tax income of $670,020? Round to the nearest whole unit.

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning