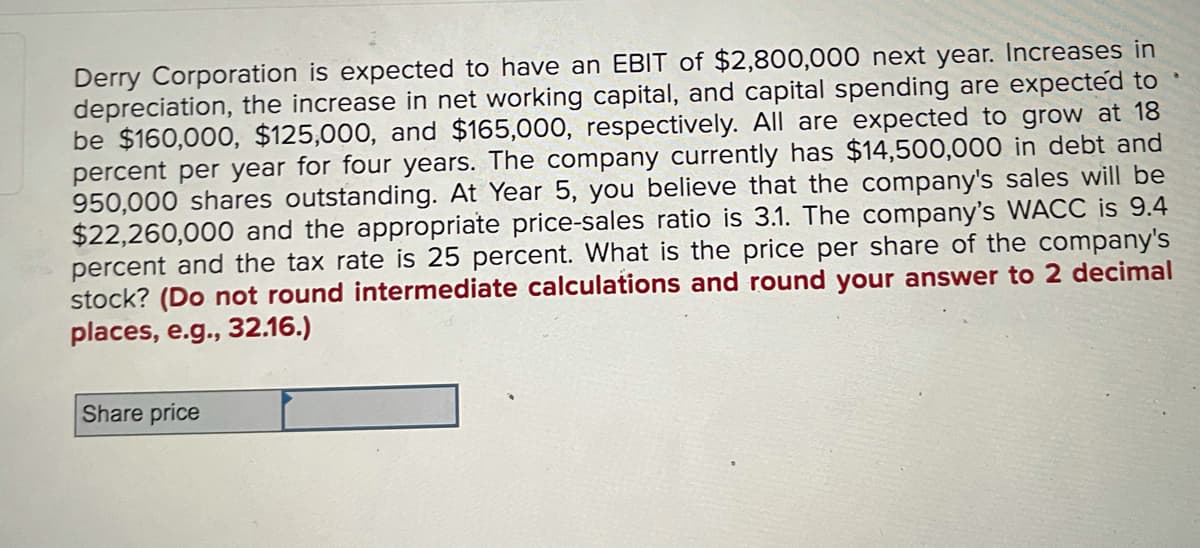

Derry Corporation is expected to have an EBIT of $2,800,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $125,000, and $165,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $14,500,000 in debt and 950,000 shares outstanding. At Year 5, you believe that the company's sales will be $22,260,000 and the appropriate price-sales ratio is 3.1. The company's WACC is 9.4 percent and the tax rate is 25 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share price

Derry Corporation is expected to have an EBIT of $2,800,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $125,000, and $165,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $14,500,000 in debt and 950,000 shares outstanding. At Year 5, you believe that the company's sales will be $22,260,000 and the appropriate price-sales ratio is 3.1. The company's WACC is 9.4 percent and the tax rate is 25 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share price

Chapter7: Common Stock: Characteristics, Valuation, And Issuance

Section: Chapter Questions

Problem 8P

Related questions

Question

Transcribed Image Text:Derry Corporation is expected to have an EBIT of $2,800,000 next year. Increases in

depreciation, the increase in net working capital, and capital spending are expected to

be $160,000, $125,000, and $165,000, respectively. All are expected to grow at 18

percent per year for four years. The company currently has $14,500,000 in debt and

950,000 shares outstanding. At Year 5, you believe that the company's sales will be

$22,260,000 and the appropriate price-sales ratio is 3.1. The company's WACC is 9.4

percent and the tax rate is 25 percent. What is the price per share of the company's

stock? (Do not round intermediate calculations and round your answer to 2 decimal

places, e.g., 32.16.)

Share price

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning