D. Compute tne stanaara aeviation Tor tne corporate Dona Tuna ana Tor tne common stOCK Tuna. The standard deviation for the corporate bond fund is. (Round to two decimal places as needed.) The standard deviation for the common stock fund is (Round to two decimal places as needed.) c. Would you invest in the corporate bond fund or the common stock fund? Explain. V that for the corporate bond fund, the common stock fund V fund should be chosen. Since the standard deviation for the common stock fund is Based on the expected value, the V the risk when making a decision. V the corporate bond fund and an investor d. If you chose to invest in the common stock fund in (c), what do you think about the possibility of losing $990 of every $1,000 invested if there is an extreme recession? O A. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose 50% of your entire investment. O B. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose virtually all of your entire investment. O C. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose 50% of your entire investment. O D. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose virtually all of your entire investment.

D. Compute tne stanaara aeviation Tor tne corporate Dona Tuna ana Tor tne common stOCK Tuna. The standard deviation for the corporate bond fund is. (Round to two decimal places as needed.) The standard deviation for the common stock fund is (Round to two decimal places as needed.) c. Would you invest in the corporate bond fund or the common stock fund? Explain. V that for the corporate bond fund, the common stock fund V fund should be chosen. Since the standard deviation for the common stock fund is Based on the expected value, the V the risk when making a decision. V the corporate bond fund and an investor d. If you chose to invest in the common stock fund in (c), what do you think about the possibility of losing $990 of every $1,000 invested if there is an extreme recession? O A. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose 50% of your entire investment. O B. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose virtually all of your entire investment. O C. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose 50% of your entire investment. O D. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose virtually all of your entire investment.

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter10: Sequences, Series, And Probability

Section10.8: Probability

Problem 68E

Related questions

Topic Video

Question

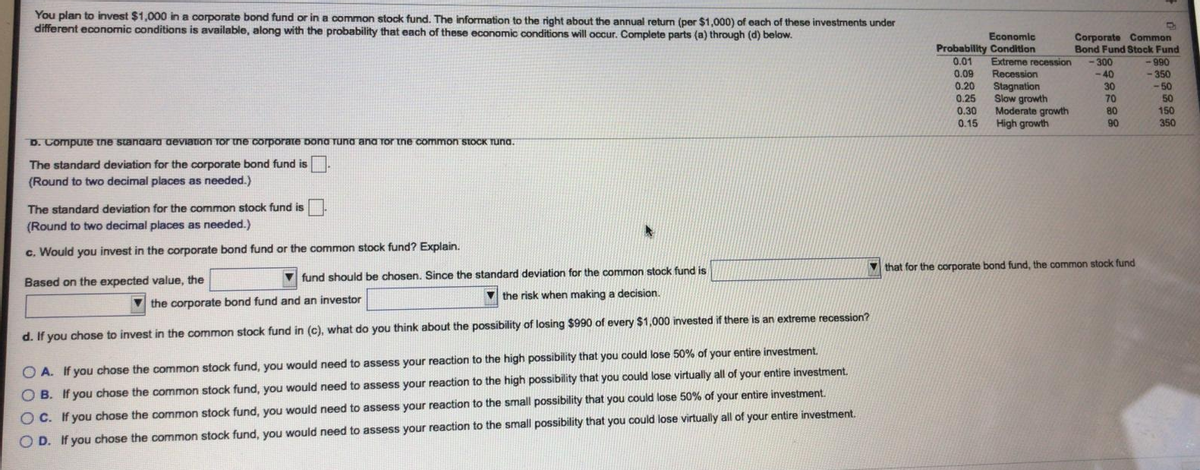

Transcribed Image Text:You plan to invest $1,000 in a corporate bond fund or in a common stock fund. The information to the right about the annual return (per $1,000) of each of these investments under

different econonic conditions is available, along with the probability that each of these economic conditions will occur. Complete parts (a) through (d) below.

Economic

Probability Condition

0.01

0.09

Corporate Common

Bond Fund Stock Fund

<-300

Extreme recession

066-

350

Recession

-40

0.20

Stagnation

Slow growth

Moderate growth

High growth

30

- 50

0.25

70

50

0.30

80

150

350

0.15

90

D. Compute the standara deviation Tor ne corporate Dona Tuna ana Tor tne common STOCK Tuna.

The standard deviation for the corporate bond fund is

(Round to two decimal places as needed.)

The standard deviation for the common stock fund is .

(Round to two decimal places as needed.)

c. Would you invest in the corporate bond fund or the common stock fund? Explain.

V that for the corporate bond fund, the common stock fund

V fund should be chosen. Since the standard deviation for the common stock fund is

Based on the expected value, the

the risk when making a decision.

the corporate bond fund and an investor

d. If you chose to invest in the common stock fund in (c), what do you think about the possibility of losing $990 of every $1,000 invested if there is an extreme recession?

O A. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose 50% of your entire investmer

O B. If you chose the common stock fund, you would need to assess your reaction to the high possibility that you could lose virtually all of your entire investment.

O C. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose 50% of your entire investment.

O D. If you chose the common stock fund, you would need to assess your reaction to the small possibility that you could lose virtually all of your entire investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL