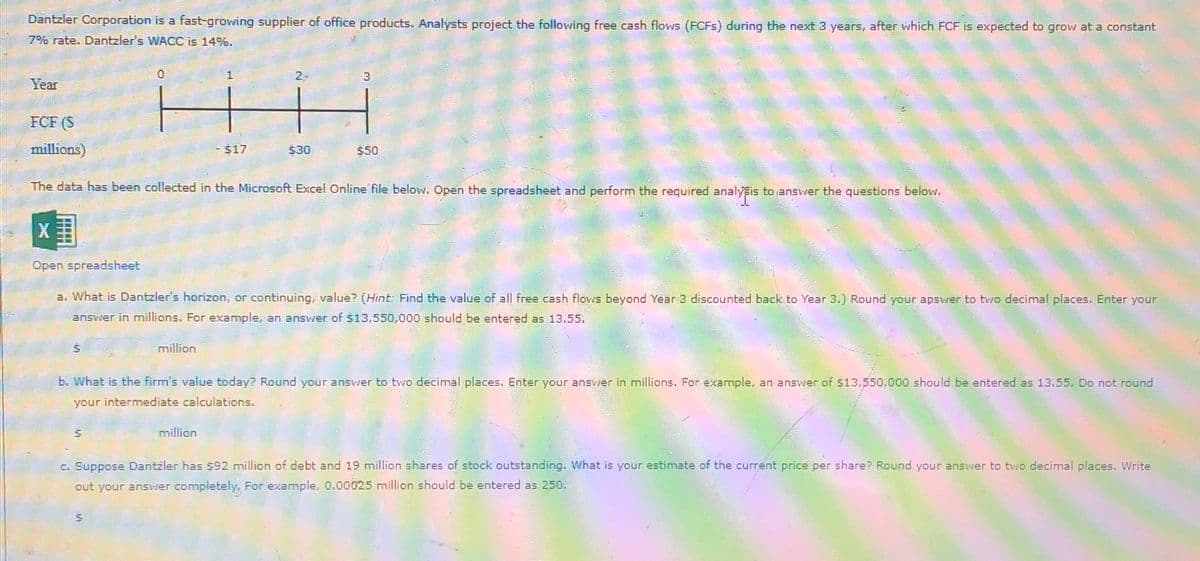

Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 14%. 3 Year FCF (S millions) $17 $30 $50 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your apswer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. million b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. million c. Suppose Dantzler has $92 million of debt and 19 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write

Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant 7% rate. Dantzler's WACC is 14%. 3 Year FCF (S millions) $17 $30 $50 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. X Open spreadsheet a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your apswer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. million b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round your intermediate calculations. million c. Suppose Dantzler has $92 million of debt and 19 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 10P

Related questions

Question

Transcribed Image Text:Dantzler Corporation is a fast-growing supplier of office products. Analysts project the following free cash flows (FCFS) during the next 3 years, after which FCF is expected to grow at a constant

7% rate. Dantzler's WACC is 14%.

Year

0

1

2

3

FCF (S

millions)

- $17

$30

$50

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below.

X

Open spreadsheet

a. What is Dantzler's horizon, or continuing, value? (Hint: Find the value of all free cash flows beyond Year 3 discounted back to Year 3.) Round your answer to two decimal places. Enter your

answer in millions. For example, an answer of $13,550,000 should be entered as 13.55.

S

million

b. What is the firm's value today? Round your answer to two decimal places. Enter your answer in millions. For example, an answer of $13,550,000 should be entered as 13.55. Do not round

your intermediate calculations.

S

million

c. Suppose Dantzler has $92 million of debt and 19 million shares of stock outstanding. What is your estimate of the current price per share? Round your answer to two decimal places. Write

out your answer completely. For example, 0.00025 million should be entered as 250.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College