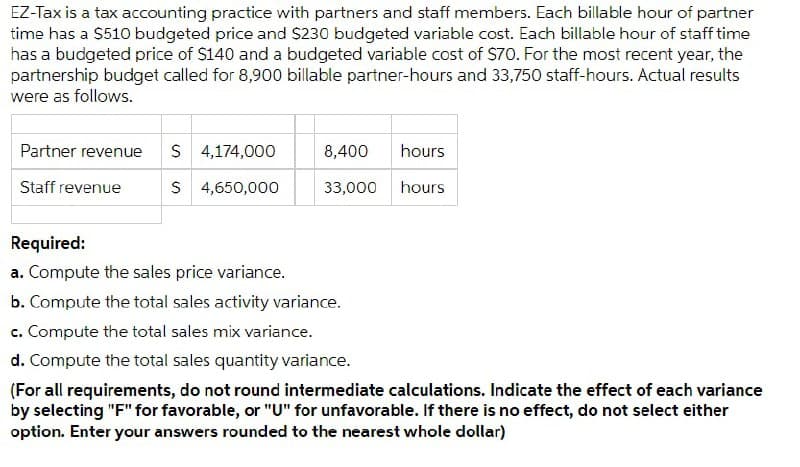

EZ-Tax is a tax accounting practice with partners and staff members. Each billable hour of partner time has a $510 budgeted price and S230 budgeted variable cost. Each billable hour of staff time has a budgeted price of S140 and a budgeted variable cost of S70. For the most recent year, the partnership budget called for 8,900 billable partner-hours and 33,750 staff-hours. Actual results were as follows. Partner revenue S 4,174,000 8,400 hours Staff revenue S 4,650,000 33,000 hours Required: a. Compute the sales price variance. b. Compute the total sales activity variance. c. Compute the total sales mix variance. d. Compute the total sales quantity variance. (For all requirements, do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Enter your answers rounded to the nearest whole dollar)

EZ-Tax is a tax accounting practice with partners and staff members. Each billable hour of partner time has a $510 budgeted price and S230 budgeted variable cost. Each billable hour of staff time has a budgeted price of S140 and a budgeted variable cost of S70. For the most recent year, the partnership budget called for 8,900 billable partner-hours and 33,750 staff-hours. Actual results were as follows. Partner revenue S 4,174,000 8,400 hours Staff revenue S 4,650,000 33,000 hours Required: a. Compute the sales price variance. b. Compute the total sales activity variance. c. Compute the total sales mix variance. d. Compute the total sales quantity variance. (For all requirements, do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option. Enter your answers rounded to the nearest whole dollar)

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter12: Activity-based Management

Section: Chapter Questions

Problem 4CE: Foy Company has a welding activity and wants to develop a flexible budget formula for the activity....

Related questions

Question

Transcribed Image Text:EZ-Tax is a tax accounting practice with partners and staff members. Each billable hour of partner

time has a $510 budgeted price and S230 budgeted variable cost. Each billable hour of staff time

has a budgeted price of S140 and a budgeted variable cost of $70. For the most recent year, the

partnership budget called for 8,900 billable partner-hours and 33,750 staff-hours. Actual results

were as follows.

Partner revenue

S 4,174,000

8,400

hours

Staff revenue

S 4,650,000

33,000

hours

Required:

a. Compute the sales price variance.

b. Compute the total sales activity variance.

c. Compute the total sales mix variance.

d. Compute the total sales quantity variance.

(For all requirements, do not round intermediate calculations. Indicate the effect of each variance

by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either

option. Enter your answers rounded to the nearest whole dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning