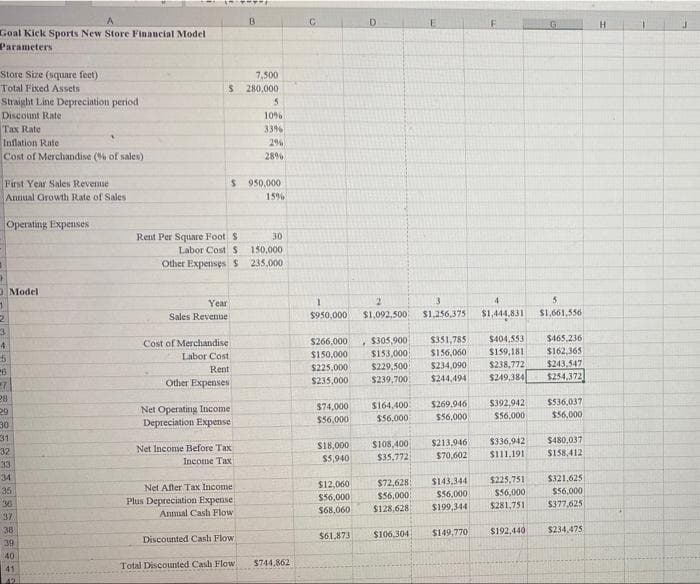

B D. H Goal Kick Sports New Store Financial Model Parameters Store Size (square feet) Total Fixed Assets Straight Line Depreciation period 7,500 280,000 Discount Rate 10% Tax Rate Inflation Rate Cost of Merchandise (% of sales) 33% 289% First Year Sales Revense Annual Growth Rate of Sales 950.000 15% Operating Expenses 30 Rent Per Square Foot S Labor Cost S 150,000 Other Expenses S 235,000 O Model 4. Year Sales Revenue $1,092.500 $1,256,375 $1,444.831 S1,661,556 $950,000 $305,900 $153,000 $229,500 $404,553 S159,181 $266,000 S351,785 $465,236 Cost of Merchandise Labor Cost $162,365 $243,547 $254,372 $150,000 $156,060 5. $238.772 $249,384 Rent $225,000 $234,090 Other Expenses $235,000 $239,700 $244,494 28 $536,037 $392,942 S56,000 $74,000 S164,400 $269.946 Net Operating Income Depreciation Expense 29 $56,000 $56,000 $56,000 $56,000 30 31 32 $213,946 $336,942 $480,037 S108,400 $35,772 Net Income Before Tax S18,000 $70,602 S111.191 SIS8,412 Income Tax $5,940 33 34 $321.625 S72,628 $56,000 $128,628 $12,060 $143,344 $225,751 35 Net After Tax Income S56.000 $199,344 S56,000 $377,625 S56,000 $56,000 Plus Depreciation Expense Anmual Cash Flow 36 $281,751 S68,060 37. 38 $61.873 $106,304 $149,770 $192,440 $234,475 Discounted Cash Flow 39 40 Total Discounted Cash Flow $744,862 41 A2. DATAF Goniick Goel Kick Sports (GKS) aa retal chain that sels youth and adult eoccer equioment. The GKS financal pianting group hes developed a spredsheet model te caleulate the net dicounted an fow of the firat five years of operations for a new store This model is used to assess new locations under consderation for expanaion (a) Use taces formula Audting tools to audin the model and correct any errors found. What is the total discounted cash fow ( dalars) calculated by the corrected spreadsheet. (Hound you anwe to the nearest dollar) (b) Once you are comfortable that the model correct, use Scenano Manager to generate a Scenario Summary report that gves Tta Dacounted Cauh Plow for the folontng scenaris Scenario 32% 24 37% 24 Tax Rate 1 4% 2 Inflation Rate 14% Annual Growth of Sales 26% 18% What is the range of values for the Total Discounted Cash Flow (in dollars) for these scenarios? (Round your answer to the nearest dolar) Need Help?

B D. H Goal Kick Sports New Store Financial Model Parameters Store Size (square feet) Total Fixed Assets Straight Line Depreciation period 7,500 280,000 Discount Rate 10% Tax Rate Inflation Rate Cost of Merchandise (% of sales) 33% 289% First Year Sales Revense Annual Growth Rate of Sales 950.000 15% Operating Expenses 30 Rent Per Square Foot S Labor Cost S 150,000 Other Expenses S 235,000 O Model 4. Year Sales Revenue $1,092.500 $1,256,375 $1,444.831 S1,661,556 $950,000 $305,900 $153,000 $229,500 $404,553 S159,181 $266,000 S351,785 $465,236 Cost of Merchandise Labor Cost $162,365 $243,547 $254,372 $150,000 $156,060 5. $238.772 $249,384 Rent $225,000 $234,090 Other Expenses $235,000 $239,700 $244,494 28 $536,037 $392,942 S56,000 $74,000 S164,400 $269.946 Net Operating Income Depreciation Expense 29 $56,000 $56,000 $56,000 $56,000 30 31 32 $213,946 $336,942 $480,037 S108,400 $35,772 Net Income Before Tax S18,000 $70,602 S111.191 SIS8,412 Income Tax $5,940 33 34 $321.625 S72,628 $56,000 $128,628 $12,060 $143,344 $225,751 35 Net After Tax Income S56.000 $199,344 S56,000 $377,625 S56,000 $56,000 Plus Depreciation Expense Anmual Cash Flow 36 $281,751 S68,060 37. 38 $61.873 $106,304 $149,770 $192,440 $234,475 Discounted Cash Flow 39 40 Total Discounted Cash Flow $744,862 41 A2. DATAF Goniick Goel Kick Sports (GKS) aa retal chain that sels youth and adult eoccer equioment. The GKS financal pianting group hes developed a spredsheet model te caleulate the net dicounted an fow of the firat five years of operations for a new store This model is used to assess new locations under consderation for expanaion (a) Use taces formula Audting tools to audin the model and correct any errors found. What is the total discounted cash fow ( dalars) calculated by the corrected spreadsheet. (Hound you anwe to the nearest dollar) (b) Once you are comfortable that the model correct, use Scenano Manager to generate a Scenario Summary report that gves Tta Dacounted Cauh Plow for the folontng scenaris Scenario 32% 24 37% 24 Tax Rate 1 4% 2 Inflation Rate 14% Annual Growth of Sales 26% 18% What is the range of values for the Total Discounted Cash Flow (in dollars) for these scenarios? (Round your answer to the nearest dolar) Need Help?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

4

Transcribed Image Text:B

D.

H

Goal Kick Sports New Store Financial Model

Parameters

Store Size (square feet)

Total Fixed Assets

Straight Line Depreciation period

7,500

280,000

Discount Rate

10%

Tax Rate

Inflation Rate

Cost of Merchandise (% of sales)

33%

289%

First Year Sales Revense

Annual Growth Rate of Sales

950.000

15%

Operating Expenses

30

Rent Per Square Foot S

Labor Cost S

150,000

Other Expenses S

235,000

O Model

4.

Year

Sales Revenue

$1,092.500

$1,256,375

$1,444.831

S1,661,556

$950,000

$305,900

$153,000

$229,500

$404,553

S159,181

$266,000

S351,785

$465,236

Cost of Merchandise

Labor Cost

$162,365

$243,547

$254,372

$150,000

$156,060

5.

$238.772

$249,384

Rent

$225,000

$234,090

Other Expenses

$235,000

$239,700

$244,494

28

$536,037

$392,942

S56,000

$74,000

S164,400

$269.946

Net Operating Income

Depreciation Expense

29

$56,000

$56,000

$56,000

$56,000

30

31

32

$213,946

$336,942

$480,037

S108,400

$35,772

Net Income Before Tax

S18,000

$70,602

S111.191

SIS8,412

Income Tax

$5,940

33

34

$321.625

S72,628

$56,000

$128,628

$12,060

$143,344

$225,751

35

Net After Tax Income

S56.000

$199,344

S56,000

$377,625

S56,000

$56,000

Plus Depreciation Expense

Anmual Cash Flow

36

$281,751

S68,060

37.

38

$61.873

$106,304

$149,770

$192,440

$234,475

Discounted Cash Flow

39

40

Total Discounted Cash Flow

$744,862

41

A2.

Transcribed Image Text:DATAF Goniick

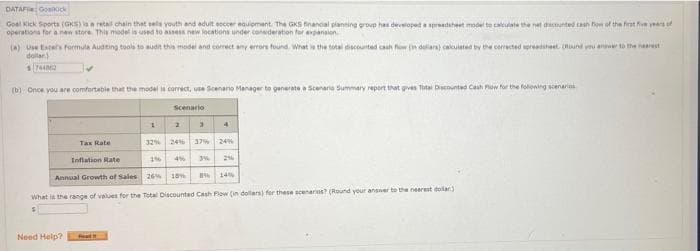

Goel Kick Sports (GKS) aa retal chain that sels youth and adult eoccer equioment. The GKS financal pianting group hes developed a spredsheet model te caleulate the net dicounted an fow of the firat five years of

operations for a new store This model is used to assess new locations under consderation for expanaion

(a) Use taces formula Audting tools to audin the model and correct any errors found. What is the total discounted cash fow ( dalars) calculated by the corrected spreadsheet. (Hound you anwe to the nearest

dollar)

(b) Once you are comfortable that the model correct, use Scenano Manager to generate a Scenario Summary report that gves Tta Dacounted Cauh Plow for the folontng scenaris

Scenario

32% 24 37% 24

Tax Rate

1 4%

2

Inflation Rate

14%

Annual Growth of Sales 26% 18%

What is the range of values for the Total Discounted Cash Flow (in dollars) for these scenarios? (Round your answer to the nearest dolar)

Need Help?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education