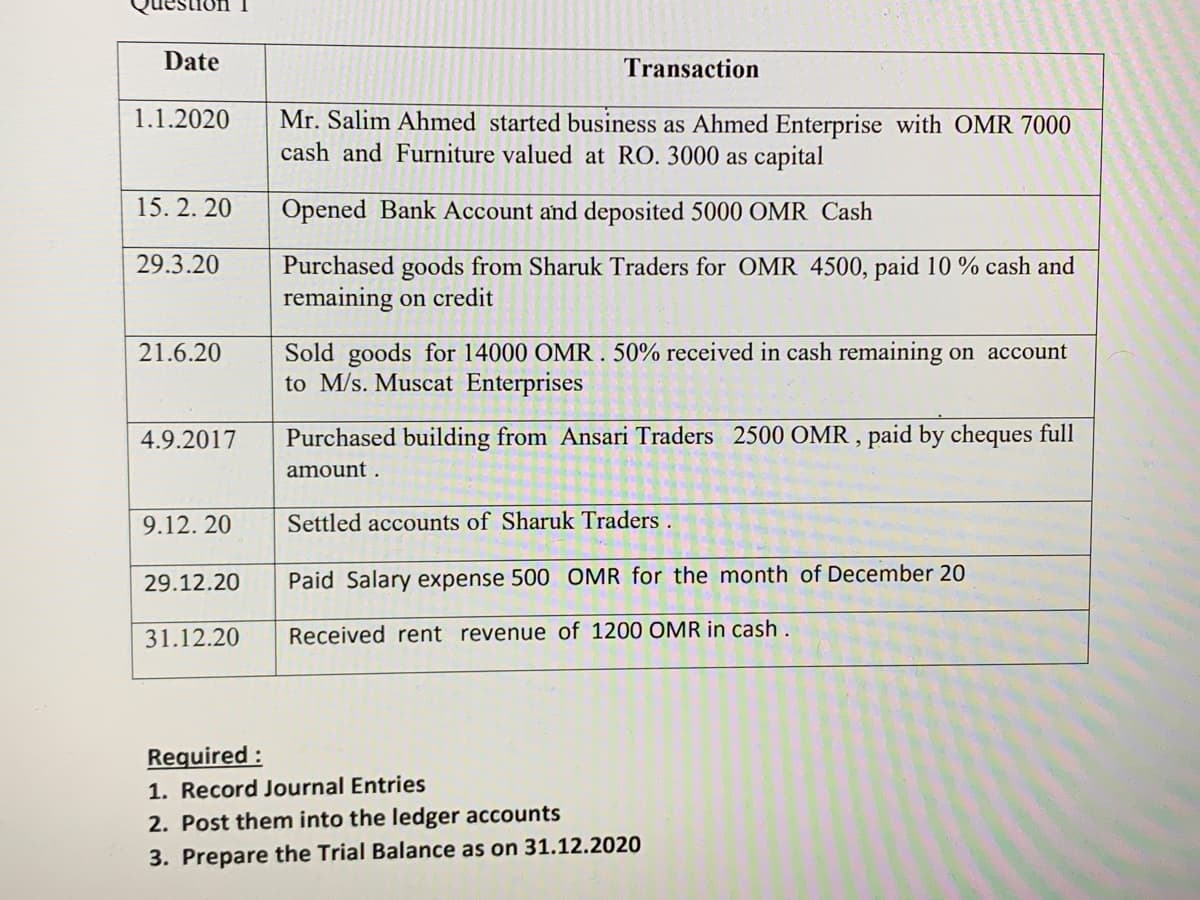

Date Transaction 1.1.2020 Mr. Salim Ahmed started business as Ahmed Enterprise with OMR 7000 cash and Furniture valued at RO. 3000 as capital 15. 2. 20 Opened Bank Account and deposited 5000 OMR Cash 29.3.20 Purchased goods from Sharuk Traders for OMR 4500, paid 10 % cash and remaining on credit Sold goods for 14000 OMR. 50% received in cash remaining on account to M/s. Muscat Enterprises 21.6.20 4.9.2017 Purchased building from Ansari Traders 2500 OMR , paid by cheques full amount . 9.12. 20 Settled accounts of Sharuk Traders . 29.12.20 Paid Salary expense 500 OMR for the month of December 20 31.12.20 Received rent revenue of 1200 OMR in cash. Required : 1. Record Journal Entries 2. Post them into the ledger accounts 3. Prepare the Trial Balance as on 31.12.2020

Date Transaction 1.1.2020 Mr. Salim Ahmed started business as Ahmed Enterprise with OMR 7000 cash and Furniture valued at RO. 3000 as capital 15. 2. 20 Opened Bank Account and deposited 5000 OMR Cash 29.3.20 Purchased goods from Sharuk Traders for OMR 4500, paid 10 % cash and remaining on credit Sold goods for 14000 OMR. 50% received in cash remaining on account to M/s. Muscat Enterprises 21.6.20 4.9.2017 Purchased building from Ansari Traders 2500 OMR , paid by cheques full amount . 9.12. 20 Settled accounts of Sharuk Traders . 29.12.20 Paid Salary expense 500 OMR for the month of December 20 31.12.20 Received rent revenue of 1200 OMR in cash. Required : 1. Record Journal Entries 2. Post them into the ledger accounts 3. Prepare the Trial Balance as on 31.12.2020

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section: Chapter Questions

Problem 3AP

Related questions

Question

I want answer

Transcribed Image Text:Date

Transaction

1.1.2020

Mr. Salim Ahmed started business as Ahmed Enterprise with OMR 7000

cash and Furniture valued at RO. 3000 as capital

15. 2. 20

Opened Bank Account and deposited 5000 OMR Cash

29.3.20

Purchased goods from Sharuk Traders for OMR 4500, paid 10 % cash and

remaining on credit

Sold goods for 14000 OMR. 50% received in cash remaining on account

to M/s. Muscat Enterprises

21.6.20

4.9.2017

Purchased building from Ansari Traders 2500 OMR , paid by cheques full

amount .

9.12. 20

Settled accounts of Sharuk Traders.

29.12.20

Paid Salary expense 500 OMR for the month of December 20

31.12.20

Received rent revenue of 1200 OMR in cash .

Required :

1. Record Journal Entries

2. Post them into the ledger accounts

3. Prepare the Trial Balance as on 31.12.2020

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College