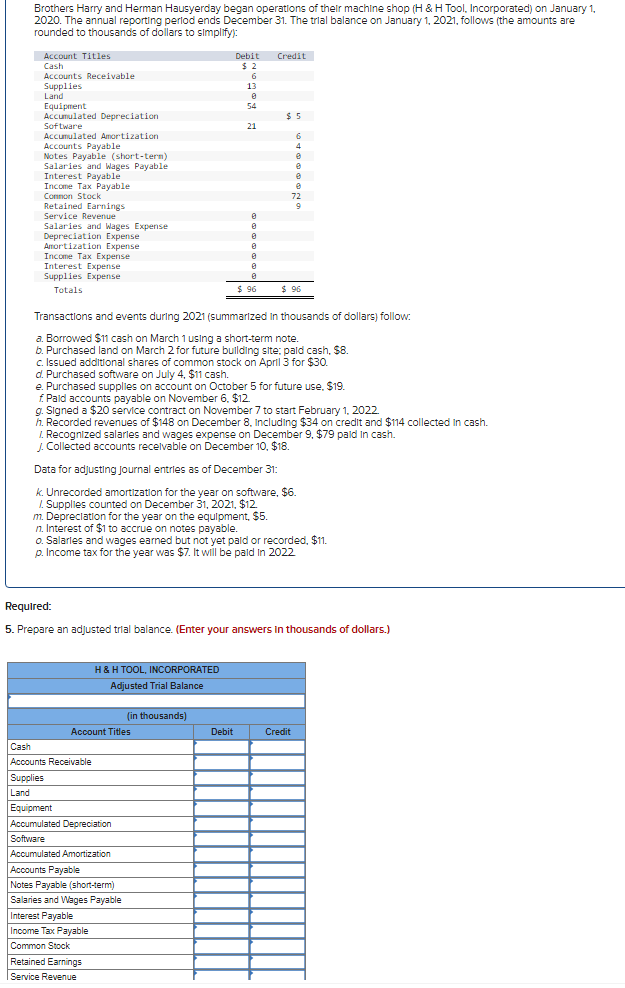

Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Incorporated) on January 2020. The annual reporting perlod ends December 31. The trial balance on January 1, 2021, follows (the amounts are rounded to thousands of dollars to simplify): Account Titles Cash Accounts Receivable Debit $ 2 6 13 Credit Supplies Land Equipment Accunulated Depreciation Software 54 21 Accunulated Amortization Accounts Payable Notes Payable (short-tern) Salaries and Wages Payable Interest Payable Income Tax Payable Connon Stock Retained tarnings Service Revenue Salaries and Wages Expense Depreciation Expense Amortization Expense Income Tax Exреnse Interest Expense Supplies Expense Tot als

Brothers Harry and Herman Hausyerday began operations of their machine shop (H & H Tool, Incorporated) on January 2020. The annual reporting perlod ends December 31. The trial balance on January 1, 2021, follows (the amounts are rounded to thousands of dollars to simplify): Account Titles Cash Accounts Receivable Debit $ 2 6 13 Credit Supplies Land Equipment Accunulated Depreciation Software 54 21 Accunulated Amortization Accounts Payable Notes Payable (short-tern) Salaries and Wages Payable Interest Payable Income Tax Payable Connon Stock Retained tarnings Service Revenue Salaries and Wages Expense Depreciation Expense Amortization Expense Income Tax Exреnse Interest Expense Supplies Expense Tot als

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter4: Completing The Accounting Cycle

Section: Chapter Questions

Problem 4PB: The unadjusted trial balance of Recessive Interiors at January 31, 2019, the end of the year,...

Related questions

Question

salaries and wages expense

supplies expense

amoization expense

interest expense

income tax expense

Total

Transcribed Image Text:Brothers Harry and Herman Hausyerday began operatlons of their machine shop (H & H Tool, Incorporated) on January 1.

2020. The annual reporting perlod ends December 31. The trial balance on January 1, 2021, follows (the amounts are

rounded to thousands of dollars to simplify):

Account Titles

Cash

Accounts Receivable

Debit Credit

$ 2

6

Supplies

Land

13

Equipment

Accumulated Depreciation

Sof tware

54

$5

21

Accumulated Amortization

6

Accounts Payable

Notes Payable (short-tern)

Salaries and Wages Payable

Interest Payable

Income Tax Payable

Connon Stock

Retained Earnings

Service Revenue

Salaries and Wages Expense

Depreciation Expense

Amortization Expense

Income Tax Expense

Interest Expense

Supplies Expense

4

72

Totals

$ 96

$ 96

Transactions and events during 2021 (summarized In thousands of dollars) follow:

a. Borrowed $11 cash on March 1 using a short-term note.

b. Purchased land on March 2 for future bullding site: pald cash, $8.

c. Issued additional shares of common stock on April 3 for $30.

d. Purchased software on July 4, $11 cash.

e. Purchased supplies on account on October 5 for future use. $19.

f Pald accounts payable on November 6. $12.

g. Signed a $20 service contract on November 7 to start February 1, 2022.

h. Recorded revenues of $148 on December 8. Including $34 on credit and $114 collected in cash.

1. Recognized salarles and wages expense on December 9, $79 pald In cash.

J. Collected accounts recelvable on December 10, $18.

Data for adjustling Journal entries as of December 31:

k. Unrecorded amortization for the year on software, $6.

1. Supplies counted on December 31, 2021, $12.

m. Depreciation for the year on the equipment, $5.

n. Interest of $1 to accrue on notes payable.

o. Salarles and wages earned but not yet pald or recorded, $1.

p. Income tax for the year was $7. It will be pald In 2022

Required:

5. Prepare an adjusted trial balance. (Enter your answers in thousands of dollars.)

H&H TOOL, INCORPORATED

Adjusted Trial Balance

(in thousands)

Account Titles

Debit

Credit

Cash

Accounts Receivable

Supplies

Land

Equipment

Accumulated Depreciation

Software

Accumulated Amortization

Accounts Payable

Notes Payable (short-term)

Salaries and Wages Payable

Interest Payable

Income Tax Payable

Common Stock

Retained Earnings

IService Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Closing

H AND H TOOLS INC DECEMBER 2021

Solution

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub