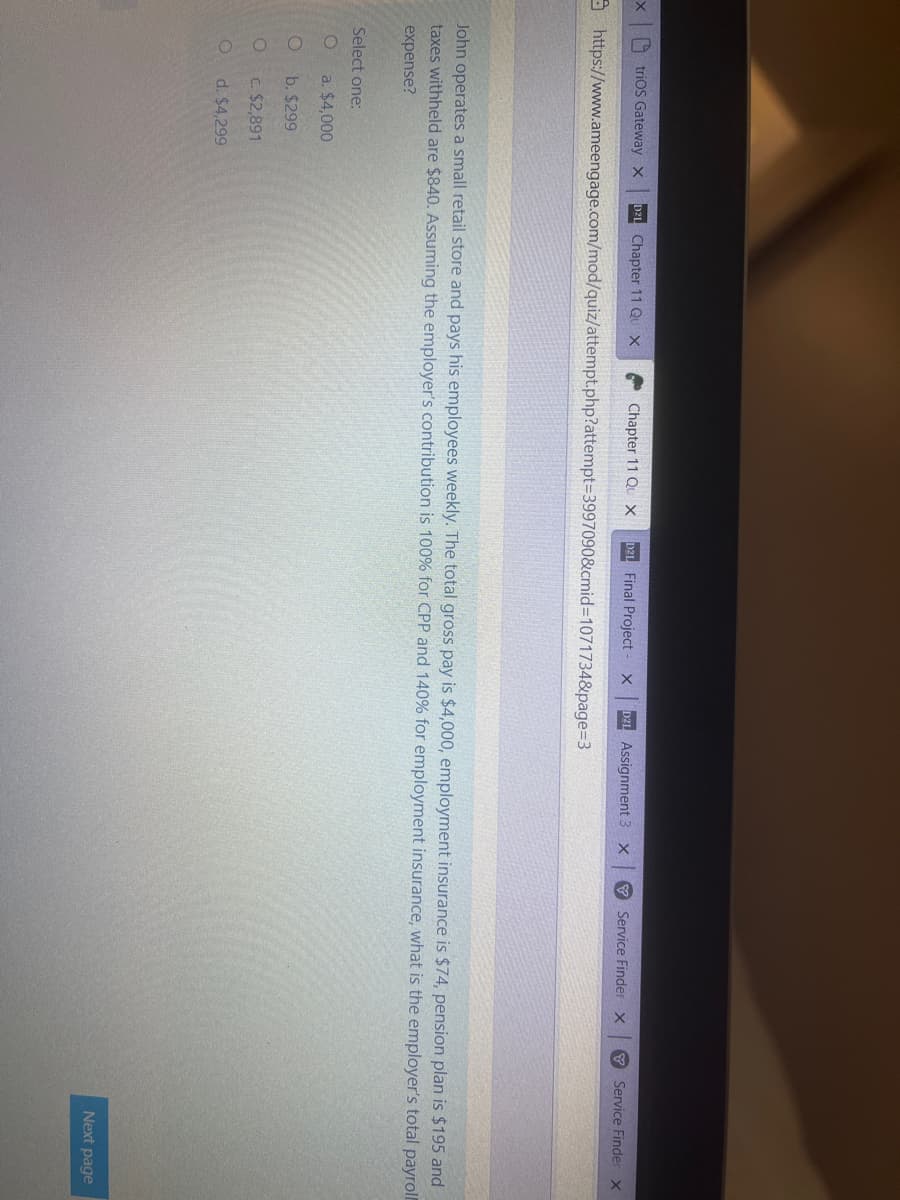

d. $4,299

Q: What is the special function that auditors perform? Whom doesthe external auditing profession serve…

A: Auditing: It is an independent assessment of an organization's financial information to determine…

Q: At the start of 2019, Croton’s Debt Service Fund had no assets or liabilities. Prepare appropriate…

A: Journal Entries in the Books of Croton’s Debt Service Fund S. No Fund Particulars Debit ($)…

Q: Current Assets Acct Receivable Inventory Prepaid Expenses Current Liabilities AP Accrued liabilities…

A: The cash flow statement is the financial statement of the business which records the cash flow from…

Q: a. Management expects to sell equipment that cost $14,000 at a gain of $7,000. Accumulated…

A: Cash Receipt :— It is the amount of cash received from transaction involving cash inflow. Cash…

Q: Required information Dierich Company uses an activity-based costing system with three activity cost…

A: Activity based costing is one of the costing method which is used for allocation of indirect costs…

Q: Discuss the above paragraph within the context of fair value hierarchy focusing on Levell, 2 and 3…

A: IFRS 13 defines fair value as the price that would be received to sell an asset or paid to transfer…

Q: On December 31, 2021, Mr. Eusebio enters into a contract will Brandon Corp, to transfer a license…

A: On transfer of the license of a franchise a specific fee is paid, it is called franchise fees. They…

Q: FunTime Company produces three lines of greeting cards: scented, musical, and regular.Segmented…

A: Income Statement The income statement is defined as the financial statement that explains the…

Q: The fact that generally accepted accounting principles allow companies flexibility in choosing…

A: Straight Line Depreciation Method :— In this method of depreciation, depreciation expense per year…

Q: TB MC Qu. 12-88 (Algo) Estimated net present value (NPV) of this proposed investment: Burn…

A: Calculation of Net present value:- Net present value = $ 442,475 EXPLANATION:- Given…

Q: The information below is from the Takafel Company.: 1. Investment property is acquired August…

A: When any Investment Property is purchased, it is recorded in the books of accounts at its…

Q: follow up question is as follows: Is the $90 for the fixed factory overhead volume variance…

A: Fixed overhead volume variance is difference between recovered overhead and budgeted over head.…

Q: 080 < CO #3 TABLE 4 Present Value of an Annuity of 1 (u) Payments 12% 5% .95238 %L 0.93458 %6 .91743…

A: Net present value calculation is one of the important technique of project evaluation. This is…

Q: Which of the following is most associated with financial accounting reports? a.prepared in…

A: Introduction: Financial reporting is characterized by the publishing of financial statements, which…

Q: Company ABX in Toronto is shipping 1050 units of computers to South Korea. Each computer is priced…

A: Insurance is an agreement under which the insurer that is from whom insurance has been taken,…

Q: writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off.…

A: The allowance for doubtful accounts is created to record estimated bad debt expense for the period.…

Q: An entity reported the following data on December 31,2019: Cash in bank, net of bank overdraft of…

A: Cash in bank net of bank o/d of 100000 = 1200,000 Cash in bank (Gross) = 1200,000 + 100,000 =…

Q: Carter Corp. uses the "Income Summary" account when it makes its closing entries. The following…

A: Lets understand the basics. Temporary accounts are accounts which needs to be closed at the year end…

Q: A manufacturer offers a 25/20 c discount if the invoice subtotal is $1,000. If the list price is $52…

A: Companies gives discount to attract the sales and increase the sales of company but that is the cost…

Q: At the beginning of the current year, Grant Company’s work in process inventory account had a…

A: WIP refers to work in process account . Direct materials , direct labor and overhead are production…

Q: Exercise 7-17 (Algo) Part 2 2. Assume the tractor was sold for $10,000 instead of $16,000. Record…

A: Journal entries refers to the recording of financial transaction in the books of the company during…

Q: A revenue account is closed by debiting Income Summary and crediting Service Revenue. True or False

A: A major step in the accounting cycle that must not be skipped by any company is the closing process.…

Q: Required: Compute the amount of Net Sales to be reported for the month ended July 31. (Round your…

A: Sales revenue refers to the amount received by the company from selling goods and services to the…

Q: CONCORD INC. Statement of Cash Flows Adjustments to reconcile net income to > < $ LA LA

A: Statement of Cash Flows :— It is a financial statement which shows change in cash & cash…

Q: How to treat interest expense when preparing a Statement of Cash flows? Interest paid is reported…

A: Operating activity under cash flow statement represent the amount of cash inflows and outflows from…

Q: Which of the following terms is used to describe the process of developing the organization’s…

A: Improving process: it is a process of identifying and analysing of existing process improving them…

Q: Segregation of duties is an important internal control. However,this control is often a challenge…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Starlight Ltd. assigned $600,000 of Accounts Receivable to Moonbeam Management as security for a…

A:

Q: Compute the cost allocations to Dept. S and Dept. T under the reciprocal method: To T: S To S: S

A: Cost Allocation :— cost allocation is the process of assignment of cost in Different Department on…

Q: ote payable to the Bank of the Giniling Islands for P2,400,000 is outstanding on December 31, 2022.…

A: Note Payable : It is a written document where the borrower is promise to pay the amount of debt to…

Q: ISEC 4340 - Assignment 2 Business Continuity Plan (BCP) Audit Salalah Hilton Garden Hotel is…

A: Introduction BCP Audit: A business continuity plan (BCP) is a file that includes the important…

Q: The following selected information is for H55 Corporation: Total assets Total shareholders' equity…

A: Gross profit takes into consideration only direct expenses whereas net profit takes into…

Q: S1] Under the current PPRS, a franchisor recognizes the initial franchise fee as revenue in full at…

A: Here asked for multi question we will solve for first question for you according to guidelines. If…

Q: Determine the cost per kit to manufacture the model airplane kits. Prepare a cost of goods sold…

A: This question belongs to the cost sheet and budget preparations. The projected manufacturing cost…

Q: b. IKEA Berhad used the allowance method to account for uncollectible accounts. Apr 1 Sold RM2,500…

A: Date Particulars Debit (RM) Credit (RM) Apr-01 Notes Receivables 2500 0 Sales 0 2500…

Q: Assume that management had determined that its organization’saudit committee is not effective. How…

A: Here discuss about the details of weakness of the Audit committee which are affected into the…

Q: Exercise 14-7 (Algo) Trend Percentages [LO14-1] Rotorua Products, Limited, of New Zealand markets…

A: >Trend Percentage Analysis is one of the analysis of the financial statements, where the results…

Q: 8. The company sold P250,000 goods for P300,000, on account. Terms: 5%, 3/10, 9. In connection with…

A: The journal keeps the record for day to day transactions of the business on regular basis. The…

Q: Journalize the transactions. If an amount box does not require an entry, leave it blank. Feb. 5.…

A: Common Stocks and Preferred Stocks are the modes of raising funds for the Comapny. Common stock…

Q: Bobbi Clothing manufactures clothing. Information about a production week is as follows: Standard…

A: Time variance (Actual hours worked - standard hours) * standard rate per hour

Q: onsider the data below and perform the following for company YZ.…

A: "Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Rs. 15,000 and Direct Expenses - Rs. 3,000. Direct wages Chargeable expenses Opening stock of raw…

A: The prime costs include the total direct costs incurred for the production. Prime cost = Direct…

Q: Sam Ple, auditor, has decided to rely on an audit client’s debtors. Sam Ple plans to use sampling…

A: Introduction: An auditor verifies the accuracy of business transactions that have been documented.…

Q: A lease of $7,200 had to be repaid with payments of $375 at the beginning of every quarter. The…

A: Lease is a kind of contract by which one party lease its asset to another in return of periodic…

Q: What principal will make a profit of $71.99 at 8 ½% in 200 days?

A: The question is related to the Simple Interest and Principal Simple Interest = P × R × T P =…

Q: Perpetual Inventory Using Weighted Average Beginning inventory, purchases, and sales for WCS12 are…

A: The different methods of inventory valuation are classified as: FIFO LIFO Weighted average method.…

Q: Which of the following is not a characteristic of useful managerial accounting reports?…

A: Managerial accounting reports are meant for the internal management of a company and not for…

Q: Rochester Flour Mills purchased new equipment and made the following expenditures: Purchase price…

A: Expenditure: The sum amount paid for the acquisition of a product or service is referred to as the…

Q: On January 1,2020, Andrea signs a 5-year noncancelable lease agreement to lease a heavy equipment to…

A: Annual Lease Payment: Lease payments are payments made in accordance with a lease agreement, in…

Q: JB Ltd was incorporated on 1 July 2021 and issued a prospectus inviting applications for 200,000…

A: Working notes 1) assuming that all forfeited amount must be refunded as per Constitution without…

Step by step

Solved in 2 steps

- Investment reporting Teasdale Inc. manufactures and sells commercial and residential security equipment. The comparative unclassified balance sheets for December 31, Year 2 and Year 1 are provided below. Selected missing balances are shown by letters. Teasdale Inc. Balance Sheet December 31, Year 2 and Year 1 Dec. 31, Year 2 Dec. 31, Year 1 Cash 160,000 156,000 Accounts receivable (net) 11S.OOO 108,000 Available for-sale investments (at cost)Note 1 a. 91,200 Plus valuation allowance for available-for-sale investments b. 8,776 Available for-sale investments (fair value) c 99,976 Interest receivable d. Investment in Wright Co. stockNote 2 e. 69,200 Office equipment (net) 96,000 105,000 Total assets f. 5538,176 Accounts payable 91,000 72,000 Common stock 80,000 80,000 Excess of issue price over par 250,000 250,000 Retained earnings g 127,400 Unrealized gain (loss) on available for-sale investments h. 8,776 Total liabilities and stockholders' equity S i. 5538,176 Note 1. Investments are classified as available for sale. The investments at cost and fair value on December 31, Year 1, are as follows: No. of Shares Cost per Share Total Cost Total Fair Value Alvarez Inc stock 960 38,00 36,480 39,936 Hirsch Inc. stock 1,900 28,80 4,720 60,040 91,200 99,976 Note 2. The Investment in Wright Co. stack is an equity method investment representing 30% of the outstanding shares of Wright Co. The following selected investment transactions occurred during Year 2: Mar. 18. Purchased 800 shares of Richter Inc. at 40, including brokerage commission. Richter is classified as an available-for-sale security. July 12. Dividends of 12,000 art: received on the Wright Co. investment. Oct 1. Purchased 24,000 of Toon Co. 4%, 10-year bonds at 100. the bonds are classified as available for sale. The bonds pay interest on October 1 and April 1. December 31. Wright Co. reported a total net income of 80,000 for Year 2. Teasdale recorder equity earnings for its share of Wright Co. net income. 31. Accrued interest for three months on the Toon Co. bonds purchased on October 1. 31. Adjusted the available-for-sale investment portfolio to fair value, using the following fair value per-share amounts: Available for Sale Investments Fair Value Alvarez Inc. stock 41,50 per share Hirsch Inc stock 26,00 per share Richter Inc. stock 48,00 per share Toon Co. bonds 101 per 100 of face amount 31. Closed the Teasdale Inc. net income of 51,240. Teasdale Int. paid no dividends during the year. Instructions Determine the missing letters in the unclassified balance sheet. Provide appropriate supporting calculations.45. Minutes. I already bought bartlet I hope u can help me to answer this activity of mine.1 Engineering Economic > ECONOMICSEthical Dilemma: Recognition Point and Ethical Considerations C7. Business Application ▶ Robert Shah, a sales representative for Quality Office Supplies Corporation, will receive a substantial bonus if he meets his annual sales goal. The company’s recognition point for sales is the day of shipment. On December 31, Shah realizes he needs sales of $2,000 to reach his sales goal and receive the bonus. He calls a purchaser for a local insurance company, whom he knows well, and asks him to buy $2,000 worth of copier paper today. The purchaser says, “But Robert, that’s more than a year’s supply for us.” Shah says, “Buy it today. If you decide it’s too much, you can return however much you want for full credit next month.” The purchaser says, “Okay, ship it.” The paper is shipped on December 31 and recorded as a sale. On January 15, the purchaser returns $1,750 worth of paper for full credit (approved by Shah) against the bill. Should the shipment on December 31 be recorded as a…

- 45. Minutes. I already bought bartlet I hope u can help me to answer this activity of mine.GO GO GO. 4 Engineering Economic > ECONOMICSACC 202 Milestone One: Operational Costs Data Appendix You plan to open a small business for manufacturing pet collars, leashes, and harnesses. You have found a workshop space you can use for sewing your products. After some research and planning, you have estimates for the various operating costs for your business. The total square footage for the sewing rooms is 1,500 square feet broken into three areas (500 square feet each). You have taken out a loan for start-up costs, and the monthly payment is $550; it goes into effect immediately and should be accounted for in your costs. You will also collect a modest salary for the first year of $500 per month; remember to divide evenly among the services. Salary and Hiring Data One collar maker, who will be paid $16.00 per hour and work 40 hours per week One leash maker, who will be paid $16.00 per hour and work 40 hours per week One harness maker, who will be paid $17.00 per hour and work 40 hours per week One receptionist, who will…Please give me the correct answer and solution pls. 10. The current assets of Domino's Gift shop by month for the last year are P500, P400, P300, P400, P500, P550, P600, P650, P700, P800, P950, P1,100. The amount of permanent current assets is a. 500 b. 400 c. 300 d. 1,100

- 6.16 Techstreet.com is a small web design business that provides services for two main types of websites: brochure sites and e-commerce sites. One package involves an up-front payment of $90,000 and monthly payments of 1.4¢ per “hit.” Kathy Cutler has a new eBay franchise and is considering the e-commerce package. She expects to have at least 6000 hits per month, and hopes that 1.5% of the hits will result in a sale. If the average income from sales (after fees and expenses) is $150, what rate of return per month will Kathy realize if she uses the website for 2 years?Problem 9-24 (LO. 3) Kristen, an independent management consultant, is based in Atlanta. During March and April of 2020, she is contracted by a national hardware chain to help implement revised human resource policies in Jackson (Mississippi) temporarily. During this period, Kristen flies to Jackson on Sunday night, spends the week at the district office, and returns home to Atlanta on Friday afternoon. The cost of returning home is $550, and the cost of spending the weekend in Jackson would have been $490. a. Presuming no reimbursement for these expenses, how much, if any, of these weekend expenses may Kristen deduct?$fill in the blank 9570f9fe1fa5079_1 b. What would your answer be if the amounts involved were reversed (i.e., the trip home would have cost $490; staying in Jackson would have been $550)? Kristen may deduct $fill in the blank 05a4acfc8fd204e_1 as weekend expenses.Ch. 7 Learn Smart-Problem Solving Please select the correct answer and explain how you arrived at that answer based on the question below. "ABC lumber spent $1,000 cutting down a tree. The result was 40 pieces of unfinished lumber that sell for $20 each and 100 bags of sawdust that sell for $1.00 each. If the unfished pieces of lumber are processed into finished lumber at a cost of $8 each, they will sell for $35. A bag of sawdust can be processed into Presto Logs that sell for $1.25 at a cost of $.75 per bag. Which of the following statements are true concerning whether the unfished pieces of lumber should be processed into finished lumber and whether the sawdust should be processed into Presto Logs" 1) The pieces of lumber should be processed 2) The pieces of lumber should be sold as is without being processed into finished lumber 3) The $1,000 cost of cutting down the tree is relevant to the decision 4) The sawdust should be processed into Presto Logs 5) The sawdust should be…

- EB1. LO 10.1 Ella Maksimovis CEO of her own marketing firm. The firm recently moved from a strip mall in the suburbs to an office space in a downtown building, in order to make the firm’s employees more accessible to clients. Two new clients are interested in using Ella’s advertising services but both clients are in the same line of business, meaning that Ella’s company can represent only one of the clients. Pampered Pooches wants to hire Ella’s firm for a one-year contract for web, newspaper, radio, and direct mail advertising. Pampered will pay $126,000 for these services. Ella estimates the cost of the services requested by Pampered Pooches to be $83,000. Delightful Dogs is interested in hiring Ella to produce mass mailings and web ads. Delightful will pay Ella $94,000 for these services and Ella estimates the cost of these services to be $47,000. Identify any relevant costs, relevant revenues, sunk costs, and opportunity costs that Ella Graham has to consider in making the decision…4C. Stay Safe Bhd (SSB) launched its new product, Super Sanitizer (SS), in January 2021.SSB faced bad publicity when the news went viral that customers suffered skin fleaallergy dermatitis due to using SS. The client filed a court action in November 2021,claiming damages of RM150,000. The lawyer had advised SSB that the chances for theclient to win the case are possible. The company paid RM5,000 for the lawyer's servicefee, including RM3,000 for services to be completed in the year 2022. REQUIRED:Explain the accounting treatment for the above situation regarding: i. Lawsuit of RM150,000; and ii. Professional fees of RM5,000.Justify your answers.Question 17 You are contemplating leaving your full-time employment to concentrate your ability on the marketing of a new low-energy portable heater. You have spoken to a group of manufacturers of similar product, and you have produced the following data based upon the production of 1200 heaters in the six months to December 31, 2021. R R Unit selling price 160 Less: Direct materials 50 Direct labour 30 Fixed Overheads: Admin 4.00 Rent 7.50 Rates…