Discuss FOUR (4) strategies that Phoenix Textile can consider to improve its profitability.

Discuss FOUR (4) strategies that Phoenix Textile can consider to improve its profitability.

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

Transcribed Image Text:iii. Discuss FOUR (4) strategies that Phoenix Textile can consider to improve its

profitability.

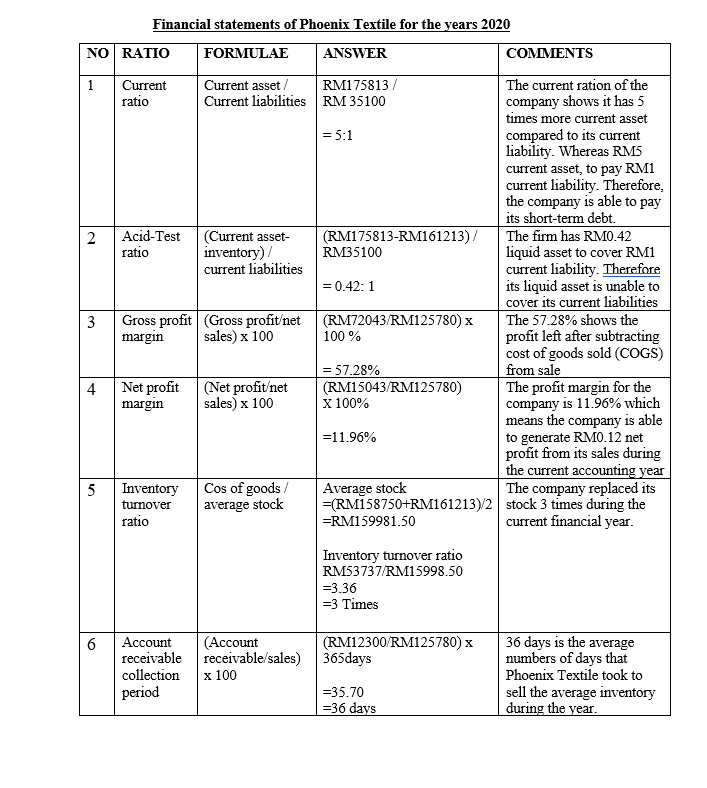

Transcribed Image Text:NO RATIO

1

2

3

4

5

Financial statements of Phoenix Textile for the years 2020

FORMULAE

ANSWER

RM175813/

RM 35100

6

Current

ratio

Acid-Test

ratio

Gross profit

margin

Net profit

margin

Inventory

turnover

ratio

Current asset/

Current liabilities

(Current asset-

inventory) /

current liabilities

(Gross profit/net

sales) x 100

(Net profit/net

sales) x 100

Cos of goods /

average stock

Account

(Account

receivable receivable/sales)

collection x 100

period

= 5:1

(RM175813-RM161213)/

RM35100

= 0.42: 1

(RM72043/RM125780) x

100 %

= 57.28%

(RM15043/RM125780)

X 100%

5%

Average stock

=(RM158750+RM161213)/2

=RM159981.50

Inventory turnover ratio

RM53737/RM15998.50

= 3.36

=3 Times

(RM12300/RM125780) x

365days

=35.70

=36 days

COMMENTS

The current ration of the

company shows it has 5

times more current asset

compared to its current

liability. Whereas RM5

current asset, to pay RM1

current liability. Therefore,

the company is able to pay

its short-term debt.

The firm has RM0.42

liquid asset to cover RM1

current liability. Therefore

its liquid asset is unable to

cover its current liabilities

The 57.28% shows the

profit left after subtracting

cost of goods sold (COGS)

from sale

The profit margin for the

company is 11.96% which

means the company is able

to generate RM0.12 net

profit from its sales during

the current accounting year

The company replaced its

stock 3 times during the

current financial year.

36 days is the average

numbers of days that

Phoenix Textile took to

sell the average inventory

during the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning