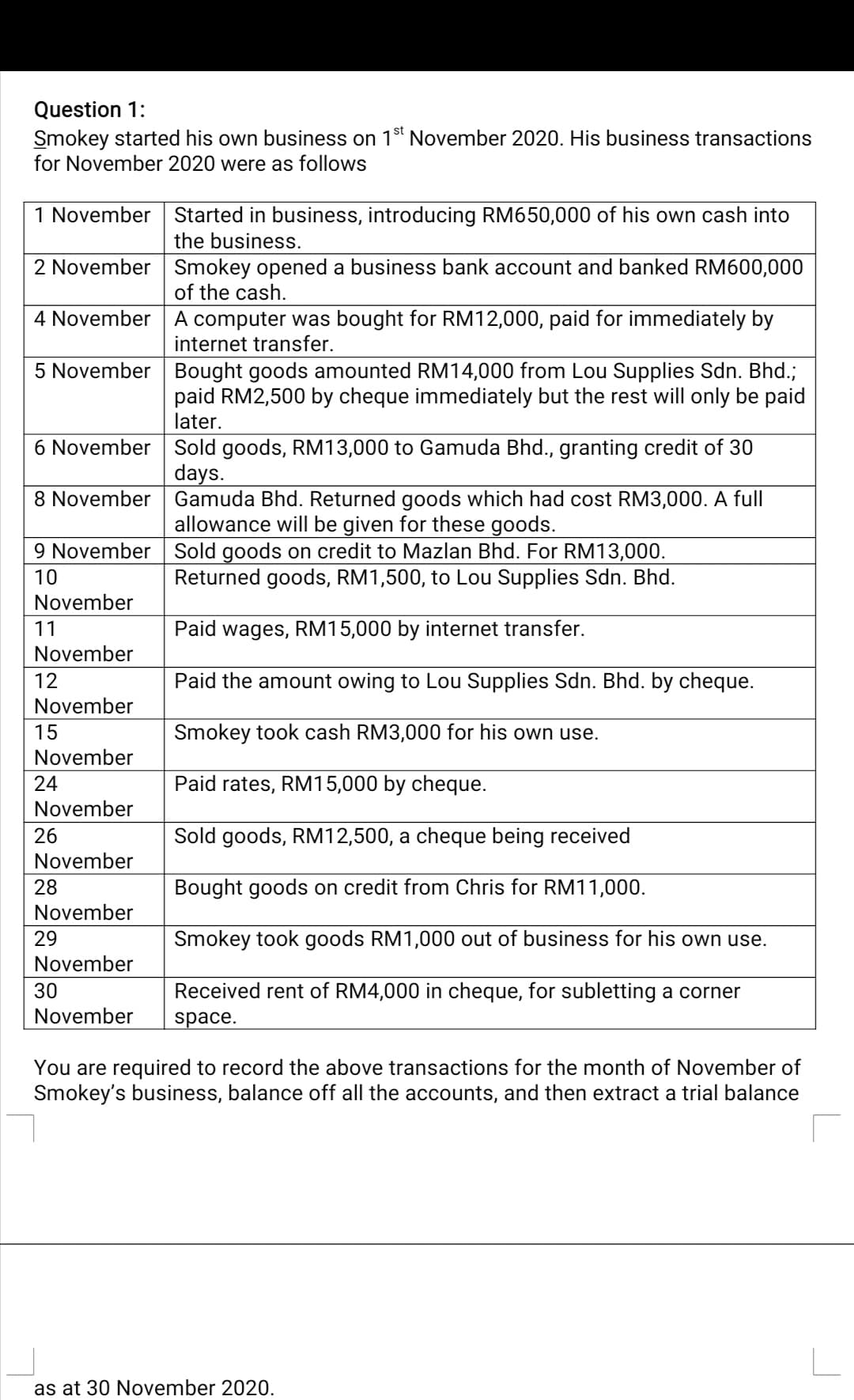

Question 1: Smokey started his own business on 1 November 2020. His business transactions for November 2020 were as follows 1 November Started in business, introducing RM650,000 of his own cash into the business. 2 November Smokey opened a business bank account and banked RM600,000 of the cash. 4 November A computer was bought for RM12,000, paid for immediately by internet transfer. 5 November Bought goods amounted RM14,000 from Lou Supplies Sdn. Bhd.; paid RM2,500 by cheque immediately but the rest will only be paid later. 6 November Sold goods, RM13,000 to Gamuda Bhd., granting credit of 30 days. 8 November Gamuda Bhd. Returned goods which had cost RM3,000. A full allowance will be given for these goods. 9 November Sold goods on credit to Mazlan Bhd. For RM13,000. Returned goods, RM1,500, to Lou Supplies Sdn. Bhd. 10 November 11 Paid wages, RM15,000 by internet transfer. November 12 Paid the amount owing to Lou Supplies Sdn. Bhd. by cheque. November 15 Smokey took cash RM3,000 for his own use. November 24 Paid rates, RM15,000 by cheque. November 26 Sold goods, RM12,500, a cheque being received November 28 Bought goods on credit from Chris for RM11,000. November 29 Smokey took goods RM1,000 out of business for his own use. November 30 Received rent of RM4,000 in cheque, for subletting a corner November space. You are required to record the above transactions for the month of November of Smokey's business, balance off all the accounts, ane then extract a trial balance

Question 1: Smokey started his own business on 1 November 2020. His business transactions for November 2020 were as follows 1 November Started in business, introducing RM650,000 of his own cash into the business. 2 November Smokey opened a business bank account and banked RM600,000 of the cash. 4 November A computer was bought for RM12,000, paid for immediately by internet transfer. 5 November Bought goods amounted RM14,000 from Lou Supplies Sdn. Bhd.; paid RM2,500 by cheque immediately but the rest will only be paid later. 6 November Sold goods, RM13,000 to Gamuda Bhd., granting credit of 30 days. 8 November Gamuda Bhd. Returned goods which had cost RM3,000. A full allowance will be given for these goods. 9 November Sold goods on credit to Mazlan Bhd. For RM13,000. Returned goods, RM1,500, to Lou Supplies Sdn. Bhd. 10 November 11 Paid wages, RM15,000 by internet transfer. November 12 Paid the amount owing to Lou Supplies Sdn. Bhd. by cheque. November 15 Smokey took cash RM3,000 for his own use. November 24 Paid rates, RM15,000 by cheque. November 26 Sold goods, RM12,500, a cheque being received November 28 Bought goods on credit from Chris for RM11,000. November 29 Smokey took goods RM1,000 out of business for his own use. November 30 Received rent of RM4,000 in cheque, for subletting a corner November space. You are required to record the above transactions for the month of November of Smokey's business, balance off all the accounts, ane then extract a trial balance

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 19EB: A business has the following transactions: A. The business is started by receiving cash from an...

Related questions

Question

Transcribed Image Text:Question 1:

Smokey started his own business on 1st November 2020. His business transactions

for November 2020 were as follows

1 November

Started in business, introducing RM650,000 of his own cash into

the business.

2 November Smokey opened a business bank account and banked RM600,000

of the cash.

A computer was bought for RM12,000, paid for immediately by

internet transfer.

4 November

5 November Bought goods amounted RM14,000 from Lou Supplies Sdn. Bhd.;

paid RM2,500 by cheque immediately but the rest will only be paid

later.

6 November Sold goods, RM13,000 to Gamuda Bhd., granting credit of 30

days.

Gamuda Bhd. Returned goods which had cost RM3,000. A full

allowance will be given for these goods.

8 November

9 November Sold goods on credit to Mazlan Bhd. For RM13,000.

10

Returned goods, RM1,500, to Lou Supplies Sdn. Bhd.

November

11

Paid wages, RM15,000 by internet transfer.

November

12

November

Paid the amount owing to Lou Supplies Sdn. Bhd. by cheque.

15

Smokey took cash RM3,000 for his own use.

November

24

Paid rates, RM15,000 by cheque.

November

26

Sold goods, RM12,500, a cheque being received

November

28

Bought goods on credit from Chris for RM11,000.

November

29

Smokey took goods RM1,000 out of business for his own use.

November

30

Received rent of RM4,000 in cheque, for subletting a corner

November

space.

You are required to record the above transactions for the month of November of

Smokey's business, balance off all the accounts, and then extract a trial balance

as at 30 November 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning