David spent $625 on 30 shares in a software company. Aftor six months, the valuos of his stocks are worth $4,762.80, David's dividend yield during this period is 1.95% (a) How much dividend per share did the company pay David? Dividend per share i : (b) David solls his shares at the $4,762.80 price. The brokerage is 3.5% of the sale. What net profit does he make from the shares? ProfitS (c) David invests his profits into an account earning interest at 1% per annum, compounded quarterly. He intends to make quarterly withdrawals over 6 years, atter which the account will be empty, Use the present valué of an annuity of $1 table below to find how much David will be able to withdraw each quarter, to the nearest cent. Present Value of an Annuity of $1 Interest Rate per period 1.00% 5.8456 2.50% 5.6972 1.50% 2.00% 5.7460 Periods 0.50% 0.25% 5.9478 6. 5.8964 5.7955 11.4349 16.7792 21.8891 11.2551 16.3983 21.2434 11.0793 16.0295 20.6242 24.8889 28.8473 10.9075 15.6726 20.0304 12 11.8073 11.6189 18 17.5795 17.1728 24 23.2660 22.5629 26.7751 25.8077 24.0158 27.7941 32.8710 30 28.8679 36 34.3865 31.4468 30.1075 27.6607 39.8230 37.7983 35.9137 34.1581 32.5213 30.9941 42

David spent $625 on 30 shares in a software company. Aftor six months, the valuos of his stocks are worth $4,762.80, David's dividend yield during this period is 1.95% (a) How much dividend per share did the company pay David? Dividend per share i : (b) David solls his shares at the $4,762.80 price. The brokerage is 3.5% of the sale. What net profit does he make from the shares? ProfitS (c) David invests his profits into an account earning interest at 1% per annum, compounded quarterly. He intends to make quarterly withdrawals over 6 years, atter which the account will be empty, Use the present valué of an annuity of $1 table below to find how much David will be able to withdraw each quarter, to the nearest cent. Present Value of an Annuity of $1 Interest Rate per period 1.00% 5.8456 2.50% 5.6972 1.50% 2.00% 5.7460 Periods 0.50% 0.25% 5.9478 6. 5.8964 5.7955 11.4349 16.7792 21.8891 11.2551 16.3983 21.2434 11.0793 16.0295 20.6242 24.8889 28.8473 10.9075 15.6726 20.0304 12 11.8073 11.6189 18 17.5795 17.1728 24 23.2660 22.5629 26.7751 25.8077 24.0158 27.7941 32.8710 30 28.8679 36 34.3865 31.4468 30.1075 27.6607 39.8230 37.7983 35.9137 34.1581 32.5213 30.9941 42

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 6PROB

Related questions

Question

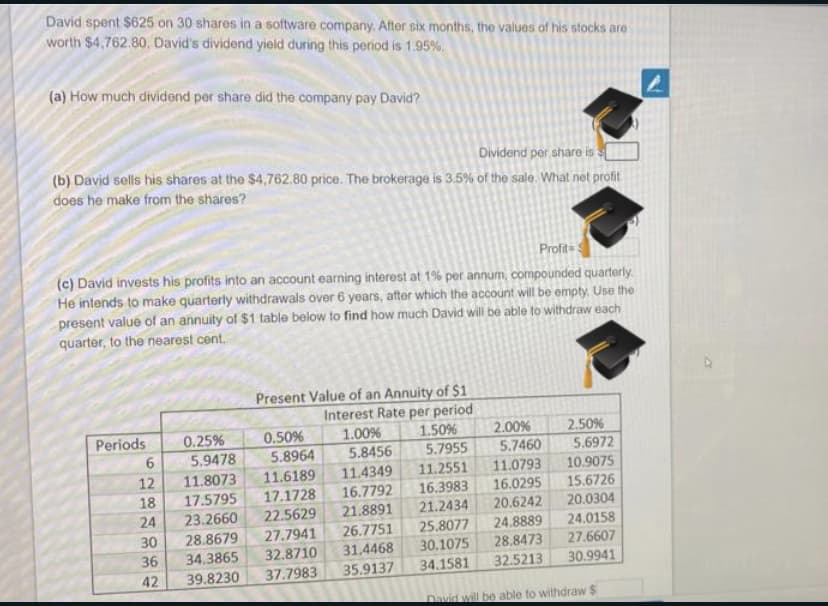

Transcribed Image Text:David spent $625 on 30 shares in a software company. After six months, the values of his stocks are

worth $4,762.80, David's dividend yield during this period is 1.95%,

(a) How much dividend per share did the company pay David?

Dividend per share is

(b) David sells his shares at the $4,762.80 price. The brokerage is 3.5% of the sale. What net profit

does he make from the shares?

ProfiteS

(c) David invests his profits into an account earning interest at 1% per annum, compounded quarterly.

He intends to make quarterly withdrawals over 6 years, atter which the account will be empty, Use the

present value of an annuity of $1 table below to find how much David will be able to withdraw each

quarter, to the nearest cent.

Present Value of an Annuity of $i

Interest Rate per period

1.00%

1.50%

2.00%

2.50%

5.6972

Periods

0.25%

5.9478

0.50%

5.8964

5.8456

5.7955

5.7460

10.9075

15.6726

11.4349

11.2551

11.0793

11.6189

17.1728

22.5629

12

11.8073

18

17.5795

16.7792

16.3983

16.0295

24

23.2660

21.8891

21.2434

20.6242

20.0304

25.8077

30.1075

24.0158

27.6607

26.7751

24.8889

27.7941

32.8710

30

28.8679

36

34.3865

31.4468

28.8473

39.8230

37.7983

35.9137

34.1581

32.5213

30.9941

42

David will be able to withdraw $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT