Dec. 1 Sold personal investment in Nike stock, which she had owned for several years, receiving $30,000 cash. Deposited the $30,000 cash from the sale of the Nike stock in her personal bank account. 2. Deposited $89,000 cash in a new business bank account titled Abby Perry, Attorney. The business issued common stock to Perry. Paid $600 cash for ink car:ridges for the printer. Purchased computer for the law office, agreeing to pay the account, $8,000, within three months. Received $2,900 cash from customers for services rendered. 15 Received bill trom The Lawyer tor magazine subscription, $300. (Use Miscellaneous Expense account.) Finished court hearings on behalf of a client and submitted a bill for legal services, $8,000, on account. 23 Paid bill from The Lawyer. 28 Paid utilities, $900. 30 31 Received $2,800 cash from clients billed on Dec. 23. Cash dividends of $3,000 were paid to stockholders. 31 9.

Dec. 1 Sold personal investment in Nike stock, which she had owned for several years, receiving $30,000 cash. Deposited the $30,000 cash from the sale of the Nike stock in her personal bank account. 2. Deposited $89,000 cash in a new business bank account titled Abby Perry, Attorney. The business issued common stock to Perry. Paid $600 cash for ink car:ridges for the printer. Purchased computer for the law office, agreeing to pay the account, $8,000, within three months. Received $2,900 cash from customers for services rendered. 15 Received bill trom The Lawyer tor magazine subscription, $300. (Use Miscellaneous Expense account.) Finished court hearings on behalf of a client and submitted a bill for legal services, $8,000, on account. 23 Paid bill from The Lawyer. 28 Paid utilities, $900. 30 31 Received $2,800 cash from clients billed on Dec. 23. Cash dividends of $3,000 were paid to stockholders. 31 9.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 1R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

Using the

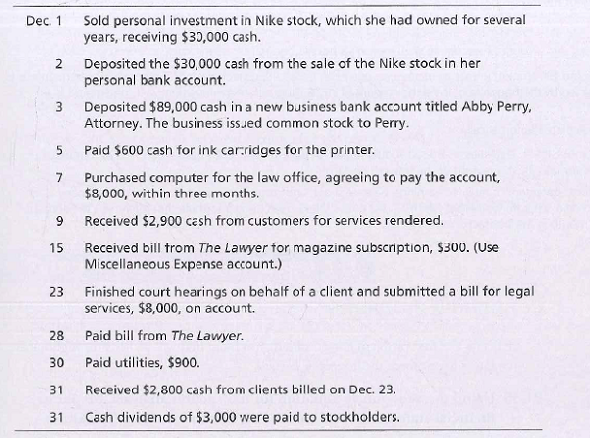

Abby Perry recently opened her own law office on December 1, which she operates as a corporation. The name of the new entity is Abby Perry, Attorney. Perry experienced the following events during the organizing phase of the new business and its first month of operation, December 2018. Some of the events were personal and did not affect the law practice. Others were business transactions and should be accounted for by the business.

Requirements

- Analyze the effects of the preceding events on the accounting equation of Abby Perry, Attorney. Use a format similar to Exhibit 1-6.

- Prepare the following financial statements:

a. Income statement.

b. Statement of

c.

d. Statement of cash flows.

Transcribed Image Text:Dec. 1

Sold personal investment in Nike stock, which she had owned for several

years, receiving $30,000 cash.

Deposited the $30,000 cash from the sale of the Nike stock in her

personal bank account.

2.

Deposited $89,000 cash in a new business bank account titled Abby Perry,

Attorney. The business issued common stock to Perry.

Paid $600 cash for ink car:ridges for the printer.

Purchased computer for the law office, agreeing to pay the account,

$8,000, within three months.

Received $2,900 cash from customers for services rendered.

15

Received bill trom The Lawyer tor magazine subscription, $300. (Use

Miscellaneous Expense account.)

Finished court hearings on behalf of a client and submitted a bill for legal

services, $8,000, on account.

23

Paid bill from The Lawyer.

28

Paid utilities, $900.

30

31

Received $2,800 cash from clients billed on Dec. 23.

Cash dividends of $3,000 were paid to stockholders.

31

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College