Sensitivity analysis: Boulder Creek Industries Boulder Creek Industries is considering an investment in equipment based on the following estimates: Cost of equipment $3,000,000 Residual value 200,000 Useful life 10 years a. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $800,000. Use the present value tables appearing in Exhibit 2 and 5 of this chapter. Net present val ue $ b. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2 and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value. Annual Net Cash Flow $800,000 $400,000 $600,000 Net present value C. Determine the net present value of the equipment, assuming a desired rate of return of 15% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2 and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value. $800,000 Annual Net Cash Flow $400,000 $600,000 Net present value d. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar. Annual Net Cash Flow $ e. Boulder Creek industries wish to invest in an eauipment and the proiections for the same is as follows: Net cash inflow $400,000 $600,000 $800,000 Net present value ($675,600) $454,400 $1,584,400 Based on the above information, when Boulder Creek industries accepts the project? (a) If the net cash flow is $600,000 (b) If the net cash flow is $800,000 (c) If the net cash flow is $400,000 (d) Both $600,000 and $800,000 net cash flow. Boulder creek industries wish to make a new investment in the equipment. Identify the statement that related to the investment decision. (a) The net present value should be positive for the investment. (b) Rate of return and its relationship to the net present value. (c) Net cash inflows out of the investment. (d) All the above

Sensitivity analysis: Boulder Creek Industries Boulder Creek Industries is considering an investment in equipment based on the following estimates: Cost of equipment $3,000,000 Residual value 200,000 Useful life 10 years a. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $800,000. Use the present value tables appearing in Exhibit 2 and 5 of this chapter. Net present val ue $ b. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2 and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value. Annual Net Cash Flow $800,000 $400,000 $600,000 Net present value C. Determine the net present value of the equipment, assuming a desired rate of return of 15% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2 and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value. $800,000 Annual Net Cash Flow $400,000 $600,000 Net present value d. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar. Annual Net Cash Flow $ e. Boulder Creek industries wish to invest in an eauipment and the proiections for the same is as follows: Net cash inflow $400,000 $600,000 $800,000 Net present value ($675,600) $454,400 $1,584,400 Based on the above information, when Boulder Creek industries accepts the project? (a) If the net cash flow is $600,000 (b) If the net cash flow is $800,000 (c) If the net cash flow is $400,000 (d) Both $600,000 and $800,000 net cash flow. Boulder creek industries wish to make a new investment in the equipment. Identify the statement that related to the investment decision. (a) The net present value should be positive for the investment. (b) Rate of return and its relationship to the net present value. (c) Net cash inflows out of the investment. (d) All the above

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1MAD: San Lucas Corporation is considering investment in robotic machinery based upon the following...

Related questions

Question

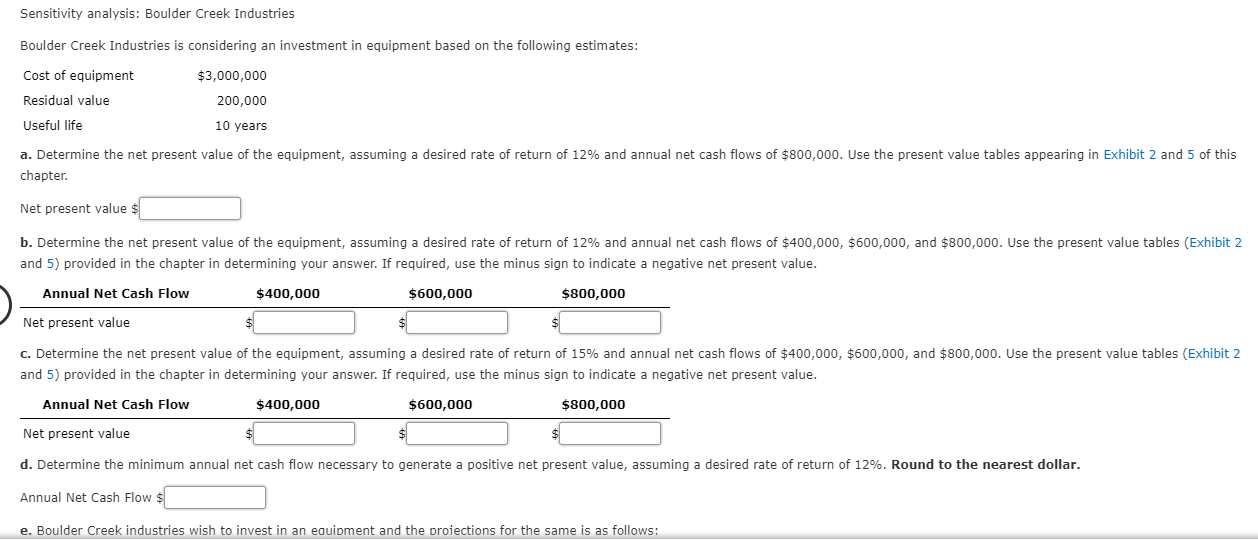

Transcribed Image Text:Sensitivity analysis: Boulder Creek Industries

Boulder Creek Industries is considering an investment in equipment based on the following estimates:

Cost of equipment

$3,000,000

Residual value

200,000

Useful life

10 years

a. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $800,000. Use the present value tables appearing in Exhibit 2 and 5 of this

chapter.

Net present val ue $

b. Determine the net present value of the equipment, assuming a desired rate of return of 12% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2

and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value.

Annual Net Cash Flow

$800,000

$400,000

$600,000

Net present value

C. Determine the net present value of the equipment, assuming a desired rate of return of 15% and annual net cash flows of $400,000, $600,000, and $800,000. Use the present value tables (Exhibit 2

and 5) provided in the chapter in determining your answer. If required, use the minus sign to indicate a negative net present value.

$800,000

Annual Net Cash Flow

$400,000

$600,000

Net present value

d. Determine the minimum annual net cash flow necessary to generate a positive net present value, assuming a desired rate of return of 12%. Round to the nearest dollar.

Annual Net Cash Flow $

e. Boulder Creek industries wish to invest in an eauipment and the proiections for the same is as follows:

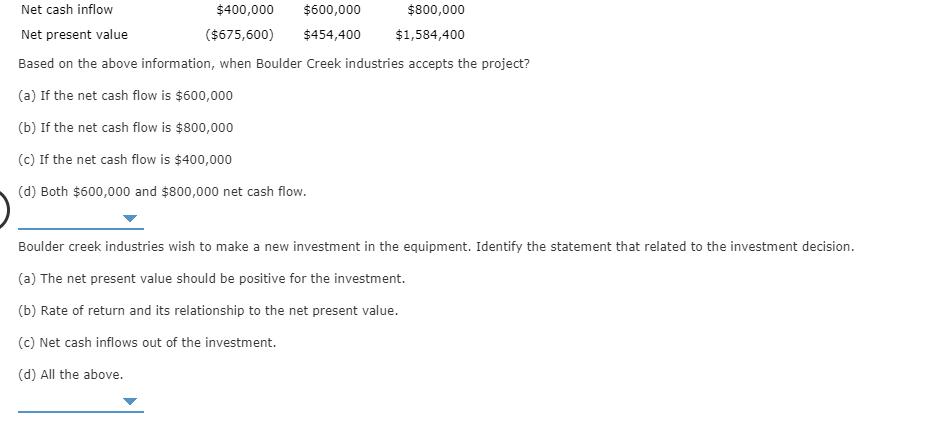

Transcribed Image Text:Net cash inflow

$400,000

$600,000

$800,000

Net present value

($675,600)

$454,400

$1,584,400

Based on the above information, when Boulder Creek industries accepts the project?

(a) If the net cash flow is $600,000

(b) If the net cash flow is $800,000

(c) If the net cash flow is $400,000

(d) Both $600,000 and $800,000 net cash flow.

Boulder creek industries wish to make a new investment in the equipment. Identify the statement that related to the investment decision.

(a) The net present value should be positive for the investment.

(b) Rate of return and its relationship to the net present value.

(c) Net cash inflows out of the investment.

(d) All the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

d. Determine the minimum annual net cash flow necessary to generate a positive

Annual Net Cash Flow fill in the blank 1 of 1$

Solution

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College