CyberMax Stockholders' Equity (Before purchase of Treasury Stock) $100.000 Common stock $10 par, 10,000 shares authorized and issues: Retained earnings Total stockholders' equity 25,000 $125,000 On May 1, CyberMax purchases 1,000 of its own shares for $11.50. 1. Prepare the journal entry to record the purchase of the treasury stock. 2. Prepare the stockholders' equity section after the purchase of the treasure stock.

CyberMax Stockholders' Equity (Before purchase of Treasury Stock) $100.000 Common stock $10 par, 10,000 shares authorized and issues: Retained earnings Total stockholders' equity 25,000 $125,000 On May 1, CyberMax purchases 1,000 of its own shares for $11.50. 1. Prepare the journal entry to record the purchase of the treasury stock. 2. Prepare the stockholders' equity section after the purchase of the treasure stock.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter15: Shareholders’ Equity: Capital Contributions And Distributions

Section: Chapter Questions

Problem 16E

Related questions

Question

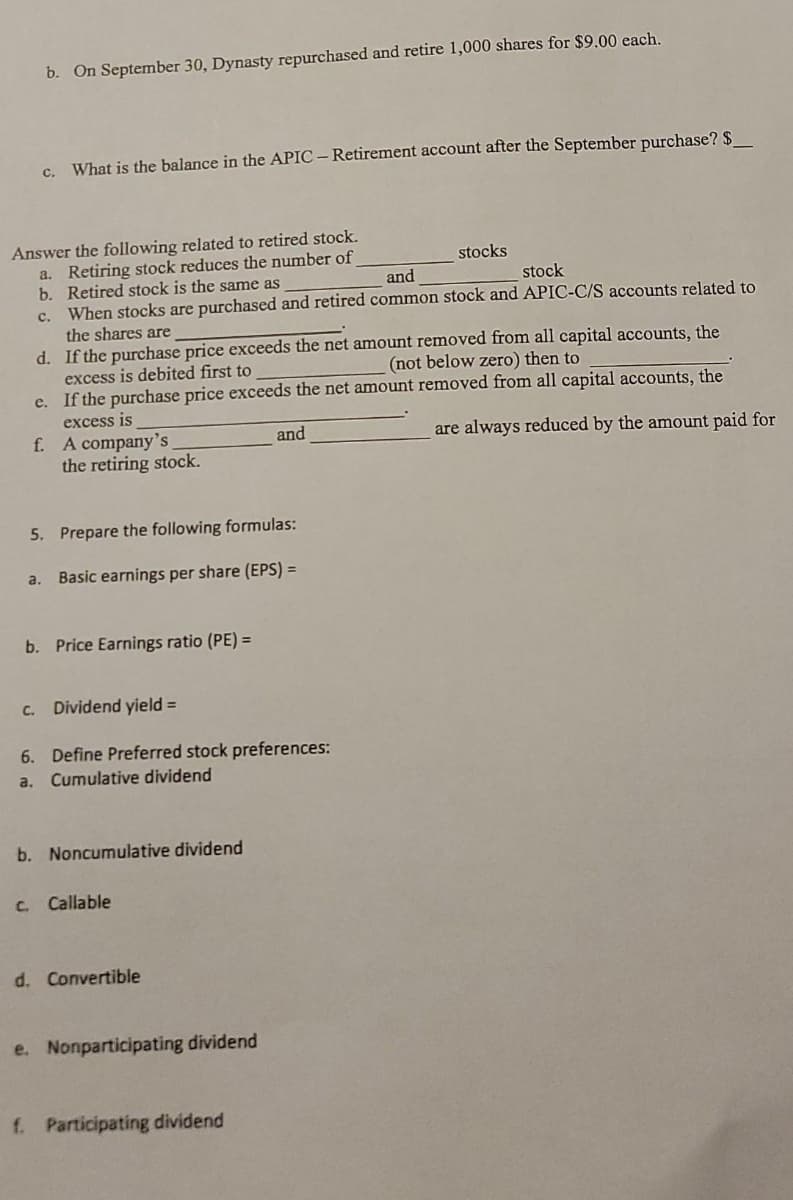

Transcribed Image Text:b. On September 30, Dynasty repurchased and retire 1,000 shares for $9.00 each,

c. What is the balance in the APIC- Retirement account after the September purchase? $

Answer the following related to retired stock.

a. Retiring stock reduces the number of

b. Retired stock is the same as

c. When stocks are purchased and retired common stock and APIC-C/S accounts related to

stocks

and

stock

the shares are

d. If the purchase price exceeds the net amount removed from all capital accounts, the

excess is debited first to

e. If the purchase price exceeds the net amount removed from all capital accounts, the

(not below zero) then to

excess is

f. A company's

the retiring stock.

and

are always reduced by the amount paid for

5. Prepare the following formulas:

a. Basic earnings per share (EPS) =

b. Price Earnings ratio (PE) =

c. Dividend yield =

6. Define Preferred stock preferences:

a. Cumulative dividend

b. Noncumulative dividend

C.

Callable

d. Convertible

e. Nonparticipating dividend

f. Participating dividend

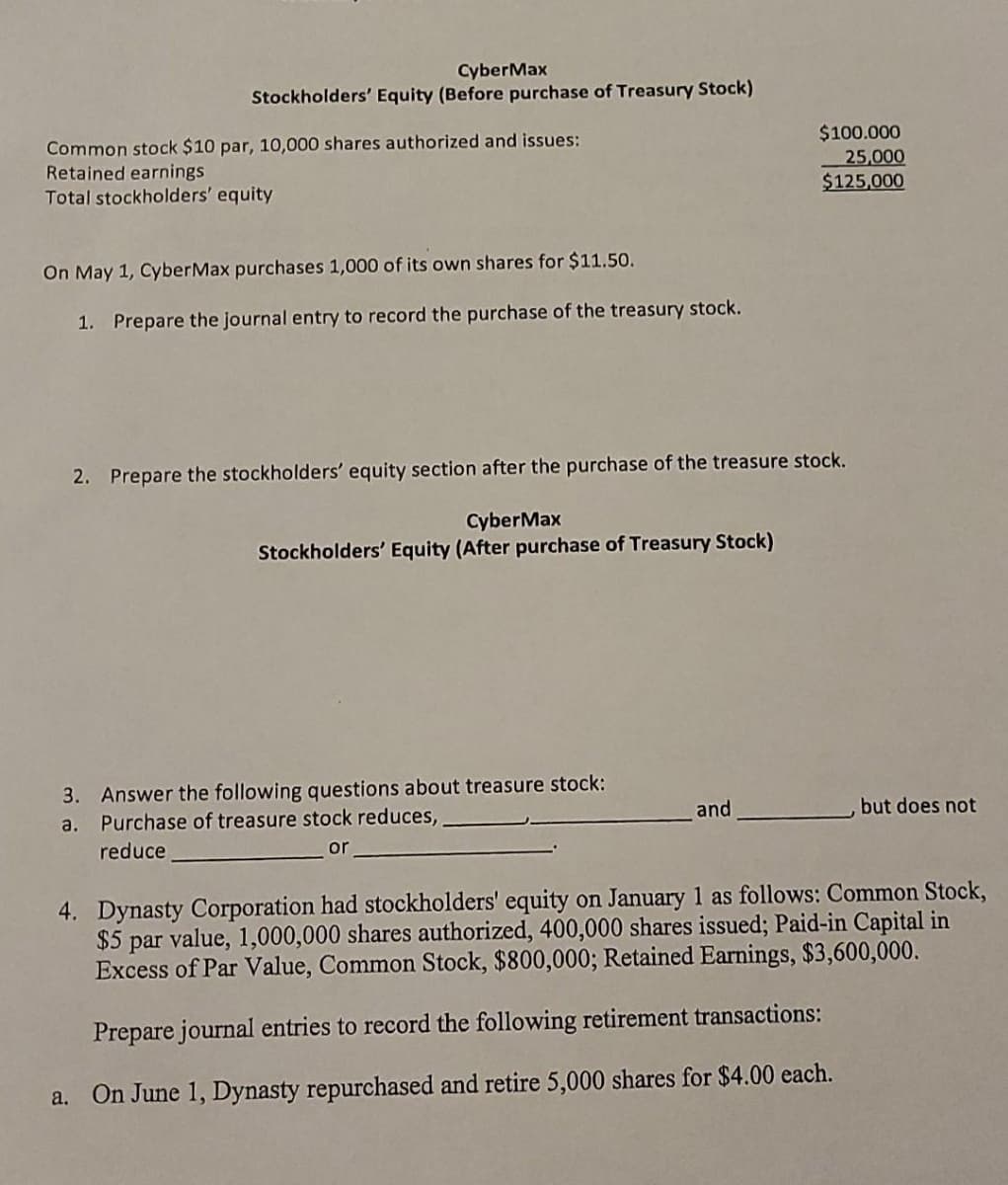

Transcribed Image Text:CyberMax

Stockholders' Equity (Before purchase of Treasury Stock)

Common stock $10 par, 10,000 shares authorized and issues:

Retained earnings

Total stockholders' equity

$100.000

25,000

$125,000

On May 1, CyberMax purchases 1,000 of its own shares for $11.50.

1. Prepare the journal entry to record the purchase of the treasury stock.

2. Prepare the stockholders' equity section after the purchase of the treasure stock.

CyberMax

Stockholders' Equity (After purchase of Treasury Stock)

3. Answer the following questions about treasure stock:

Purchase of treasure stock reduces,

a.

and

but does not

reduce

or

4. Dynasty Corporation had stockholders' equity on January 1 as follows: Common Stock,

$5 par value, 1,000,000 shares authorized, 400,000 shares issued; Paid-in Capital in

Excess of Par Value, Common Stock, $800,000; Retained Earnings, $3,600,000.

Prepare journal entries to record the following retirement transactions:

On June 1, Dynasty repurchased and retire 5,000 shares for $4.00 each.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,