Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter1: Fundamental Concepts Of Algebra

Section1.4: Fractional Expressions

Problem 66E

Related questions

Question

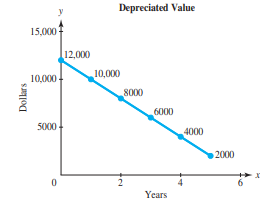

Depreciation Suppose a business purchases equipment for $12,000 and depreciates it over 5 years with

the straight-line method until it reaches its salvage

value of $2000 (see the figure below). Assuming that

the depreciation can be for any part of a year, do the

following:

a. Write an equation that represents the depreciated

value V as a function of the years t.

b. Write an inequality that indicates that the depreciated value V of the equipment is less than $8000.

c. Write an inequality that describes the time t during which the depreciated value is at least half of

the original value.

Transcribed Image Text:Depreciated Value

15,000

12,000

10,000

10,000 -

8000

6000

5000

4000

2000

Years

Dolars

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning