Debits Credits Cash 261,400 Taxes Receivable – Current 888,500 62,000 325,700 15,900 Estimated Uncollectible Current Taxes Accounts Payable Due to Other Funds 520,000 Tax Anticipation Notes Payable Reserve for Encumbrances 112,000 Fund Balance 122,500 Estimated Revenues 1,556,200 Revenues 1,457,300 Appropriations 1,551,600 Encumbrances 112,000 Expenditures 1.349,000 Totals 4.167.100 4.164.000

Q: Data concerning the cash records of Tamang Panahon Company for the months of November and December…

A: What is a Bank Reconciliation statement? This statement is prepared to record the difference between…

Q: Normal balances) Cash on hand and in bank 239,186 Short-term investments 353,700 Accounts receivable…

A: The balance sheet depicts a company's financial position by recording all of its assets,…

Q: ebits Cash $ 20,000 Property taxes receivable 30,000 Due from other funds 10,000 Vouchers payable $…

A: It is made for closing the temporary accounts.

Q: Petron Globe Assets Cash Receivables Inventories 7,619 90, 602 16, 757 7, 621 5, 972 2. 810 17,927…

A: Average payment period is the time in days to pay accounts payable. It can be calculate Average…

Q: Accounts payable P 24,000 Wages Payable (all have priority) 4,000 Taxes payable 4,000 Notes payable…

A: ANSWER the estimated dividend percentage is

Q: Consider the following data extracted from an after-tax cash flow calculation. Before-Tax-and-Loan =…

A: After Tax Cash Flows are the amount of cash and cash equivalents a firm receives in a financial year…

Q: Current Assets Cash Php 25,000 Php 30.000 Marketable Securities 40,000 10,000 Accounts Receivable…

A: Current ratio of an organisation is a measure to calculate the organisation’s ability to pay off its…

Q: Using the data that is shown below - (a) calculate the individual after-tax cash flow effect of each…

A: After-tax revenue = Revenue ( 1 - Tax ) After tax operating expense = Operating expenses * ( 1 - Tax…

Q: Liabilities OMR Assets OMR Equity share capital Accounts Payable Reserves and surplus Bills payable…

A: Net income = OMR 113,950 (as calculated below) Shareholders equity = OMR 27,800 (given)

Q: Surcharges 30,000.00 170,000.00 Interest from Loans Filling Fee 12,000.00 38,000.00 6,000.00 Service…

A: Claculation for surplus are as follows

Q: CURRENT ASSETS .Cash (Note 6) Short-Term Investments (Note 7) Trade and Other Receivables (Note 8)…

A: Horizontal analysis - Horizontal Analysis is part of the analysis in which individuals get the idea…

Q: Calculate the source of funds from the given information Particulars OMR Particulars OMR Share…

A: The Source of funds is the different ways that lead to the inflow of funds into the business. It…

Q: ndia Company reported the following accounts on December 31, 2020: Cash on hand P 1,000,000…

A: Step 1 Restricted items or items which are not available for immediate use are excluded ad cash and…

Q: Cash P18,600 10,000 Accounts Receivable 5,000 4,000 10,000 50,000 6,000 4,000 Notes Receivable…

A: Introduction: Balance sheet: All Assets and liabilities are shown in balance sheet. It tells the net…

Q: On December 1, 2020, Kyle Corporation established a petty cash fund of P4,000. On December 31, 2020,…

A: Cash short and over = Receipts and documents for miscellaneous expenses + additional cash -opening…

Q: Financial information of ABC Company for the year ended December 31, 2021. Description Debit…

A: Statement of Financial Position: The statement of financial position or Balance Sheet indicates the…

Q: Bank A Bank B 750,000 Total assets Total loans 950,000 8,000 18,500 Total reserves 40,000 8,000…

A: Formula of return on equity: Return on Equity=Net IncomeTotal Equity Formula of return on assets:…

Q: . Using the Balance Sheet in the St. Johns County, Florida 2015 CAFR calculate the following ratios…

A: Before we get into the numbers, let's revist some of the concepts and our observations:Current Ratio…

Q: Brandon Company Bank Reconciliation May 31, 2020 Balance per books May 31 Add: Electronic Fund…

A: Introduction: BRS: BRS stands for Bank Reconciliation statement. To reconcile the difference between…

Q: Assets Liabilities Cash 55,000 Demand deposits 207,000 Fed Funds…

A: Interest Rate Sensitive Liabilities: The interest rate-sensitive liabilities are those liabilities…

Q: Financial assets Twilight Co. has the following assets on Dec. 31, 20x1: Petty cash fund Cash in…

A: Financial assets: These often includes all the assets that are of non-physical nature and are…

Q: After-Tax Cash Flows Using the data that is shown below - (a) calculate the individual after-tax…

A: Net after-tax cash flows = Cash revenues - Cash operating expenses + Tax savings on depreciation

Q: Calculate the total assets shown in he Particulars OMR Particulars OMR Capital 200,000 Fixed deposit…

A: Total Assets Total assets are the assets which are of economic value and that are owned by an…

Q: CASH PAID FOR: Interest on debt $320 Income tax 90 Debt principal reduction Purchase of equipment…

A: Cash flow statement shows the amount of cash and cash equivalents which is entering or leaving a…

Q: Calculate cash balances based on the information provided in the chart below and show me how you did…

A: Introduction Cash flow statement provides the information about cash inflows and outflows in a…

Q: How much is the Net cash paid by the Government? Sale on Account to Government (VAT Inc) 672,000.00…

A: VAT is one of the indirect tax being imposed by the government on sale of goods. Business needs to…

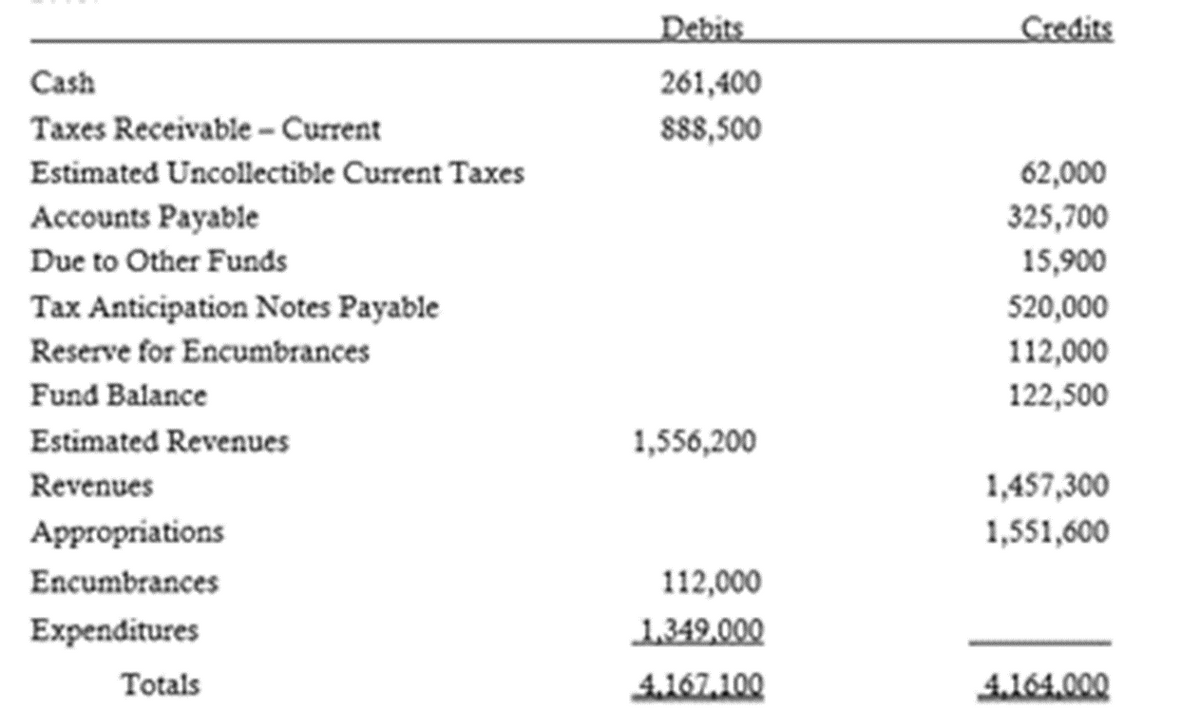

Q: The following trial balance is taken from the General Fund of the City of Jennings for the year…

A:

Q: Advances to Oficers Advances to suppli ers Allowance for Doub tful Accounts Biological Assets Bonds…

A: The financial statements of a company are the financial reports that show the working status of the…

Q: Increased/decre ased (amount) Increased/decreased (Percentage) 31st March 31st March Particulars…

A: Fixed LIability: The phrase "fixed liabilities" refers to financial obligations such as bonds,…

Q: Total After tax cash Cash outflows Tax shields deductions outflows= Cash Year =Interest +…

A: The tax shield = deductions * tax rate

Q: Assets Liabilities Cash 55,000 Demand deposits 207,000 Fed Funds 192,500 Savings Accounts 362,200…

A: The interest sensitivity ratio for banks or financial institutions is the ratio of…

Q: Income-Expenditure (USD Million) March 2019 Interest income 113 Interest on loans 100 Interest…

A: Net income (NI) means net result from the all different activities which may affect the net loss or…

Q: Current Year Previous Year (in millions) (in millions) Cash and cash equivalents $19,993 $10,174…

A: The current ratio is the ratio of current assets and current liabilities. The quick ratio is the…

Q: P1,020,000 1,000 120,000 Cash in Bank Petty Cash Fund Accounts Receivable Est. Uncollectible Account…

A: The adjustment entries are prepared to adjust the revenues and expenses of the current period.

Q: Cash $38,100; Short-term investments $4,100; Accounts receivable $48,500; Supplies $6,100; Long-term…

A: Notes to Account Note no. Particulars Amount 1. Tangible Assets Equipment $96,500…

Q: 2021 June 1- A petty cash of P10,000 was established. 5- Disbursements were: Supplies Transportation…

A: The journal entries for the above question is attached in the next step:-

Q: Using the given, compute the cash conversion cycle of the entity. Use 360 days in a year…

A: Cash conversion cycle is the amount of time that will take to convert raw material into cash means…

Q: Accounts Payable $ 100 5,500 2,300 2,820 3,000 8,140 18,560 18,760 $ Accounts Receivable Bank Loan…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: Cash of $60,000 is transferred from the general fund to the debt service fund. What is reported on…

A: The correct answer is 2. Other Financing Sources increase by $60,000; Other Financing Uses increase…

Q: On December, 31 2021, Alberto Company had the following cash balances: Cash in banks 1,800,000 Petty…

A: Cash and cash equivalents refer to cash or which can be converted into cash immediately. It is…

Q: pe naut geh PROBLEMS 1. What is the year-end balance if the cash basis of accounting is used? What…

A: Cash Basis Accounting In cash basis accounting, Sales are recognized only when cash is received…

Q: December 31, 2021 Account Title Debits Credits Cash 65,000 Accounts receivable 160,000 285,000…

A: Balance sheet is the summary showing totals of resources or assets an entity has and the totals of…

The following is a pre-closing

Prepare Closing entries at June, 30, 2005

Step by step

Solved in 2 steps

- 13 - 391- The balance of the calculated VAT account is 10,000 TL, 191 The balance of the deductible VAT account is 15,000 TL, 190-The balance of the transferred VAT account is 4000 TL. How is the difference saved to which account?A) 190- To the receivable of the transferred VAT accountB) 360-To the debt of the tax and funds payable account C) 360-Tax and funds payable account receivable D) 190- To the debt of the transferred VAT accountE) None9 - 391- The balance of the calculated VAT account is 5,000 TL, 191 The balance of the deductible VAT account is also3 750 T, 190-The balance of the transferred VAT account is 1000 TL. Which account is the difference and how?saved? A) 360-To the receivable of the tax and funds account payable B) 190- To the debt of the transferred VAT accountC) 360-To the debt of the tax and funds payable account D) 190- To the receivable of the VAT account of the transferredE) None1. Compute the current assets.Cash Php 25,867.00Barney’s drawing 50,485.00Accounts Payable 78,584.00Notes Receivable 45,051.00Building 1,500,125.00Inventory 33,669.002. Compute the Net Income.Service Income Php 356,867.00Prepaid Rent 16,800.00Interest Expense 1,523.00Barney’s drawing 21,786.00Taxes 4,544.00Utilities Expense 3,651.003. The liabilities of Bb Barn are equal to 1/3 of thetotal assets. The owner's equity is P 6,300,500. Whatis the amount of the liabilities?4. Prepare journal entries to the following transactionsfor the year 2020.Sept. 1 V Barney invested Php 150,000 in Barney repair ShopSept 3 Purchased equipment worth Php 80,000 on account.Sept. 12 Paid Php 25, 000 for the equipmentpurchased dated Sept. 3, 2020.Sept. 15 Rendered service amounting toPhp 45,000.Sept. 17 Paid salaries to employees, Php16,000

- Balance on April 1, 2020Debtors control Dr. $65, 145Debtors control Cr. 600Creditors control Dr. 950Creditors control Cr. 75, 500Totals for the month of April 2020Cash purchases 35, 600Credit purchases 62, 600Cash Sales 47, 000Credit Sales 75, 000Contra entry: Set off 1, 800Refund to cash customers 2, 800Bad debt written off 3, 300Discount Allowed 3, 750Total payments to suppliers 87, 000Total receipt from customers 98, 800Discount received 5, 500Dishonoured cheques: customers 2, 900Increase in the allowance for bad debts 2, 100Return Inwards 2, 400Return Outwards 15, 200Balances at 30 April 2020Debtors control: Dr. ? Cr: $8 300Creditors control: Dr. $7 500 Cr: ?Required: Prepare the Sales ledger control account Prepare the Purchases control account6 - Which of the following is the account and amount that should appear in the dotted places in the journal article above? a) 191 VAT Deductible 5.400 TL B) 391 VAT to be calculated Hs. 5.400 TL NS) 391 Calculated VAT Hs. 6.300 TL D) 360 Taxes and Funds Payable Hs. 5.400 TL TO) 191 VAT Deductible 5,000 TLQuestion The following are the balances extracted from the public Accounts on the consolidated fund from the year ended 31 December 2016. GHS000 Direct Tax 1044460 compensation of employee 808672 Goods and Services 404336 Non-financial Assets 134779 Indirect tax 939556 Grants 28110 Interest Expenses 398138 Social benefits 238882 Other Expenses 159255 Other revenue…

- Income tac was $300,409 for the year. Income tac payable was $28,102 and $42,997 at the beginning and end of the year,reapectively. Cash payants for income tac reportés on the statement pc cash flots usine the direct method la a. $ 285,514 b. 315,304 c. 300,409 d. 371,5088. Iniwan Corp. maintains its accounting records on the cash basis but restates it financial statements to accrual basis. Iniwan had P600,000 in cash basis pre-tax income for 2020. The following information pertains to Iniwan’s operations for the year ended December 31, 2019 and 2020: Accounts receivable: 2020- P400,000; 2019- P200,000 Accounts payable: 2020- P150,000; 2019- P300,000 Under accrual method, what is the income before taxes should Iniwan report in its December 31, 2020? a. P250,000 b. P950,000 c. P550,000 d. P650,000Locker Rent 3500 Income from Government securities 2274 Interest on deposits 473 Transfer fees received 576 Rent and Lighting 767 From the above information Total Non-Interest income will be: a. OMR 5790 b. OMR 6350 c. OMR 6530 d. OMR 7590

- UTV Corp. have the following account balances for the year ended December 31, 2020:DEBIT BALANCESAmountCash and cash equivalents400,000Accounts receivable900,000Raw materials560,000Goods in process600,000Finished goods1,400,000Financial assets at FVOCI2,500,000Sinking fund200,000Land1,000,000Building6,000,000Plant and equipment2,400,000Patent800,000Goodwill1,400,000Unrealized loss – FVOCI100,000Prepaid benefit cost20,000Treasury shares at cost250,000TOTAL18,530,000 CREDIT BALANCESAmountBank overdraft100,000Due from an officer50,000Allowance for bad debts40,000Accumulated depreciation – building1,600,000Accumulated depreciation – plant and equipment400,000Notes payable, due June 30, 20211,300,000Notes payable, due June 30, 20222,100,000Accounts payable1,000,000Provision180,000Warranty liabilities80,000Income tax payable120,000Finance lease liability180,000Deferred tax liability280,000Actuarial gain300,000Revaluation surplus360,000Share capital6,000,000Share premium2,000,000Retained…A company reported in the income statement for the current year P900,000 income before provision for income tax. Please consider the following information: Rent income received in advance P150,000Interest income on time deposit 200,000Depreciation deducted for income tax purposes in excess of financial depreciation P100,000Income tax rate 30% 1. How much is the taxable income?A. 950,000B. 750,000C. 850,000D. 700,0002. How much is the accounting income subject to tax?A. 900,000B. 750,000C. 700,000D. 225,000Thank you.Life-Positive’s Account Balances 2021 ($) 2022 ($) accounts payable 24,600.00 21,250.00Accounts receivable 15,700.00 12,340.00Cash 23,450.00 28,600.00Cost of goods sold 19,700.00 23,000.00Depreciation 3,090.00 4,590.00Dividends 5,800.00 10,800.00Interest 2,340.00 2,890.00Inventory 7,050.00 8,640.00Long-term debt 28,000.00 30,000.00Net fixed assets 41,500.00 48,000.00Other expenses 2,400.00 2,800.00Sales 58,000.00 62,500.00Short-term Notes Payable 2,890.00 2,340.00Shares outstanding 85,000.00 90,000.00 tax rate is 32% 4. Calculate the cash flow from assets, cash flow to creditors,and cash flow to stockholders…