Dee is evaluating a mining prospect for her employer, ElectroShock, ES. The purpose of the mine is to acquire the key rare minerals for the construction of batteries needed for electric cars, EV. The mining site is on federal government land. The parcel that Dee is considering is to be leased. This lease gives ElectroShock, ES, mineral rights for a period of 22 years. To acquire the lease and mineral rights, ES will have to initially spend $950K. There will also be a yearly $65K lease fee. However, the $65K lease fee, payable at each year’s end, will increase at a rate of 1% per year starting in the second year. Once acquiring the lease, ES expects to spend $375K for initial planning and $600K for core sample drilling by the end of the first year. After selecting the ‘best’ site on the leased property, ES will focus on access and infrastructure development. Access roads and bridges as well as the necessary site buildings will be constructed prior to the installation of the any mining equipment. The goal for ES is to start and complete the infrastructure development by the end of the second year after acquiring the lease. The initial cost of the roads and buildings is estimated to be $2.95M. In the first year ES will likely expend $2.5M of the initial costs and the remaining $450K by the end of the second year. ES estimates the annual operating costs to maintain the entire infrastructure to be about $275K per year starting in year three, the first projected year of mining operations.

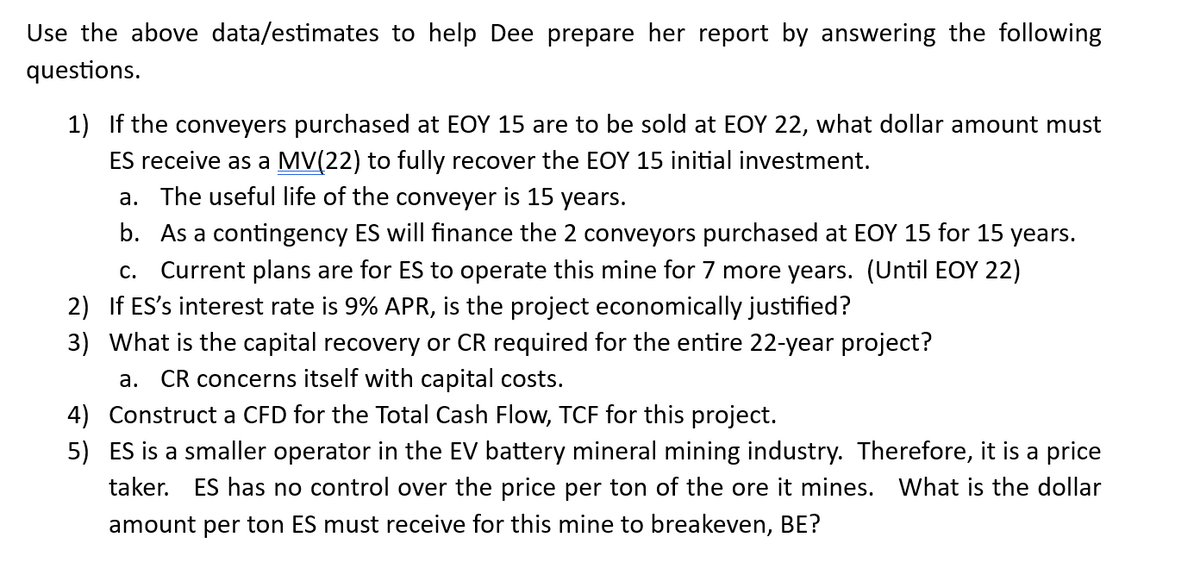

THE QUESTIONS ARE POSTED IN IMAGE. Thank you so much:) please use excel

Dee is evaluating a mining prospect for her employer, ElectroShock, ES. The purpose of the mine is to acquire the key rare minerals for the construction of batteries needed for electric cars, EV.

The mining site is on federal government land. The parcel that Dee is considering is to be leased. This lease gives ElectroShock, ES, mineral rights for a period of 22 years. To acquire the lease and mineral rights, ES will have to initially spend $950K. There will also be a yearly $65K lease fee. However, the $65K lease fee, payable at each year’s end, will increase at a rate of 1% per year starting in the second year. Once acquiring the lease, ES expects to spend $375K for initial planning and $600K for core sample drilling by the end of the first year.

After selecting the ‘best’ site on the leased property, ES will focus on access and infrastructure development. Access roads and bridges as well as the necessary site buildings will be constructed prior to the installation of the any mining equipment. The goal for ES is to start and complete the infrastructure development by the end of the second year after acquiring the lease. The initial cost of the roads and buildings is estimated to be $2.95M. In the first year ES will likely expend $2.5M of the initial costs and the remaining $450K by the end of the second year. ES estimates the annual operating costs to maintain the entire infrastructure to be about $275K per year starting in year three, the first projected year of mining operations.

In the latter part of the first year, ES plans to purchase and install a dragline at a cost of $1.25M. This dragline will have a useful life equal to the 22-year term of the project. At the end of its life, the market value for the dragline is typically zero. The cost to operate the dragline is estimated to be about $200K per year. The site will not likely be fully operational during the second year of the lease, however, the dragline will be used for training. Hence the operating costs for the dragline will begin to accrue during the second year of the site lease.

The goal for ES is to complete the infrastructure installation and begin operations during year 3. To meet this goal, ES will need to purchase and use the following equipment by the end of year 3. ES needs: 16 off-road dump trucks at $250K each, 6 pickups at $45K each, 4 loaders for $240K each and 2 conveyers at $525K each. The pickups will last for 5 years and have no market value at the end of their useful life. The dump trucks and loaders have a 10-year useful life. At the end of their useful lives their market value is 8% of their initial costs. The conveyer has a useful life of 15 years and a market value of 20% of its initial cost at the end of its useful life. At EOY 22 the conveyer will be sold at a price set at its unrecovered capital.

It is assumed that at the end of each piece of equipment’s useful it will be replaced until the end of the lease at EOY 22. Annual operating and maintenance costs for the equipment are estimated to be 45% of the first cost for the dump trucks and pickups. The loaders expect to have O&M costs of 35% of the initial cost. The conveyer will have O&M costs of 20% of the first costs.

At the end of year 3, the production volume will be 45K tons. This will increase to 95K tons for years 4 through 6, but then it will fall by 2% per year. The initial yield from the deposit will be 1.3%, but this will fall by 0.04% per year. The minerals are worth $1.80 per pound now, which is expected to increase by $0.03 per year due to EV demand.

Dee is tasked with presenting the final report to ES managers. Your task is to help Dee prepare her report by answering the questions posed below. The answers to these questions must be submitted as a Word/pdf/Excel document. If required, use a sentence or two to describe your method of solution as well as your results to Dee (grader). Do not forget to list your assumptions. Assume inflation, f = 0% for this study. Assume the cash flow estimates are accurate. MARR = 9% APR

Since inflation is zero, assume that future equipment replacement costs (capital and operating) are the same as their initial cost estimates. The new equipment is nearly identical to its replacement.

Trending now

This is a popular solution!

Step by step

Solved in 5 steps