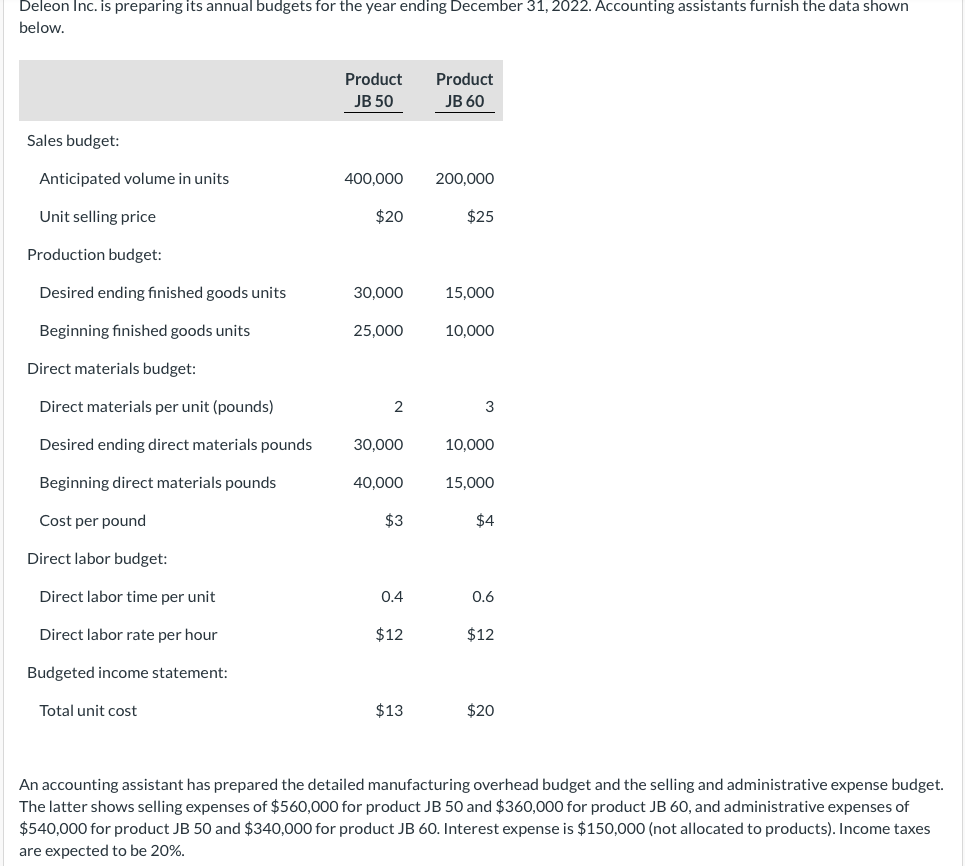

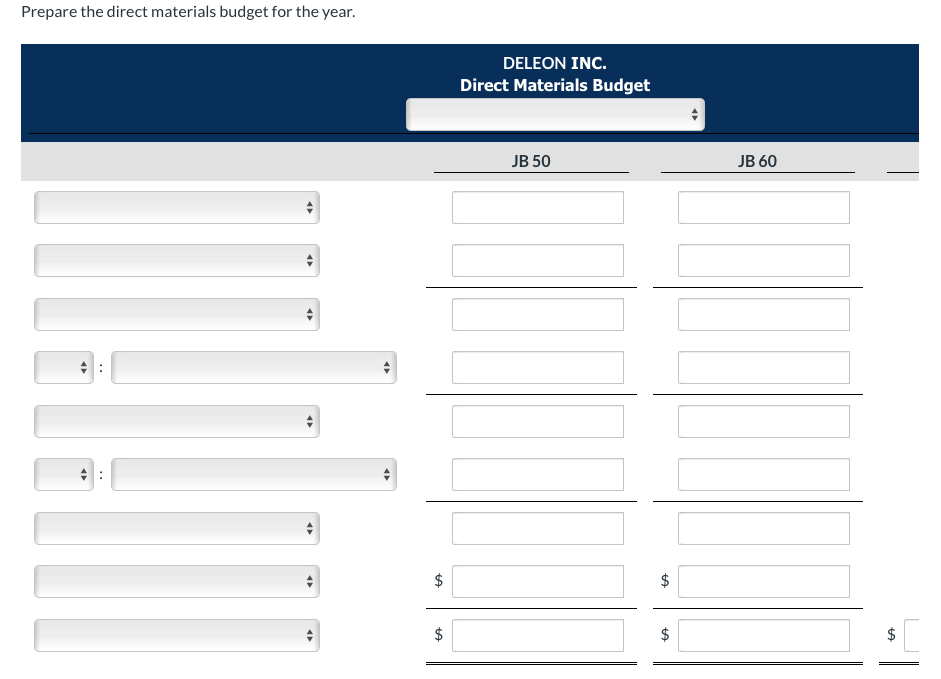

Deleon Inc. is preparing its annual budgets for the year ending December 31, 2022. Accounting assistants furnish the data shown below. Sales budget: Anticipated volume in units Unit selling price Production budget: Desired ending finished goods units Beginning finished goods units Direct materials budget: Direct materials per unit (pounds) Desired ending direct materials pounds Beginning direct materials pounds Cost per pound Direct labor budget: Direct labor time per unit Direct labor rate per hour Budgeted income statement: Total unit cost Product JB 50 400,000 $20 30,000 25,000 2 30,000 40,000 $3 0.4 $12 $13 Product JB 60 200,000 $25 15,000 10,000 3 10,000 15,000 $4 0.6 $12 $20 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expense budget The latter shows selling expenses of $560,000 for product JB 50 and $360,000 for product JB 60, and administrative expenses of $540,000 for product JB 50 and $340,000 for product JB 60. Interest expense is $150,000 (not allocated to products). Income taxes are expected to be 20%.

Master Budget

A master budget can be defined as an estimation of the revenue earned or expenses incurred over a specified period of time in the future and it is generally prepared on a periodic basis which can be either monthly, quarterly, half-yearly, or annually. It helps a business, an organization, or even an individual to manage the money effectively. A budget also helps in monitoring the performance of the people in the organization and helps in better decision-making.

Sales Budget and Selling

A budget is a financial plan designed by an undertaking for a definite period in future which acts as a major contributor towards enhancing the financial success of the business undertaking. The budget generally takes into account both current and future income and expenses.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps