d. Non-cumulative an 3. The shareholders' equity of BTY Corporation as of December 31, 2021 is shown below: Share Capital, P100 par, 5,000 shares issued and outstanding P500,000 30,000 200,000 Share Premium Retained Earnings Requirement: Compute the book value per share.

d. Non-cumulative an 3. The shareholders' equity of BTY Corporation as of December 31, 2021 is shown below: Share Capital, P100 par, 5,000 shares issued and outstanding P500,000 30,000 200,000 Share Premium Retained Earnings Requirement: Compute the book value per share.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 5MC: Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par...

Related questions

Question

Transcribed Image Text:Compute the book value per share assuming the preference share is:

three years including the

3. The shareholders' equity of BTY Corporation as of December 31, 2021 is

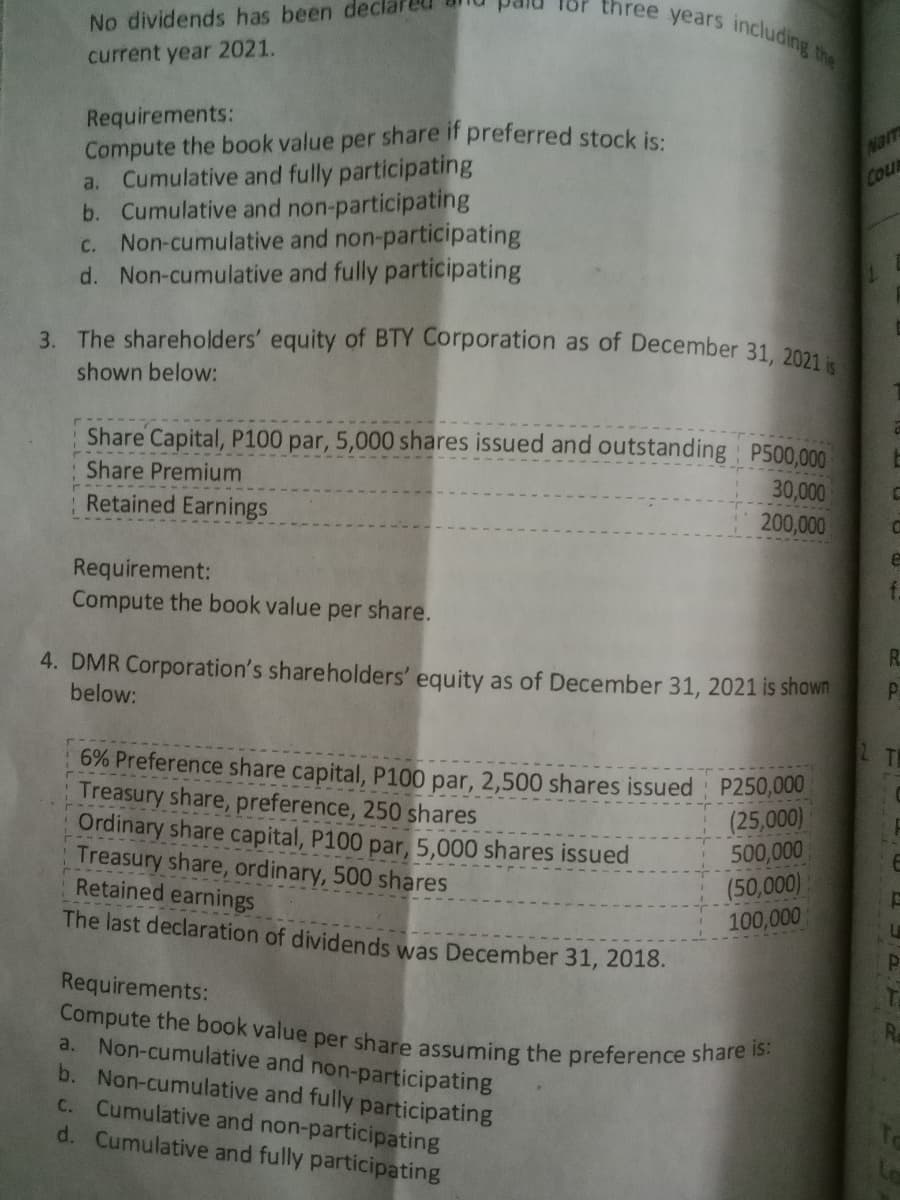

No dividends has been deck

current year 2021.

Requirements:

Compute the book value per share if preferred stock is:

a. Cumulative and fully participating

b. Cumulative and non-participating

c. Non-cumulative and non-participating

d. Non-cumulative and fully participating

Narm

Cou

shown below:

Share Capital, P100 par, 5,000 shares issued and outstanding P500,000

Share Premium

30,000

200,000

Retained Earnings

Requirement:

Compute the book value per share.

R.

4. DMR Corporation's shareholders' equity as of December 31, 2021 is shown

below:

2 TH

6% Preference share capital, P100 par, 2,500 shares issued P250,000

Treasury share, preference, 250 shares

Ordinary share capital, P100 par, 5,000 shares issued

Treasury share, ordinary, 500 shares

Retained earnings

The last declaration of dividends was December 31, 2018.

(25,000)

500,000

(50,000)

100,000

Requirements:

a. Non-cumulative and non-participating

b. Non-cumulative and fully participating

c. Cumulative and non-participating

d. Cumulative and fully participating

Transcribed Image Text:Less: Treasury share (at cost)

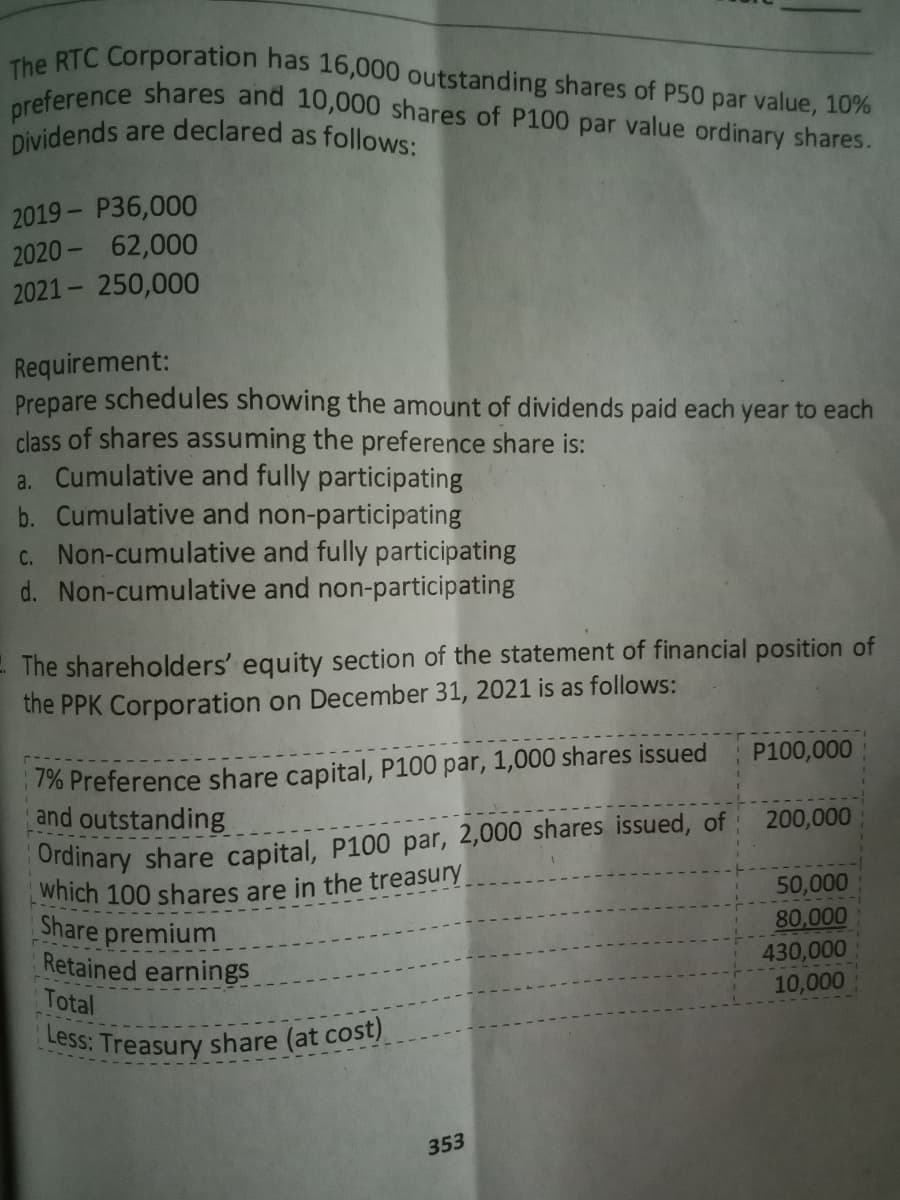

RTC Corporation has 16,000 outstanding shares of P50 par value, 10%

preference shares and 10,000 shares of P100 par value ordinary shares.

Dividends are declared as follows:

2019- P36,000

2020- 62,000

2021- 250,000

Requirement:

Prepare schedules showing the amount of dividends paid each year to each

class of shares assuming the preference share is:

a. Cumulative and fully participating

b. Cumulative and non-participating

C. Non-cumulative and fully participating

d. Non-cumulative and non-participating

The shareholders' equity section of the statement of financial position of

the PPK Corporation on December 31, 2021 is as follows:

1% Preference share capital, P100 par, 1,000 shares issued

and outstanding

Ordinary share capital, P100 par, 2,000 shares issued, of

Which 100 shares are in the treasury

Share premium

Retained earnings

Total

P100,000

200,000

50,000

80,000

430,000

10,000

353

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning