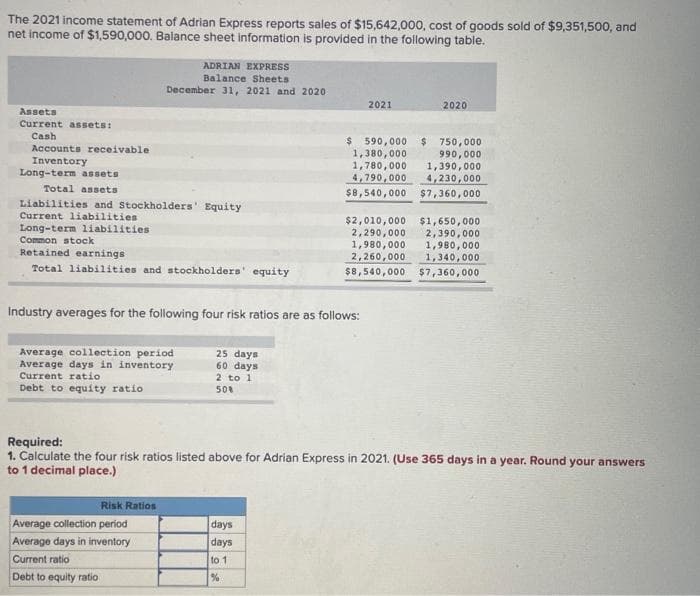

The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of $9,351,500, and net income of $1,590,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Common stock Retained earnings Total liabilities and stockholders' equity Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days 2 to 1 50% 2021 days days to 1 % 2020 $ 590,000 1,380,000 $750,000 990,000 1,780,000 1,390,000 4,790,000 4,230,000 $8,540,000 $7,360,000 Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) $2,010,000 $1,650,000 2,290,000 2,390,000 1,980,000 1,980,000 2,260,000 1,340,000 $8,540,000 $7,360,000

The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of $9,351,500, and net income of $1,590,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Common stock Retained earnings Total liabilities and stockholders' equity Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days 2 to 1 50% 2021 days days to 1 % 2020 $ 590,000 1,380,000 $750,000 990,000 1,780,000 1,390,000 4,790,000 4,230,000 $8,540,000 $7,360,000 Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) $2,010,000 $1,650,000 2,290,000 2,390,000 1,980,000 1,980,000 2,260,000 1,340,000 $8,540,000 $7,360,000

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 89E: Ratio Analysis Rising Stars Academy provided the following information on its 2019 balance sheet and...

Related questions

Question

Transcribed Image Text:The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of $9,351,500, and

net income of $1,590,000. Balance sheet information is provided in the following table.

Assets

Current assets:

Cash

Accounts receivable

Inventory

Long-term assets

Total assets

Liabilities and Stockholders' Equity

Current liabilities

Long-term liabilities.

ADRIAN EXPRESS

Balance Sheets

December 31, 2021 and 2020

Common stock

Retained earnings

Total liabilities and stockholders' equity

Average collection period

Average days in inventory

Current ratio

Debt to equity ratio

Industry averages for the following four risk ratios are as follows:

Risk Ratios

Average collection period

Average days in inventory

Current ratio

Debt to equity ratio

25 days

60 days

2 to 1

50%

days

days

2021

Required:

1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers

to 1 decimal place.)

to 1

%

2020

$ 590,000

1,380,000

$750,000

990,000

1,780,000 1,390,000

4,790,000 4,230,000

$8,540,000 $7,360,000

$2,010,000 $1,650,000

2,290,000 2,390,000

1,980,000 1,980,000

2,260,000 1,340,000

$8,540,000 $7,360,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub