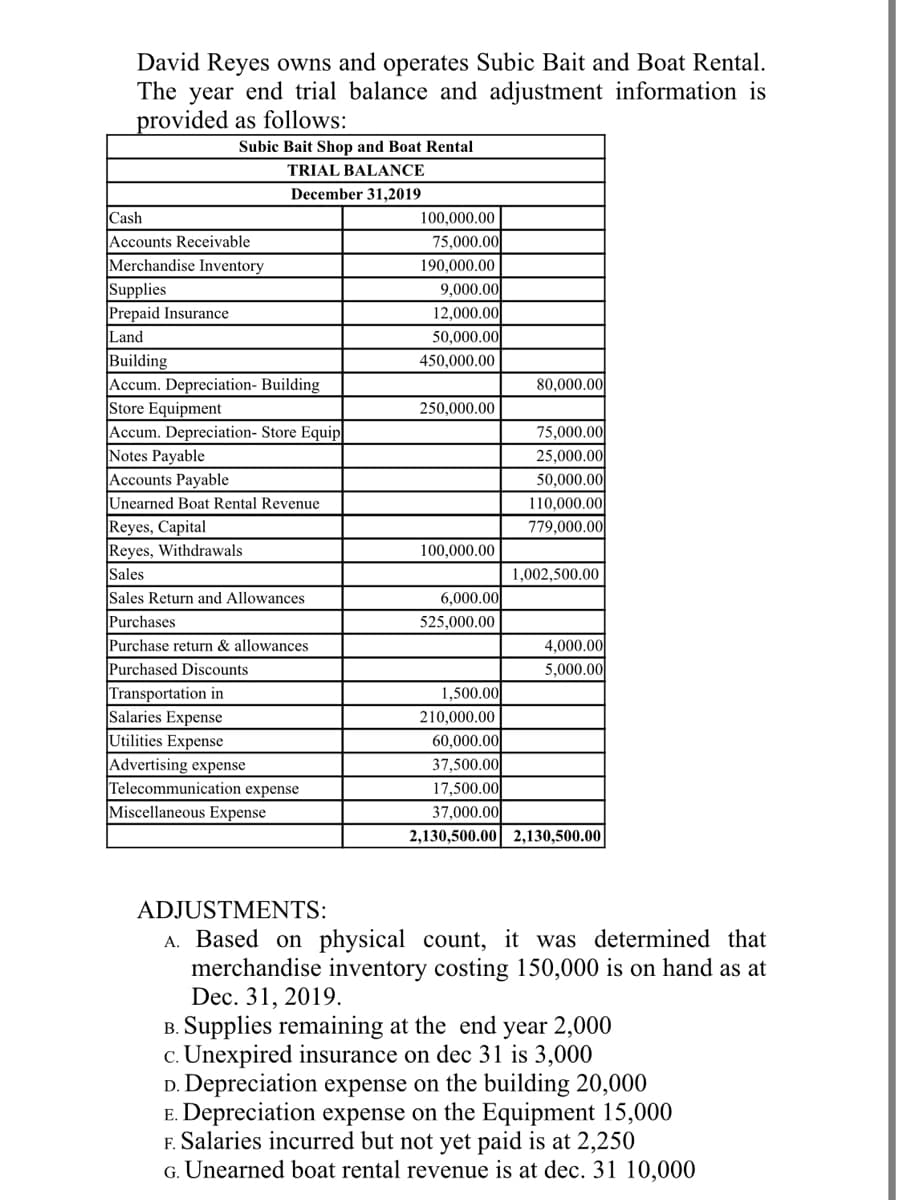

David Reyes owns and operates Subic Bait and Boat Rental. The year end trial balance and adjustment information is provided as follows: Subic Bait Shop and Boat Rental TRIAL BALANCE December 31,2019 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Land Building Accum. Depreciation- Building Store Equipment 100,000.00 75,000.00 190,000.00 9,000.00 12,000.00 50,000.00 450,000.00 80,000.00 250,000.00 Accum. Depreciation- Store Equip Notes Payable Accounts Payable Unearned Boat Rental Revenue Reyes, Capital Reyes, Withdrawals Sales Sales Return and Allowances Purchases Purchase return & allowances Purchased Discounts Transportation in Salaries Expense Utilities Expense Advertising expense Telecommunication expense 75,000.00 25,000.00 50,000.00 110,000.00 779,000.00 100,000.00 1,002,500.00 6,000.00 525,000.00 4,000.00 5,000.00 1,500.00 210,000.00 60,000.00 37,500.00 17,500.00 Miscellaneous Expense 37,000.00 2,130,500.00 2,130,500.00 ADJUSTMENTS: A. Based on physical count, it was determined that merchandise inventory costing 150,000 is on hand as at Dec. 31, 2019. B. Supplies remaining at the end year 2,000 c. Unexpired insurance on dec 31 is 3,000 D. Depreciation expense on the building 20,000 E. Depreciation expense on the Equipment 15,000 F. Salaries incurred but not yet paid is at 2,250 G Unearned boat rental revenue is at dec 31 10.000

David Reyes owns and operates Subic Bait and Boat Rental. The year end trial balance and adjustment information is provided as follows: Subic Bait Shop and Boat Rental TRIAL BALANCE December 31,2019 Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Land Building Accum. Depreciation- Building Store Equipment 100,000.00 75,000.00 190,000.00 9,000.00 12,000.00 50,000.00 450,000.00 80,000.00 250,000.00 Accum. Depreciation- Store Equip Notes Payable Accounts Payable Unearned Boat Rental Revenue Reyes, Capital Reyes, Withdrawals Sales Sales Return and Allowances Purchases Purchase return & allowances Purchased Discounts Transportation in Salaries Expense Utilities Expense Advertising expense Telecommunication expense 75,000.00 25,000.00 50,000.00 110,000.00 779,000.00 100,000.00 1,002,500.00 6,000.00 525,000.00 4,000.00 5,000.00 1,500.00 210,000.00 60,000.00 37,500.00 17,500.00 Miscellaneous Expense 37,000.00 2,130,500.00 2,130,500.00 ADJUSTMENTS: A. Based on physical count, it was determined that merchandise inventory costing 150,000 is on hand as at Dec. 31, 2019. B. Supplies remaining at the end year 2,000 c. Unexpired insurance on dec 31 is 3,000 D. Depreciation expense on the building 20,000 E. Depreciation expense on the Equipment 15,000 F. Salaries incurred but not yet paid is at 2,250 G Unearned boat rental revenue is at dec 31 10.000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Prepare the following Ratio Analysis:

1. Liquidity ratio

2. Activity ratio

3. Solvency Ratio

4. Profitability Ratio

Transcribed Image Text:David Reyes owns and operates Subic Bait and Boat Rental.

The year end trial balance and adjustment information is

provided as follows:

Subic Bait Shop and Boat Rental

TRIAL BALANCE

December 31,2019

Cash

Accounts Receivable

Merchandise Inventory

Supplies

Prepaid Insurance

Land

Building

Accum. Depreciation- Building

Store Equipment

100,000.00

75,000.00

190,000.00

9,000.00

12,000.00

50,000.00

450,000.00

80,000.00

250,000.00

Accum. Depreciation- Store Equip

Notes Payable

Accounts Payable

Unearned Boat Rental Revenue

Reyes, Capital

Reyes, Withdrawals

Sales

Sales Return and Allowances

Purchases

Purchase return & allowances

Purchased Discounts

Transportation in

Salaries Expense

Utilities Expense

Advertising expense

Telecommunication expense

75,000.00

25,000.00

50,000.00

110,000.00

779,000.00

100,000.00

1,002,500.00

6,000.00

525,000.00

4,000.00

5,000.00

1,500.00

210,000.00

60,000.00

37,500.00

17,500.00

Miscellaneous Expense

37,000.00

2,130,500.00| 2,130,500.00

ADJUSTMENTS:

A. Based on physical count, it was determined that

merchandise inventory costing 150,000 is on hand as at

Dec. 31, 2019.

B. Supplies remaining at the end year 2,000

c. Unexpired insurance on dec 31 is 3,000

D. Depreciation expense on the building 20,000

E. Depreciation expense on the Equipment 15,000

F. Salaries incurred but not yet paid is at 2,250

G. Unearned boat rental revenue is at dec. 31 10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning