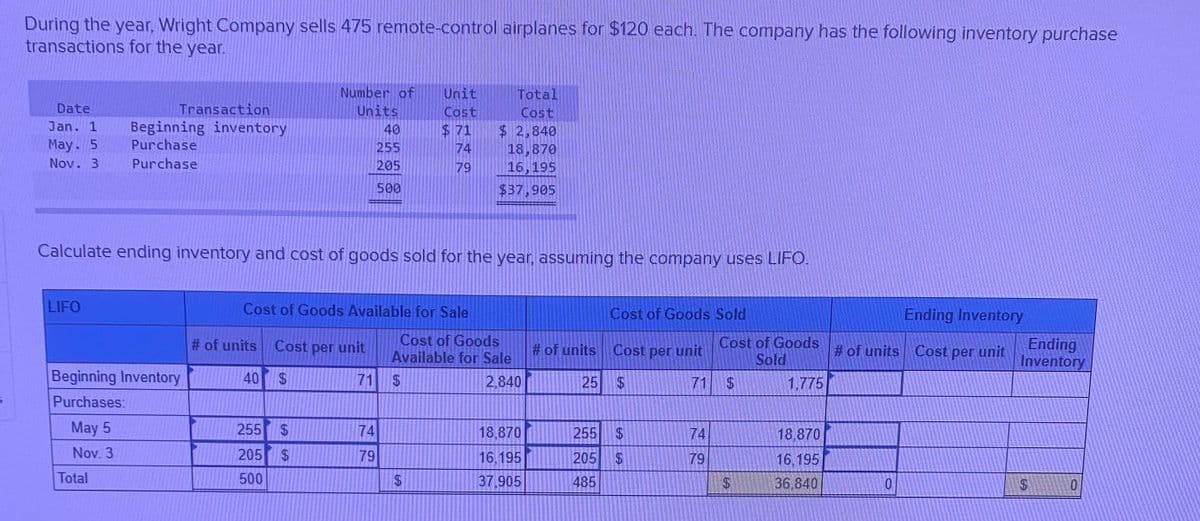

During the year, Wright Company sells 475 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Number of Unit Total Date Transaction Units Cost Beginning inventory Purchase Purchase Cost $ 2,840 18,870 16,195 Jan. 1 40 $ 71 May. 5 Nov. 3 255 74 205 79 500 $37,905 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Available for Sale # of units Cost per unit Cost of Goods Sold Ending Inventory # of units Cost per unit Beginning Inventory 40 S 25 $ 71 2.840 71 2$ 1,775 Purchases: May 5 255 S 255 $ 205 $ 485 74 18,870 74 18,870 Nov. 3 205 S 79 16.195 79 16,195 Total 500 37,905 2$ 36,840

During the year, Wright Company sells 475 remote-control airplanes for $120 each. The company has the following inventory purchase transactions for the year. Number of Unit Total Date Transaction Units Cost Beginning inventory Purchase Purchase Cost $ 2,840 18,870 16,195 Jan. 1 40 $ 71 May. 5 Nov. 3 255 74 205 79 500 $37,905 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Available for Sale # of units Cost per unit Cost of Goods Sold Ending Inventory # of units Cost per unit Beginning Inventory 40 S 25 $ 71 2.840 71 2$ 1,775 Purchases: May 5 255 S 255 $ 205 $ 485 74 18,870 74 18,870 Nov. 3 205 S 79 16.195 79 16,195 Total 500 37,905 2$ 36,840

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8P: Comprehensive The following information for 2019 is available for Marino Company: 1. The beginning...

Related questions

Question

Transcribed Image Text:During the year, Wright Company sells 475 remote-control airplanes for $120 each. The company has the following inventory purchase

transactions for the year.

Number of

Units

40

255

205

Unit

Cost

$71

74

79

Total

Cost

$2,840

18,870

16,195

Date

Transaction

Beginning inventory

Purchase

Jan. 1

May. 5

Nov. 3

Purchase

500

$37,905

Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIIFO.

LIFO

Cost of Goods Available for Sale

Cost of Goods Sold

Ending Inventory

Cost of Goods

Available for Sale

Cost of Goods

Sold

Ending

Inventory

# of units Cost per unit

# of units Cost per unit

#of units Cost per unit

Beginning Inventory

40

2,840

25

71

1.775

Purchases:

May 5

255

74

18,870

255

$4

74

18.870

Nov. 3

205

79

16,195

205

79

16,195

Total

500

37,905

485

36.840

%24

%24

%24

%24

%24

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,