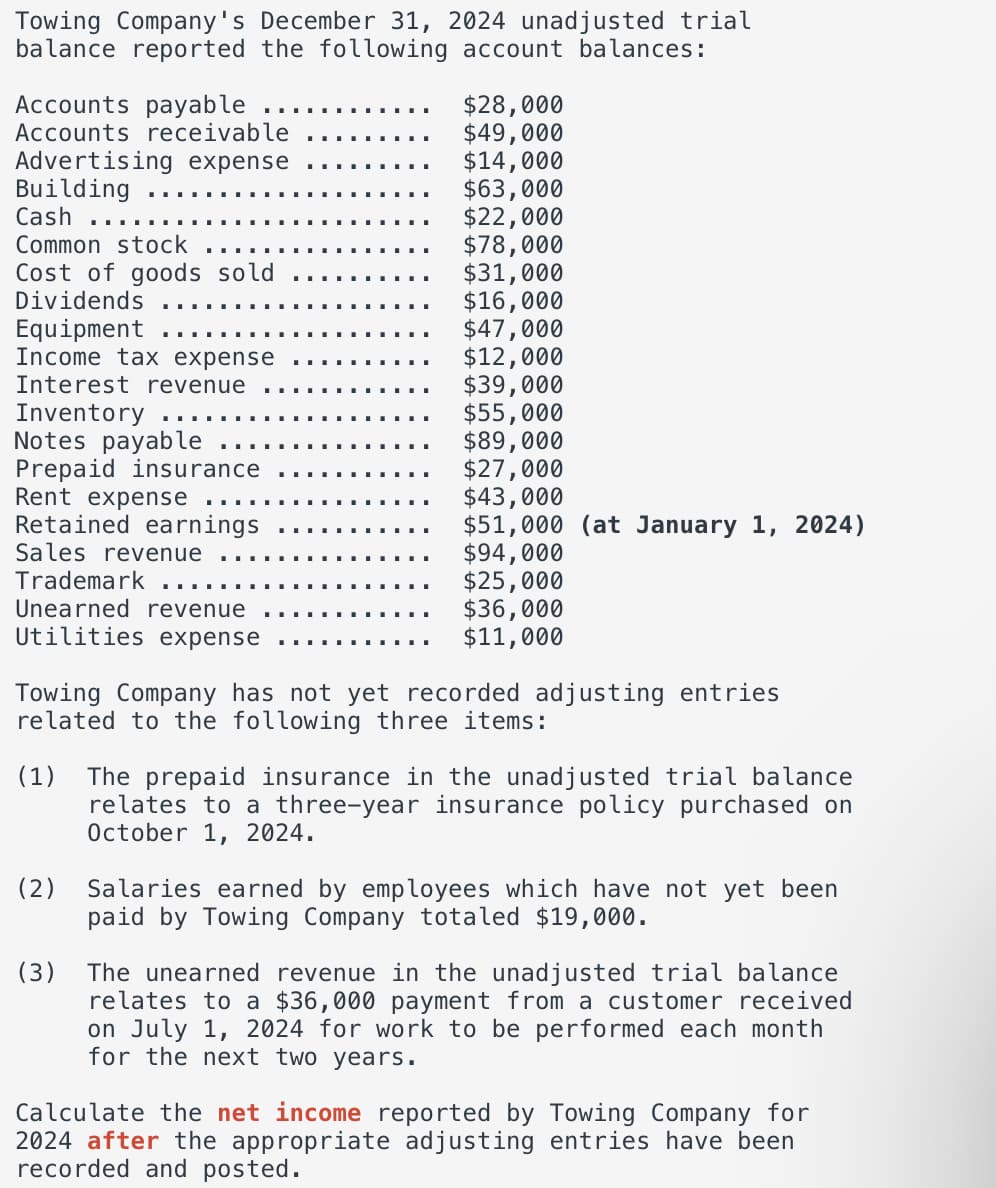

Towing Company's December 31, 2024 unadjusted trial balance reported the following account balances:

Towing Company's December 31, 2024 unadjusted trial balance reported the following account balances:

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section: Chapter Questions

Problem 1AP

Related questions

Question

Transcribed Image Text:Towing Company's December 31, 2024 unadjusted trial

balance reported the following account balances:

Accounts payable

Accounts receivable

Advertising expense

Building

Cash

Common stock

Cost of goods sold

Dividends

Equipment

Income tax expense

Interest revenue

Inventory

Notes payable

Prepaid insurance

Rent expense

Retained earnings

Sales revenue

Trademark

Unearned revenue

Utilities expense

I

$28,000

$49,000

$14,000

$63,000

$22,000

$78,000

$31,000

$16,000

$47,000

$12,000

$39,000

$55,000

$89,000

$27,000

(3)

$43,000

$51,000 (at January 1, 2024)

$94,000

$25,000

$36,000

$11,000

Towing Company has not yet recorded adjusting entries

related to the following three items:

(1) The prepaid insurance in the unadjusted trial balance

relates to a three-year insurance policy purchased on

October 1, 2024.

(2) Salaries earned by employees which have not yet been

paid by Towing Company totaled $19,000.

The unearned revenue in the unadjusted trial balance

relates to a $36,000 payment from a customer received

on July 1, 2024 for work to be performed each month

for the next two years.

Calculate the net income reported by Towing Company for

2024 after the appropriate adjusting entries have been

recorded and posted.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning