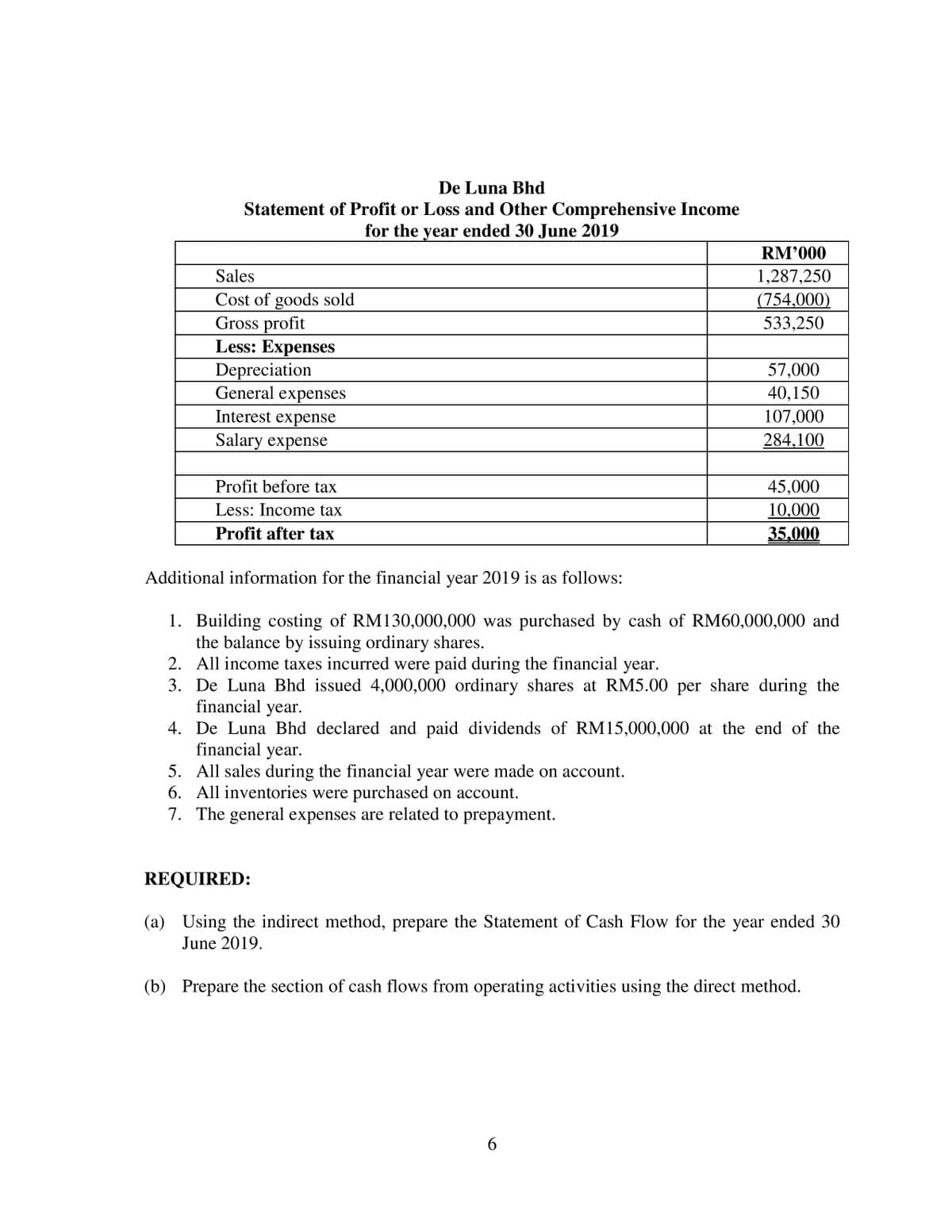

De Luna Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019 RM’000 Sales 1,287,250 Cost of goods sold Gross profit Less: Expenses Depreciation General expenses Interest expense Salary expense (754,000) 533,250 57,000 40,150 107,000 284,100 Profit before tax 45,000 Less: Income tax 10,000 35,000 Profit after tax Additional information for the financial year 2019 is as follows: 1. Building costing of RM130,000,000 was purchased by cash of RM60,000,000 and the balance by issuing ordinary shares. 2. All income taxes incurred were paid during the financial year. 3. De Luna Bhd issued 4,000,000 ordinary shares at RM5.00 per share during the financial year. 4. De Luna Bhd declared and paid dividends of RM15,000,000 at the end of the financial year. 5. All sales during the financial year were made on account. 6. All inventories were purchased on account. 7. The general expenses are related to prepayment. REQUIRED: (a) Using the indirect method, prepare the Statement of Cash Flow for the year ended 30 June 2019. (b) Prepare the section of cash flows from operating activities using the direct method.

De Luna Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2019 RM’000 Sales 1,287,250 Cost of goods sold Gross profit Less: Expenses Depreciation General expenses Interest expense Salary expense (754,000) 533,250 57,000 40,150 107,000 284,100 Profit before tax 45,000 Less: Income tax 10,000 35,000 Profit after tax Additional information for the financial year 2019 is as follows: 1. Building costing of RM130,000,000 was purchased by cash of RM60,000,000 and the balance by issuing ordinary shares. 2. All income taxes incurred were paid during the financial year. 3. De Luna Bhd issued 4,000,000 ordinary shares at RM5.00 per share during the financial year. 4. De Luna Bhd declared and paid dividends of RM15,000,000 at the end of the financial year. 5. All sales during the financial year were made on account. 6. All inventories were purchased on account. 7. The general expenses are related to prepayment. REQUIRED: (a) Using the indirect method, prepare the Statement of Cash Flow for the year ended 30 June 2019. (b) Prepare the section of cash flows from operating activities using the direct method.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter5: Accounting For Retail Businesses

Section: Chapter Questions

Problem 5MAD: Analyze Home Depot The Home Depot (HD) reported the following data (in millions) in its recent...

Related questions

Question

100%

Transcribed Image Text:De Luna Bhd

Statement of Profit or Loss and Other Comprehensive Income

for the year ended 30 June 2019

RM'000

Sales

1,287,250

(754,000)

Cost of goods sold

Gross profit

Less: Expenses

Depreciation

General expenses

533,250

57,000

40,150

107,000

Interest expense

Salary expense

284,100

Profit before tax

45,000

Less: Income tax

10,000

Profit after tax

35.000

Additional information for the financial year 2019 is as follows:

1. Building costing of RM130,000,000 was purchased by cash of RM60,000,000 and

the balance by issuing ordinary shares.

2. All income taxes incurred were paid during the financial year.

3. De Luna Bhd issued 4,000,000 ordinary shares at RM5.00 per share during the

financial year.

4. De Luna Bhd declared and paid dividends of RM15,000,000 at the end of the

financial year.

5. All sales during the financial year were made on account.

6. All inventories were purchased on account.

7. The general expenses are related to prepayment.

REQUIRED:

(a) Using the indirect method, prepare the Statement of Cash Flow for the year ended 30

June 2019.

(b) Prepare the section of cash flows from operating activities using the direct method.

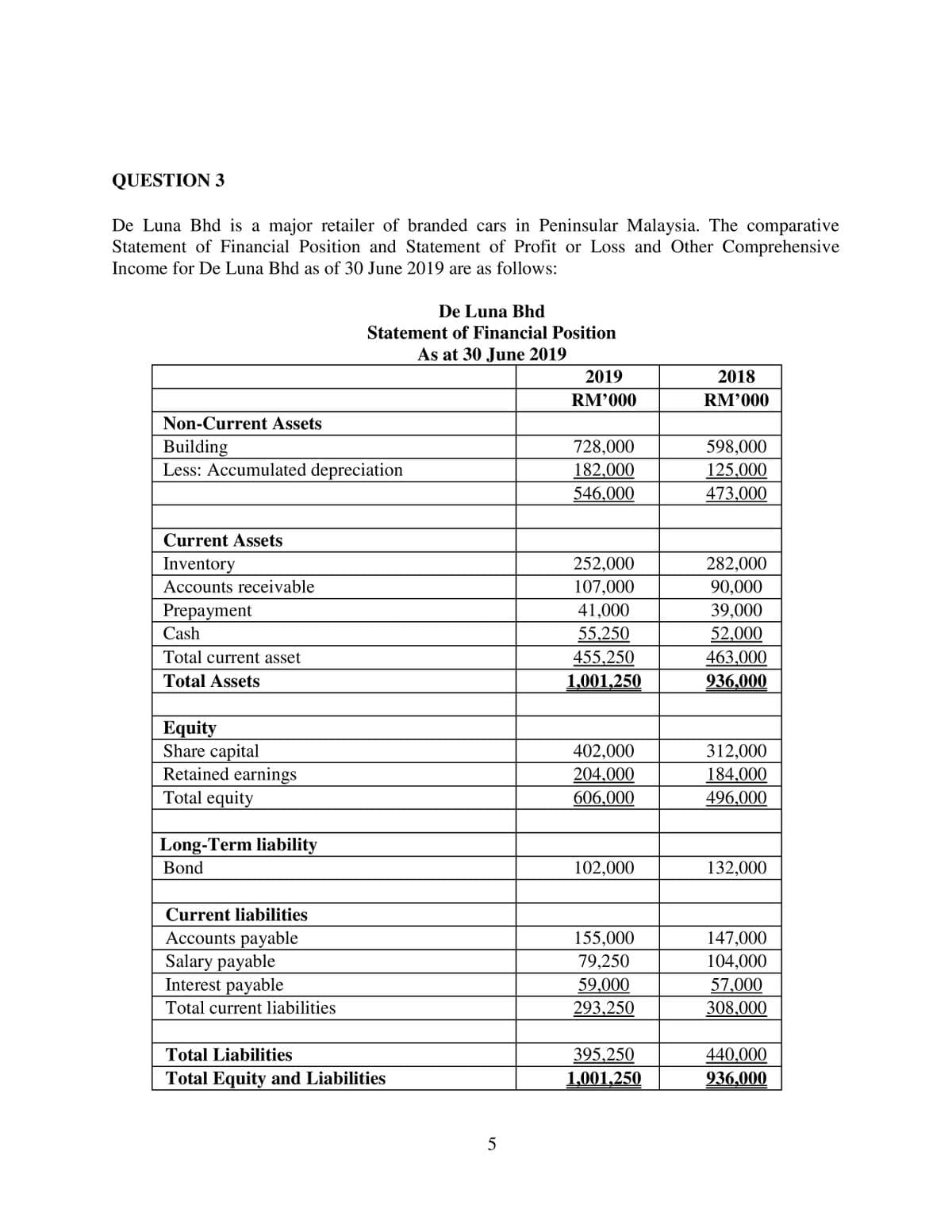

Transcribed Image Text:QUESTION 3

De Luna Bhd is a major retailer of branded cars in Peninsular Malaysia. The comparative

Statement of Financial Position and Statement of Profit or Loss and Other Comprehensive

Income for De Luna Bhd as of 30 June 2019 are as follows:

De Luna Bhd

Statement of Financial Position

As at 30 June 2019

2019

2018

RM'000

RM'000

Non-Current Assets

728,000

Building

Less: Accumulated depreciation

598,000

182,000

546,000

125,000

473,000

Current Assets

Inventory

252,000

282,000

Accounts receivable

107,000

90,000

Prepayment

41,000

39,000

55,250

455,250

Cash

52,000

Total current asset

463,000

936,000

Total Assets

1,001,250

Equity

Share capital

Retained earnings

Total equity

402,000

204,000

312,000

184,000

496.000

606,000

Long-Term liability

Bond

102,000

132,000

Current liabilities

Accounts payable

Salary payable

Interest payable

155,000

79,250

147,000

104,000

59,000

293,250

57,000

Total current liabilities

308,000

Total Liabilities

395,250

440,000

Total Equity and Liabilities

1,001,250

936,000

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning