d. Prepare all journal entries relating to income tax. e. Compute the total income tax expense, identifying separately the current income tax expense and the deferred tax expanse

d. Prepare all journal entries relating to income tax. e. Compute the total income tax expense, identifying separately the current income tax expense and the deferred tax expanse

Chapter5: Corporations: Earnings & Profits And Dividend Distributions

Section: Chapter Questions

Problem 41P

Related questions

Question

d. Prepare all

e. Compute the total income tax expense, identifying separately the current income tax expense and the

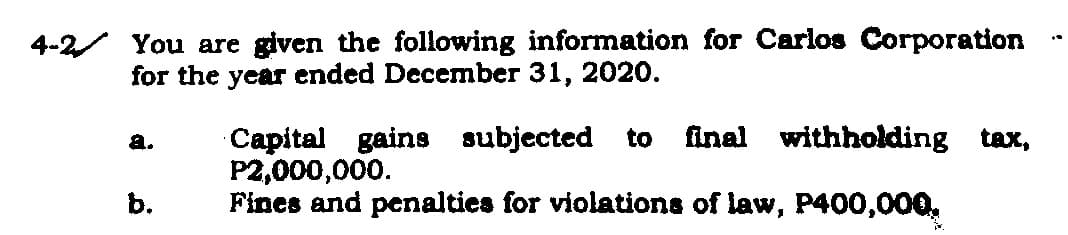

Transcribed Image Text:4-2 You are given the following information for Carlos Corporation

for the year ended December 31, 2020.

a.

b.

Capital gains subjected to final withholding tax,

P2,000,000.

Fines and penalties for violations of law, P400,000,

A

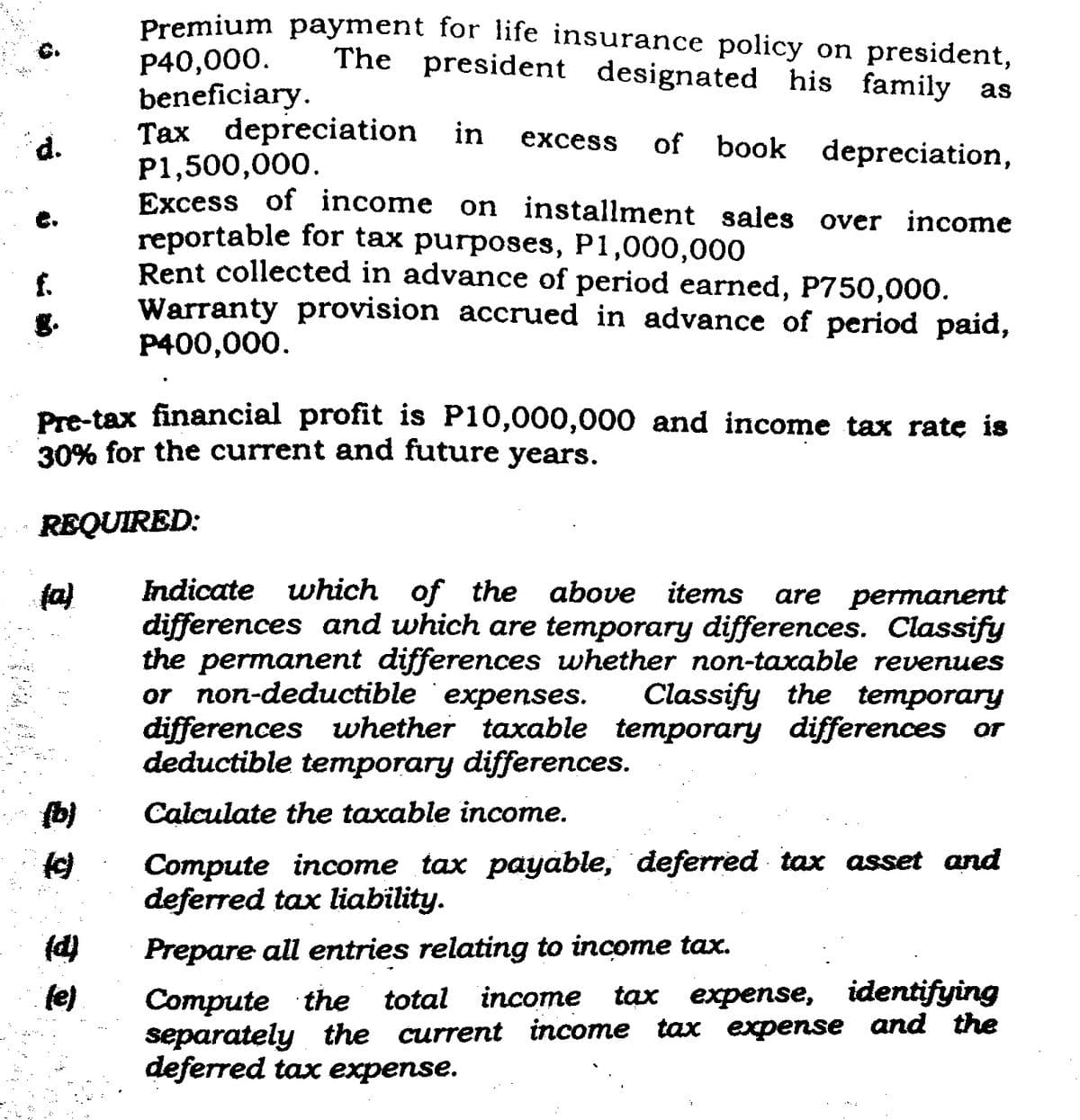

Transcribed Image Text:d.

f.

30

Pre-tax financial profit is P10,000,000 and income tax rate is

30% for the current and future years.

REQUIRED:

(a)

(b)

(c)

Premium payment for life insurance policy on president,

P40,000.

The president designated his family as

beneficiary.

Tax depreciation in excess

P1,500,000.

of book depreciation,

Excess of income on installment sales over income

reportable for tax purposes, P1,000,000

Rent collected in advance of period earned, P750,000.

Warranty provision accrued in advance of period paid,

P400,000.

(d)

(e)

Indicate which of the above items are permanent

differences and which are temporary differences. Classify

the permanent differences whether non-taxable revenues

or non-deductible expenses. Classify the temporary

differences whether taxable temporary differences or

deductible temporary differences.

Calculate the taxable income.

Compute income tax payable, deferred tax asset and

deferred tax liability.

Prepare all entries relating to income tax.

Compute the total income tax expense, identifying

separately the current income tax expense and the

deferred tax expense.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT