Debbie McAdams paid 9% interest on a $16,500 loan balance. Jan Burke paid $6,450 interest on a $107,500 loan. Based on 1 year: a. What was the amount of interest paid by Debbie? Interest paid by Debbie b. What was the interest rate paid by Jan? Note: Round your answer to the nearest tenth percent. Interest rate paid by Jan c. Debbie and Jan are both in the 28% tax bracket. Since the interest is deductible, how much would Debbie and Jan each save in taxes? Note: Round your answers to the nearest cent. Save in taxes % Debbie Jan

Debbie McAdams paid 9% interest on a $16,500 loan balance. Jan Burke paid $6,450 interest on a $107,500 loan. Based on 1 year: a. What was the amount of interest paid by Debbie? Interest paid by Debbie b. What was the interest rate paid by Jan? Note: Round your answer to the nearest tenth percent. Interest rate paid by Jan c. Debbie and Jan are both in the 28% tax bracket. Since the interest is deductible, how much would Debbie and Jan each save in taxes? Note: Round your answers to the nearest cent. Save in taxes % Debbie Jan

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 25DQ

Related questions

Question

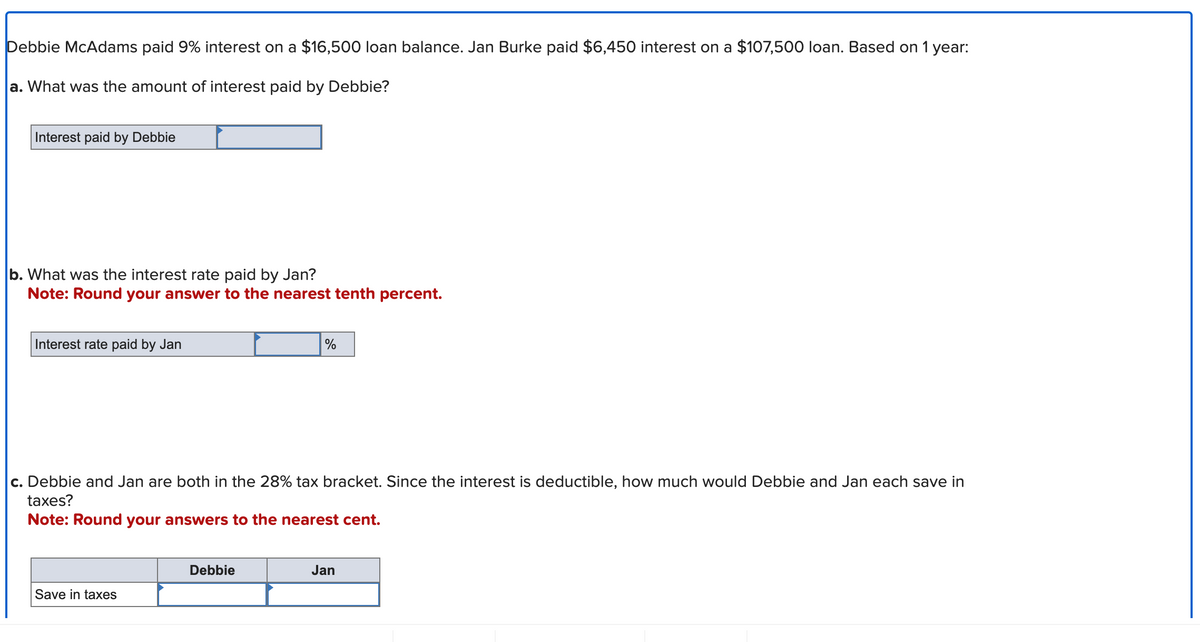

Transcribed Image Text:Debbie McAdams paid 9% interest on a $16,500 loan balance. Jan Burke paid $6,450 interest on a $107,500 loan. Based on 1 year:

a. What was the amount of interest paid by Debbie?

Interest paid by Debbie

b. What was the interest rate paid by Jan?

Note: Round your answer to the nearest tenth percent.

Interest rate paid by Jan

c. Debbie and Jan are both in the 28% tax bracket. Since the interest is deductible, how much would Debbie and Jan each save in

taxes?

Note: Round your answers to the nearest cent.

Save in taxes

%

Debbie

Jan

Expert Solution

Step 1

Answer:-

Tax meaning:- Tax is a compulsory charges that a government imposes on a person or a business in order to raise money for public projects like building infrastructure and services etc. Tax is basically revenue for the government.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT