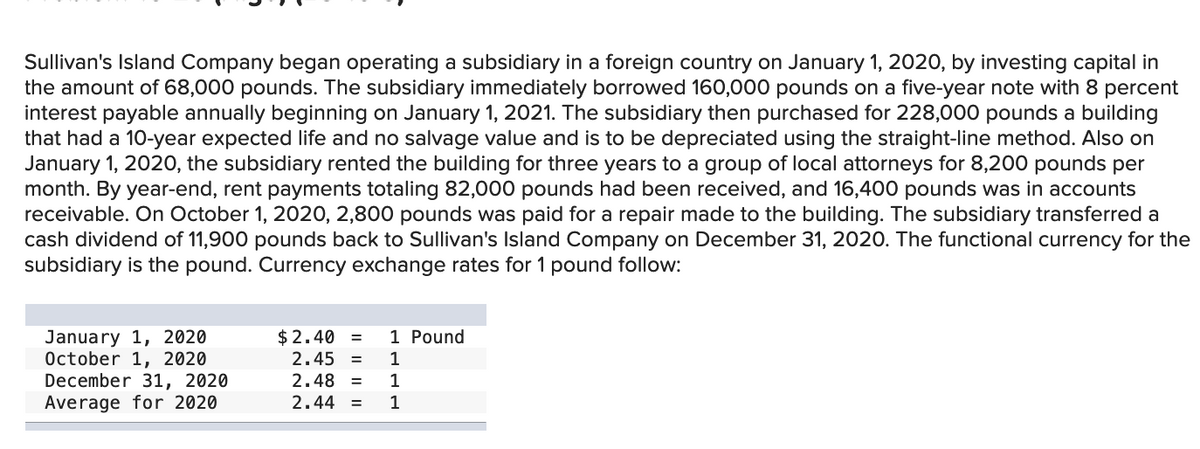

Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 68,000 pounds. The subsidiary immediately borrowed 160,000 pounds on a five-year note with 8 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 228,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,200 pounds per month. By year-end, rent payments totaling 82,000 pounds had been received, and 16,400 pounds was in accounts receivable. On October 1, 2020, 2,800 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11,900 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound follow: 1 Pound January 1, 2020 October 1, 2020 December 31, 2020 Average for 2020 $2.40 = 2.45 = 1 2.48 = 1 2.44 = 1

Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in the amount of 68,000 pounds. The subsidiary immediately borrowed 160,000 pounds on a five-year note with 8 percent interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 228,000 pounds a building that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,200 pounds per month. By year-end, rent payments totaling 82,000 pounds had been received, and 16,400 pounds was in accounts receivable. On October 1, 2020, 2,800 pounds was paid for a repair made to the building. The subsidiary transferred a cash dividend of 11,900 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the subsidiary is the pound. Currency exchange rates for 1 pound follow: 1 Pound January 1, 2020 October 1, 2020 December 31, 2020 Average for 2020 $2.40 = 2.45 = 1 2.48 = 1 2.44 = 1

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 7P

Related questions

Question

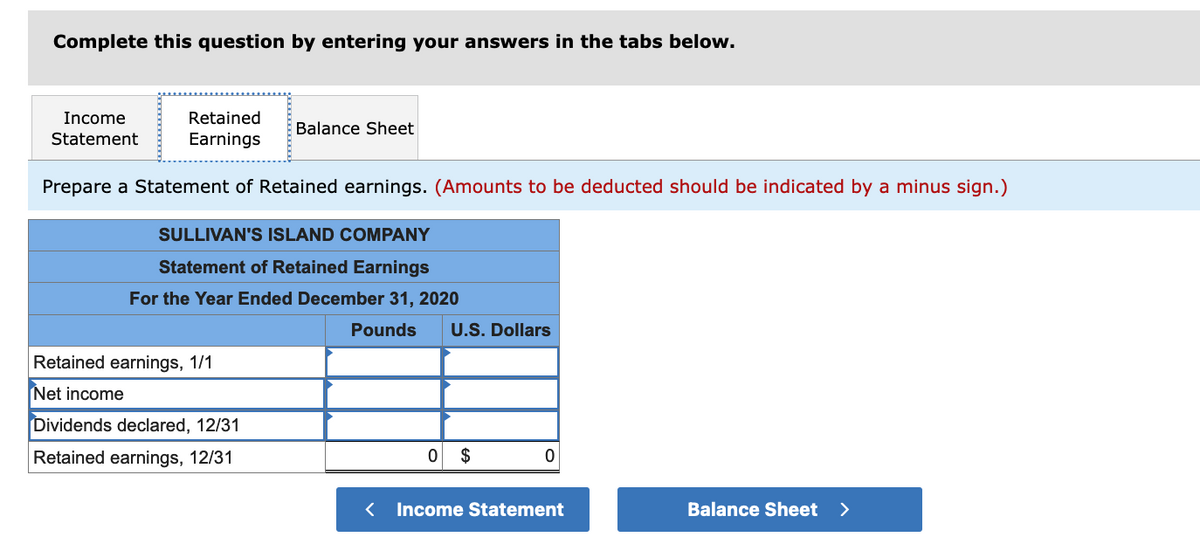

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Income

Retained

Balance Sheet

Statement

Earnings

Prepare a Statement of Retained earnings. (Amounts to be deducted should be indicated by a minus sign.)

SULLIVAN'S ISLAND COMPANY

Statement of Retained Earnings

For the Year Ended December 31, 2020

Pounds

U.S. Dollars

Retained earnings, 1/1

Net income

Dividends declared, 12/31

Retained earnings, 12/31

$

< Income Statement

Balance Sheet >

Transcribed Image Text:Sullivan's Island Company began operating a subsidiary in a foreign country on January 1, 2020, by investing capital in

the amount of 68,000 pounds. The subsidiary immediately borrowed 160,000 pounds on a five-year note with 8 percent

interest payable annually beginning on January 1, 2021. The subsidiary then purchased for 228,000 pounds a building

that had a 10-year expected life and no salvage value and is to be depreciated using the straight-line method. Also on

January 1, 2020, the subsidiary rented the building for three years to a group of local attorneys for 8,200 pounds per

month. By year-end, rent payments totaling 82,000 pounds had been received, and 16,400 pounds was in accounts

receivable. On October 1, 2020, 2,800 pounds was paid for a repair made to the building. The subsidiary transferred a

cash dividend of 11,900 pounds back to Sullivan's Island Company on December 31, 2020. The functional currency for the

subsidiary is the pound. Currency exchange rates for 1 pound follow:

$ 2.40 =

1 Pound

January 1, 2020

October 1, 2020

December 31, 2020

Average for 2020

2.45

1

%3D

2.48

1

2.44

1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT