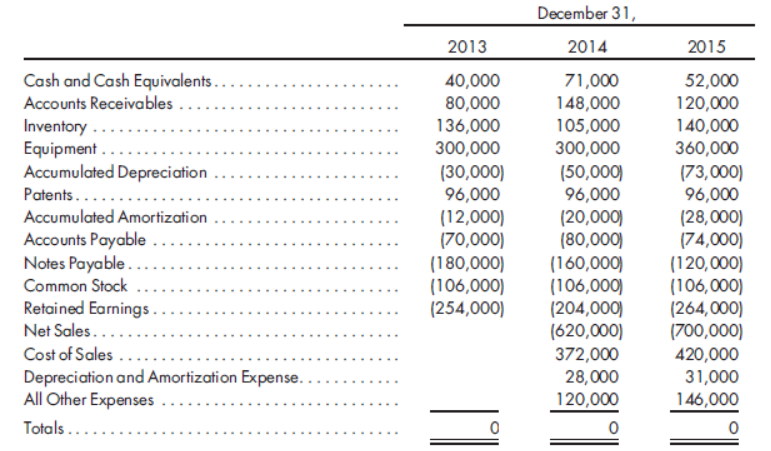

December 31, 2013 2014 2015 Cash and Cash Equivalents.. Accounts Receivables . 40,000 80,000 136,000 300,000 (30,000) 96,000 (12,000) (70,000) (180,000) (106,000) (254,000) 71,000 148,000 105,000 300,000 (50,000) 96,000 (20,000) (80,000) (160,000) (106,000) (204,000) (620,000) 372,000 28,000 120,000 52,000 120,000 140,000 360,000 Inventory .... Equipment ... Accumulated Depreciation Patents... Accumulated Amortization Accounts Payable Notes Payable . (73,000) 96,000 (28,000) (74,000) (120,000) (106,000) (264,000) (700,000) 420,000 31,000 Common Stock Retained Earnings. Net Sales..... Cost of Sales .. Depreciation and Amortization Expense.. All Other Expenses 146,000 Totals .....

Dontelli Enterprises began operations on July 1, 2012, as a manufacturer of heat sensitive valves used in the plumbing industry. Effective at the beginning of 2014, Platco, an American company, acquired an 80% interest in Dontelli paying 400,000 FC. Of the purchase price in excess of book value, 42,000 FC was allocated to patents having a remaining useful life of 10 years and the balance was allocated to

Dontelli’s condensed

Additional equipment was purchased on April 1, 2015. Dividends were paid on June 30 of 2014 and 2015. At the end of 2015, goodwill traceable to the acquisition of Dontelli was tested for impairment, and accordingly, the goodwill was written down by 20%. Calculate the balance of the cumulative translation adjustment as of year-end 2014 and 2015. Given the consolidated income statement for years 2014 and 2015, determine the amount of consolidated net income that is traceable to the noncontrolling interest.

Selected exchange rates are as follows:

| 1 FC= | 1 FC= |

|

July 1, 2012 . . . . . . . . . . . . . . $1.10 December 31, 2013 . . . . . . . . 1.25 Average 2014. . . . . . . . . . . . . 1.32 June 30, 2014. . . . . . . . . . . . . 1.30 December 31, 2014 . . . . . . . . 1.35 |

April 1, 2015 . . . . . . . . . . . . $1.31 June 30, 2015. . . . . . . . . . . . 1.28 Average 2015. . . . . . . . . . . . 1.26 December 31, 2015 . . . . . . . 1.21

|

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images