Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 240,000 Accounts payable $ 600,000 Receivables 1,575,000 Notes payable 100,000 Inventories 1,135,000 Other current liabilities 560,000 Total current assets $2,950,000 Total current liabilities $1,260,000 Net fixed assets 1,315,000 Long-term debt 400,000 Common equity 2,605,000 Total assets $4,265,000 Total liabilities and equity $4,265,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) Sales $7,500,000 Cost of goods sold 6,375,000 Selling, general, and administrative expenses 943,000 Earnings before interest and taxes (EBIT) $ 182,000 Interest expense 40,000 Earnings before taxes (EBT) $ 142,000 Federal and state income taxes (25%) 35,500 Net income

Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 240,000 Accounts payable $ 600,000 Receivables 1,575,000 Notes payable 100,000 Inventories 1,135,000 Other current liabilities 560,000 Total current assets $2,950,000 Total current liabilities $1,260,000 Net fixed assets 1,315,000 Long-term debt 400,000 Common equity 2,605,000 Total assets $4,265,000 Total liabilities and equity $4,265,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) Sales $7,500,000 Cost of goods sold 6,375,000 Selling, general, and administrative expenses 943,000 Earnings before interest and taxes (EBIT) $ 182,000 Interest expense 40,000 Earnings before taxes (EBT) $ 142,000 Federal and state income taxes (25%) 35,500 Net income

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 51E: Juroe Company provided the following income statement for last year: Juroes balance sheet as of...

Related questions

Question

Comprehensive Ratio Analysis

Data for Lozano Chip Company and its industry averages follow.

| Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) |

||||

| Cash | $ 240,000 | Accounts payable | $ 600,000 | |

| Receivables | 1,575,000 | Notes payable | 100,000 | |

| Inventories | 1,135,000 | Other current liabilities | 560,000 | |

| Total current assets | $2,950,000 | Total current liabilities | $1,260,000 | |

| Net fixed assets | 1,315,000 | Long-term debt | 400,000 | |

| Common equity | 2,605,000 | |||

| Total assets | $4,265,000 | Total liabilities and equity | $4,265,000 |

| Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) |

|

| Sales | $7,500,000 |

| Cost of goods sold | 6,375,000 |

| Selling, general, and administrative expenses | 943,000 |

| Earnings before interest and taxes (EBIT) | $ 182,000 |

| Interest expense | 40,000 |

| Earnings before taxes (EBT) | $ 142,000 |

| Federal and state income taxes (25%) | 35,500 |

| Net income | $ 106,500 |

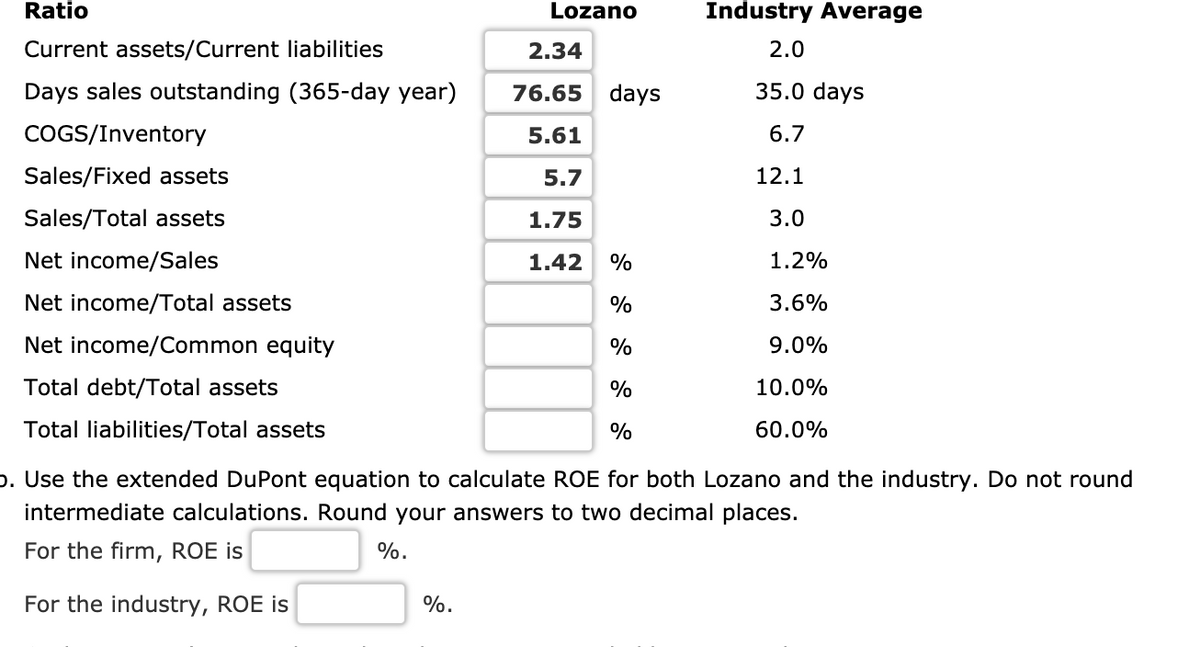

Transcribed Image Text:Ratio

Lozano

Industry Average

Current assets/Current liabilities

2.34

2.0

Days sales outstanding (365-day year)

76.65 days

35.0 days

COGS/Inventory

5.61

6.7

Sales/Fixed assets

5.7

12.1

Sales/Total assets

1.75

3.0

Net income/Sales

1.42

%

1.2%

Net income/Total assets

%

3.6%

Net income/Common equity

%

9.0%

Total debt/Total assets

%

10.0%

Total liabilities/Total assets

%

60.0%

p. Use the extended DuPont equation to calculate ROE for both Lozano and the industry. Do not round

intermediate calculations. Round your answers to two decimal places.

For the firm, ROE is

%.

For the industry, ROE is

%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub