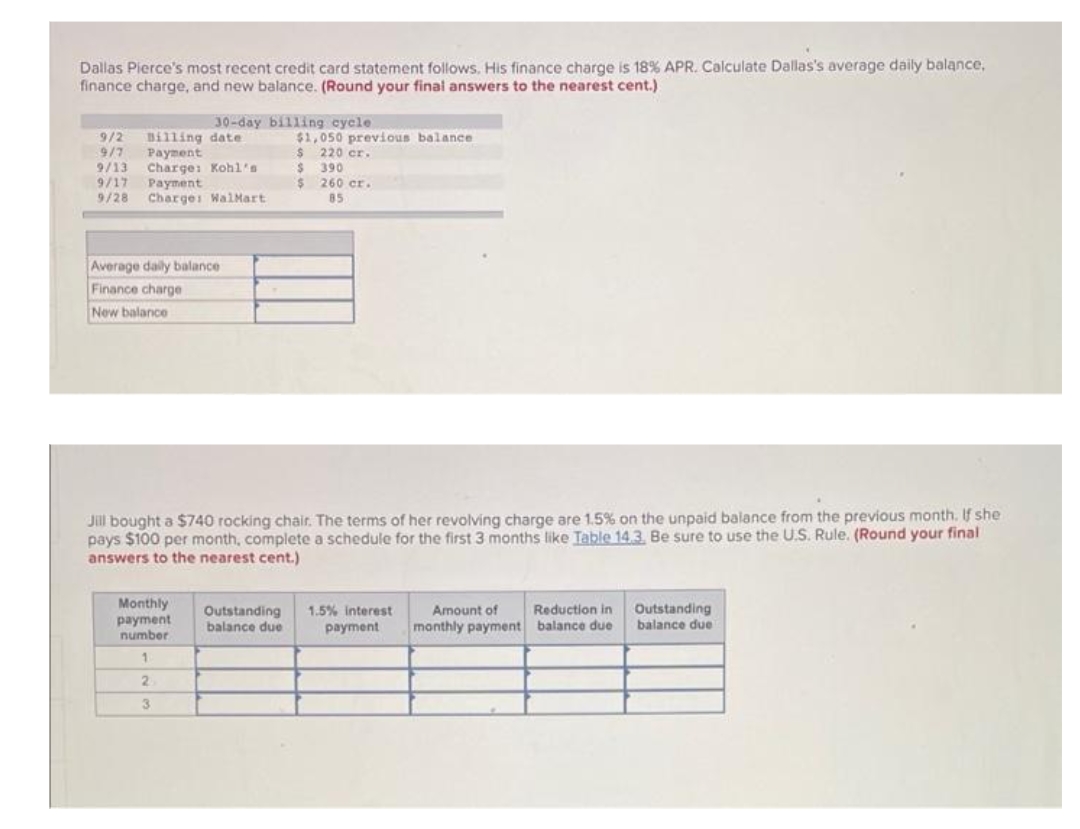

Dallas Pierce's most recent credit card statement follows. His finance charge is 18% APR. Calculate Dallas's average daily balance, finance charge, and new balance. (Round your final answers to the nearest cent.) 30-day billing cycle $1,050 previous balance $ 220 cr. 9/2 9/7 9/13 9/17 Billing date Payment Charge: Kohl's Payment Charge: WalMart 390 260 cr. 9/28 85 Average daily balance Finance charge New balance Jill bought a $740 rocking chair. The terms of her revolving charge are 1.5% on the unpaid balance from the previous month. If she pays $100 per month, complete a schedule for the first 3 months like Table 14.3, Be sure to use the U.S. Rule. (Round your final answers to the nearest cent.) Monthly payment number Outstanding balance due 1.5% interest payment Outstanding balance due Amount of Reduction in monthly payment balance due 2. 3.

Dallas Pierce's most recent credit card statement follows. His finance charge is 18% APR. Calculate Dallas's average daily balance, finance charge, and new balance. (Round your final answers to the nearest cent.) 30-day billing cycle $1,050 previous balance $ 220 cr. 9/2 9/7 9/13 9/17 Billing date Payment Charge: Kohl's Payment Charge: WalMart 390 260 cr. 9/28 85 Average daily balance Finance charge New balance Jill bought a $740 rocking chair. The terms of her revolving charge are 1.5% on the unpaid balance from the previous month. If she pays $100 per month, complete a schedule for the first 3 months like Table 14.3, Be sure to use the U.S. Rule. (Round your final answers to the nearest cent.) Monthly payment number Outstanding balance due 1.5% interest payment Outstanding balance due Amount of Reduction in monthly payment balance due 2. 3.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 10EB: Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts...

Related questions

Question

Transcribed Image Text:Dallas Pierce's most recent credit card statement follows. His finance charge is 18% APR. Calculate Dallas's average daily balance,

finance charge, and new balance. (Round your final answers to the nearest cent.)

30-day billing cycle

9/2

9/7

9/13

9/17

9/28

Billing date

Payment

Charge: Kohl's

Payment

Charges WalMart

$1,050 previous balance

$ 220 er.

$ 390

$ 260 cr.

85

Average daily balance

Finance charge

New balance

Jill bought a $740 rocking chair. The terms of her revolving charge are 1.5% on the unpaid balance from the previous month. f she

pays $100 per month, complete a schedule for the first 3 months like Table 14.3. Be sure to use the U.S. Rule. (Round your final

answers to the nearest cent.)

Monthly

payment

number

1.5% interest

payment

Outstanding

balance due

Amount of

Reduction in

Outstanding

balance due

monthly payment balance due

1

2.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning