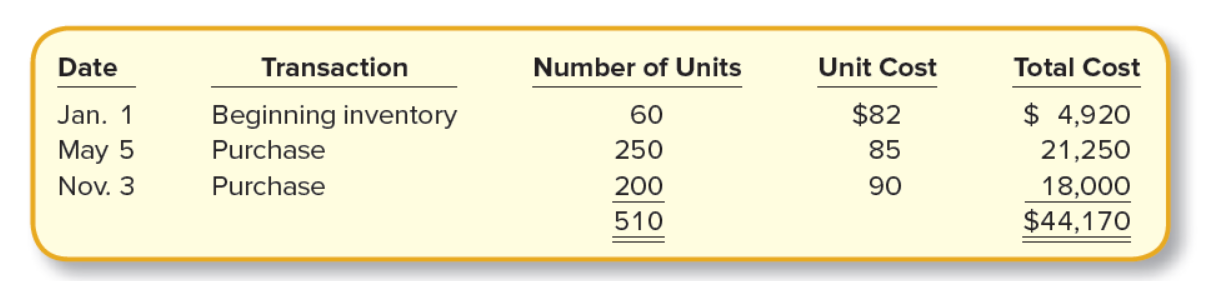

Date Transaction Number of Units Unit Cost Total Cost $ 4,920 21,250 Jan. 1 Beginning inventory 60 $82 May 5 Purchase 250 85 Nov. 3 Purchase 200 90 18,000 $44,170 510

Q: Hobbes antiques has 4 lion statues in its inventory, purchased at the following prices in the…

A: Calculation of gross profit for December are as follows:

Q: What is this?

A: Inventory valuation can be done under different methods like FIFO,LIFO, Weighted Average.To…

Q: Use the following to answer questions 7- 17 During September, KC Company sells 730 mountain bikes…

A: Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: At the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of…

A: Perpetual inventory system: Under this method of recording inventory, a running balance in relation…

Q: Johnson Corporation began the year with inventory of 29,000 units of its only product. The units…

A: LIFO RESERVE ACCOUNT: It is the excess of FIFO over LIFO costs. LIFO : LAST IN FIRST OUT FIFO :…

Q: June Corp. sells one product and uses a perpetual inventory system. The beginning inventory…

A: There are various methods of inventory valuation like FIFO, LIFO, Weighted Average methods etc.

Q: During 2021, a company sells 470 units of inventory for $94 each. The company has the following…

A: Average cost per unit = Cost of goods available for sales / Total units available for sale = $41,053…

Q: Ava Inc. had the following transactions on its inventory during 2021. Ava uses perpetual inventory…

A: The inventory can be valued using various methods as FIFO, LIFO and weighted average method. Using…

Q: June Corp. sells one product and uses perpetual inventory system. The beginning inventort consisted…

A: FIFO, first in first out is one of method which is used for inventory valuation under this method…

Q: a company had begining inventory of 10 units at a cost of 13 each on march 1 on march 2 it purchased…

A: "First-In, First-Out” is the method of inventory management that focuses on the usage of the…

Q: The following hammers were available for sale during the year for Wilkins Tools: Beginning…

A: FIFO (First-in First Out): Under FIFO inventory accounting, units prurchased first are sold first.…

Q: During the year, Wright Company sells 460 remote-control airplanes for $120 each. The company has…

A: Introduction: FIFO Inventory Method: FIFO stands for First-in First-Out. As the name suggests, this…

Q: During the year, Wright Company sells 535 remote-control airplanes for $120 each. The company has…

A: Under weighted average method, the unit cost is calculated as total cost of goods available for sale…

Q: At the beginning of the current period, Haitijah Industries has 150 units of a product with a unit…

A: under FIFO Method the goods which bought first will be sold first under LIFO method the goods…

Q: The following hammers were available for sale during the year for Wilkins Tools: Beginning…

A: UNDER LAST IN FIRST OUT METHOD (LIFO) , THE COST OF THE MOST RECENT PURCHASED ITEM ARE FIRST TO BE…

Q: The Reuschel Company began 2021 with inventory of 10,000 units at a cost of $7 per unit. During…

A:

Q: Glasgow Corporation has the following inventory transactions during the year. Unit Number of Units…

A: Inventory valuation is based on the flow of exemption used by the company. There are many methods…

Q: At May 1, 2022, Ayayai Corp. had beginning inventory consisting of 280 units with a unit cost of $7.…

A:

Q: During the current period, Haitijah sells 340 units. A. Assume Haitijah uses the FIFO method.…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: During the year, Wright Company sells 475 remote-control airplanes for $120 each. The company has…

A: LIFO: LIFO stands for Last-In, First-Out. In this method inventory purchased at last will be sell…

Q: Marvin Company has a beginning inventory of 12 sets of paints at a cost of $1.50 each. During the…

A: Total units available for sale = 12+4+6+6+10 = 38 units Particulars No. of Units Cost per…

Q: Swifty Company's inventory records show the following data: Units Unit Cost Inventory, January 1…

A: LIFO means last in first out where as FIFO means first in first out. Inventory and cost of goods…

Q: At the beginning of November, Yoshi Inc.’s inventory consists of 60 units with a cost per unit of…

A: In the First in First Out method, inventories that are purchased first are assumed to be sold first.…

Q: During 2021, a company sells 460 units of inventory for $87 each. The company has the following…

A: To use the weighted average model, one divides the cost of the goods that are available for sale by…

Q: During 2021, a company sells 379 units of inventory for $92 each. The company has the following…

A: LIFO: LIFO stands for Last-In, First-Out. As its name suggest, this method assumes that the most…

Q: During the year, Wright Company sells 435 remote-control airplanes for $120 each. The company has…

A: The question is based on the concept of Cost Accounting.

Q: ABC Corporation begins the month of April with 1,200 units of inventory recorded at total historical…

A: The average cost per unit will be equal to total cost of beginning inventory & purchase cost…

Q: Oriole Company had 110 units in beginning inventory at a total cost of $13,200. The company…

A: FIFO means the first in first out which means that goods purchased first will be sold first.…

Q: Vaughn Company had 100 units in beginning inventory at a total cost of $10,000. The company…

A: Cost of goods and value of ending inventory using FIFO method, periodic inventory system Cost of…

Q: During the year, Wright Company sells 490 remote-control airplanes for $120 each. The company has…

A: Introduction: FIFO: FIFO stands for First in First Out. Which means first received inventory to be…

Q: LIFO and FIFO. What is the differences? Examples

A: Computations under FIFO

Q: Sell 100 units of inventory to customers on account, $12,600. [Hint: The cost of units sold from the…

A: An adjusting journal entry is made at the end of the accounting period to account for the…

Q: Jones Corporation had a beginning inventory of 300 units which it bought for $5 each. Jones bought…

A: Inventory valuation method includes: FIFO Method LIFO Method Weighted average cost method FIFO…

Q: yler Toys has beginning inventory for the year of $19,600. During the year, Tyler purchases…

A: ending inventory = beginning inventory + purchases - cost of goods sold

Q: Lisa Company uses the periodic inventory system and had 100 units in beginning inventory at a total…

A: given that, beginnig inventory = 100 units @ $10000 purchases = 200 units @ $26000 closing stock =…

Q: At the beginning of October, Bowser Co.’s inventory consists of 50 units with a cost per unit of…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: The Reuschel Company began 2021 with inventory of 11,000 units at a cost of $6 per unit. During…

A: LIFO Method: Last in first out method is the an inventory valuation method where inventory which get…

Q: At the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of…

A: All amount are in dollar.

Q: At the beginning of November, Yoshi Inc.’s inventory consists of 64 units with a cost per unit of…

A: By calculating net income in multiple steps, the multi-step income statement provides detailed…

Q: During 2012, a company sells 200 units of inventory for $50 each. The company has the following…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: During 2021, a company sells 280 units of inventory for $89 each. The company has the following…

A: Under FIFO the earliest goods will be sold first

Q: ABC Corporation begins the month of April with 12.400 units of inventory recorded at total…

A: It is assumed that there is a typing error in the amounts given in the question. Therefore, we have…

Q: The following information is for the Bud Company; the company sells just one product: Units Unit…

A:

Q: During the year, Wright Company sells 425 remote-control airplanes for $110 each. The company has…

A: Under LIFO method, the units purchased later are sold at first. The older units are left in the…

Q: United Co. had 10 units of an inventory item on hand at the beginning of the current year, each of…

A: LIFO means last in first out where as FIFO means first in first out. Inventory and cost of goods…

Q: During the year, Wright Company sells 470 remote-control airplanes for $110 each. The company has…

A: In LIFO method the last unit that purchased will be sold first

Q: Camino Jet Engines, Inc. Is a supplier of jet engine parts. The company began the most reecent…

A: FIFO: FIFO method of inventory valuation assumes that the goods purchased first are removed first…

Q: During the year, Wright Company sells 330 remote-control airplanes for $110 each. The company has…

A: Units available for sale = 375 units Units sold = 330 units Ending Inventory = 375 - 330 = 45 units

Q: During the year, Wright Company sells 320 remote-control airplanes for $100 each. The company has…

A: There are various methods by which the cost of ending inventory and cost of goods sold can be…

Q: In December year 1, Johnny corporation produced three products that it still has in inventory at…

A: Inventory refers to the stock that the company held for resale purposes or which is not sold in the…

During the year, Wright Company sells 470 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year.

Calculate ending inventory and cost of goods sold for the year, assuming the company uses FIFO.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- At what figure should the inventory be valued? *a. P 880,000b. P 760,000c. P 980,000d. P 940,000E8.12 (LO 3) (FIFO, LIFO, Average-Cost Inventory) Shania Twain Company was formed onDecember 1, 2019. The following information is available from Twain’s inventory records for Product BAP. Units Unit CostJanuary 1, 2020 (beginning inventory) 600 $ 8.00Purchases:January 5, 2020 1,200 9.00January 25, 2020 1,300 10.00February 16, 2020 800 11.00March 26, 2020 600 12.00 A physical inventory on March 31, 2020, shows 1,600 units on hand.InstructionsPrepare schedules to compute the ending inventory at March 31, 2020, under each of the following inventory methods.a. FIFO b. LIFO. c. Weighted-average (round unit costs to two decimal places)Hall Company’s beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: UnitsUnit PriceTotal CostJanuary 1Beginning inventory800$11.00$8,800March 51st purchase60012.007,200April 162nd purchase50012.506,250June 33rd purchase70014.009,800August 184th purchase80015.0012,000September 135th purchase90017.0015,300November 146th purchase40018.007,200December 37th purchase50020.3010,150 5,200 $76,700 There are 1,100 units of inventory on hand on December 31.Required:1.Calculate the total amount to be assigned to the ending inventory and cost of goods sold on December 31 under each of the following methods:(a)FIFO(b)LIFO(c)Weighted-average (round calculations to two decimal places)2.Assume that the market price per unit (cost to replace) of Hall’s inventory on December 31 was $16. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods:(a)FIFO lower-of-cost-or-market(b)Weighted-average…

- Where is 63000 coming from? Current Assets ($73,000)- 63000 = $10, 5000 (Inventory)FE9Advice the closing inventory value as at July 31stProduct Qty On Hand Cost NRVWJ01 225 $0.05 $1.00WJ02 114 $0.20 $0.90WJ03 74 $2.00 $1.60WJ04 35 $6.20 $6.18WJ05 3 $2,500.00 $2,550.00WJ06 58 $1.50 $1.55a) 7,986.05b) 7,955.75c) 8,402.20d) 7,960.65The estimated inventory amount is: A. P720,000 B. P600,000 C. P784,000 D. P840,000 E. P550,000

- Presented below is information related to Rembrandt Inc.’s inventory. 000(per unit)000 00Skis00 0Boots0 Parkas Historical cost $190.00 $106.00 $53.00 Selling price 212.00 145.00 73.75 Cost to sell 19.00 8.00 2.50 Cost to complete 32.00 29.00 21.25 Determine the following: (a) the net realizable value for each item, and (b) the carrying value of each item under LCNRV.Determine the Sales for the year, Gross Profit P240,000.00, Ending Inventory P120,000.00, Goods available for sale P 200,000.00 P 460,000.00 P 320,000.00 P 400,000.00 P 300,000.00Beginning inventory 32 000 Cost of goods sold 404 000 Ending inventory 45 000 Net icome 28 000 Net sales 750 000 Operating expenses 220 000 Sales revenue 765 000 Compute each of the follwoing ratios Gross profit rate Inventory turnover Days in inventory Profit ma

- 5. For the movement of the INVEST commodity from 01.01.20X1 to 31.12.20X1 you are given the following information: Initial Inventory and Purchases: Units unit price Total 01/01/20X1 Initial Stock 700 350 245.000,00 12/03/20X1 Market 1 270 400 108.000,00 05/06/20X1 Market 2 400 420 168.000,00 12/09/20X1 Market 3 500 440 220.000,00 21/11/20X1 Market 4 200 460 92.000,00 Total 2070 833.000,00 Sales: Units unit price Total 15/02/20X1 Sale 1 300 710 213.000,00 20/05/20X1 Sale 2 500 730 365.000,00 10/09/20X1 Sale 3 400 740 296.000,00 10/12/20X1 Sale 4 750 750 562.500,00 0,00 Total 1950 1.436.500,00 Whereas: A. ABC determines the cost of its goods sold on the basis of: The FIFO method The method of the weighted average (cost) B. During the inventory of the goods on 31/12/20X1 it was found that its current price amounted to € 520 per unit. It is requested to calculate without calendar entries: the cost of…Floyd Corporation has the following four items in its ending inventory. 000Item000 000Cost000 Net Realizable 0Value (NRV)0 Jokers $2,00000 $2,100000 Penguins 5,00000 4,950000 Riddlers 4,40000 4,625000 Scarecrows 3,20000 3,830000 Determine the following: (a) the LCNRV for each item, and (b) the amount of write-down, if any, using (1) an item-by-item LCNRV evaluation and (2) a total category LCNRV evaluation.Extreme Company shows the following information:Units Unit cost Total costJanuary 1 Beginning 10,000 40 400,00031 Sale 5,000April 1 Purchase 15,000 50 750,000July 31 Sale 18,000October 1 Purchase 25,000 60 1,500,000December 31 Sale 12,000Required:Compute the cost of the ending inventory and cost of sales using:1. FIFO – periodic2. Weighted average3. Moving average