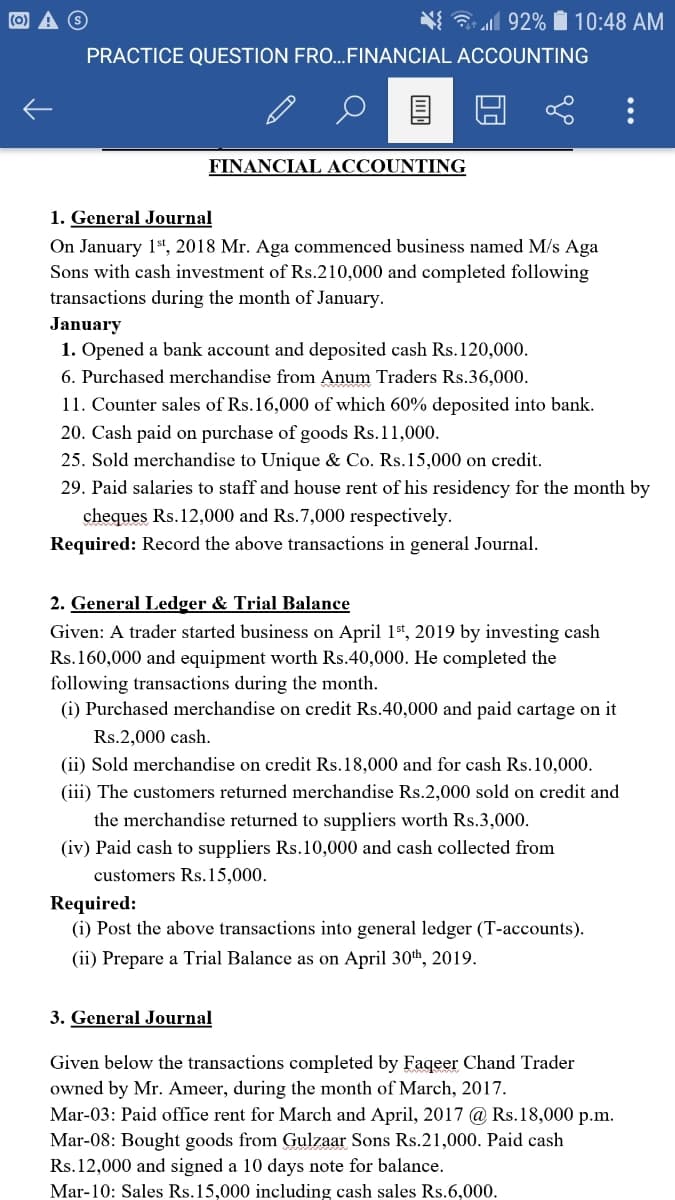

1. General Journal On January 1", 2018 Mr. Aga commenced business named M/s Aga Sons with cash investment of Rs.210,000 and completed following transactions during the month of January. January 1. Opened a bank account and deposited cash Rs.120,000. 6. Purchased merchandise from Anum Traders Rs.36,000. 11. Counter sales of Rs.16,000 of which 60% deposited into bank. 20. Cash paid on purchase of goods Rs.11,000. 25. Sold merchandise to Unique & Co. Rs.15,000 on credit. 29. Paid salaries to staff and house rent of his residency for the month by cheques Rs.12,000 and Rs.7,000 respectively. Required: Record the above transactions in general Journal.

1. General Journal On January 1", 2018 Mr. Aga commenced business named M/s Aga Sons with cash investment of Rs.210,000 and completed following transactions during the month of January. January 1. Opened a bank account and deposited cash Rs.120,000. 6. Purchased merchandise from Anum Traders Rs.36,000. 11. Counter sales of Rs.16,000 of which 60% deposited into bank. 20. Cash paid on purchase of goods Rs.11,000. 25. Sold merchandise to Unique & Co. Rs.15,000 on credit. 29. Paid salaries to staff and house rent of his residency for the month by cheques Rs.12,000 and Rs.7,000 respectively. Required: Record the above transactions in general Journal.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter5: Accounting For Merchandising Businesses

Section: Chapter Questions

Problem 5.5APR: Multiple-step income statement and balance sheet The following selected accounts and their current...

Related questions

Question

Transcribed Image Text:(0)

l 92% 1 10:48 AM

PRACTICE QUESTION FRO...FINANCIAL ACCOUNTING

FINANCIAL ACCOUNTING

1. General Journal

On January 1st, 2018 Mr. Aga commenced business named M/s Aga

Sons with cash investment of Rs.210,000 and completed following

transactions during the month of January.

January

1. Opened a bank account and deposited cash Rs.120,000.

6. Purchased merchandise from Anum Traders Rs.36,000.

11. Counter sales of Rs.16,000 of which 60% deposited into bank.

20. Cash paid on purchase of goods Rs.11,000.

25. Sold merchandise to Unique & Co. Rs.15,000 on credit.

29. Paid salaries to staff and house rent of his residency for the month by

cheques Rs.12,000 and Rs.7,000 respectively.

Required: Record the above transactions in general Journal.

2. General Ledger & Trial Balance

Given: A trader started business on April 1st, 2019 by investing cash

Rs.160,000 and equipment worth Rs.40,000. He completed the

following transactions during the month.

(i) Purchased merchandise on credit Rs.40,000 and paid cartage on it

Rs.2,000 cash.

(ii) Sold merchandise on credit Rs.18,000 and for cash Rs.10,000.

(iii) The customers returned merchandise Rs.2,000 sold on credit and

the merchandise returned to suppliers worth Rs.3,000.

(iv) Paid cash to suppliers Rs.10,000 and cash collected from

customers Rs.15,000.

Required:

(i) Post the above transactions into general ledger (T-accounts).

(ii) Prepare a Trial Balance as on April 30th, 2019.

3. General Journal

Given below the transactions completed by Faqeer Chand Trader

owned by Mr. Ameer, during the month of March, 2017.

Mar-03: Paid office rent for March and April, 2017 @ Rs.18,000 p.m.

Mar-08: Bought goods from Gulzaar Sons Rs.21,000. Paid cash

Rs.12,000 and signed a 10 days note for balance.

Mar-10: Sales Rs.15,000 including cash sales Rs.6,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning