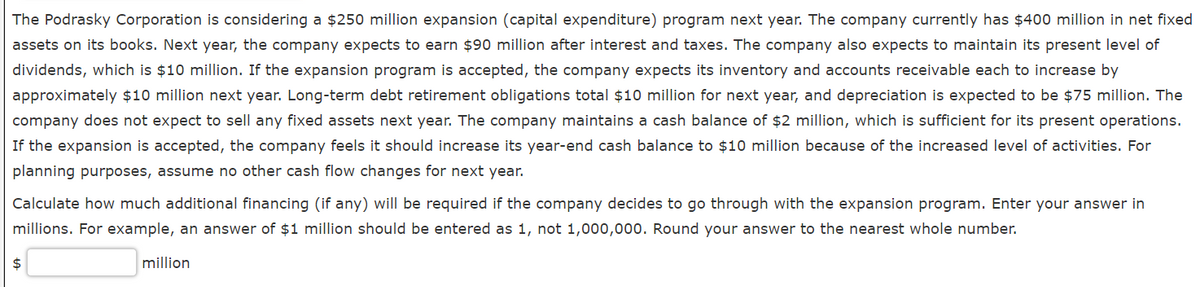

The Podrasky Corporation is considering a $250 million expansion (capital expenditure) program next year. The company currently has $400 million in net fixed assets on its books. Next year, the company expects to earn $90 million after interest and taxes. The company also expects to maintain its present level of dividends, which is $10 million. If the expansion program is accepted, the company expects its inventory and accounts receivable each to increase by approximately $10 million next year. Long-term debt retirement obligations total $10 million for next year, and depreciation is expected to be $75 million. The company does not expect to sell any fixed assets next year. The company maintains a cash balance of $2 million, which is sufficient for its present operations. If the expansion is accepted, the company feels it should increase its year-end cash balance to $10 million because of the increased level of activities. For planning purposes, assume no other cash flow changes for next year. Calculate how much additional financing (if any) will be required if the company decides to go through with the expansion program. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number. $ million

The Podrasky Corporation is considering a $250 million expansion (capital expenditure) program next year. The company currently has $400 million in net fixed assets on its books. Next year, the company expects to earn $90 million after interest and taxes. The company also expects to maintain its present level of dividends, which is $10 million. If the expansion program is accepted, the company expects its inventory and accounts receivable each to increase by approximately $10 million next year. Long-term debt retirement obligations total $10 million for next year, and depreciation is expected to be $75 million. The company does not expect to sell any fixed assets next year. The company maintains a cash balance of $2 million, which is sufficient for its present operations. If the expansion is accepted, the company feels it should increase its year-end cash balance to $10 million because of the increased level of activities. For planning purposes, assume no other cash flow changes for next year. Calculate how much additional financing (if any) will be required if the company decides to go through with the expansion program. Enter your answer in millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number. $ million

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:The Podrasky Corporation is considering a $250 million expansion (capital expenditure) program next year. The company currently has $400 million in net fixed

assets on its books. Next year, the company expects to earn $90 million after interest and taxes. The company also expects to maintain its present level of

dividends, which is $10 million. If the expansion program is accepted, the company expects its inventory and accounts receivable each to increase by

approximately $10 million next year. Long-term debt retirement obligations total $10 million for next year, and depreciation is expected to be $75 million. The

company does not expect to sell any fixed assets next year. The company maintains a cash balance of $2 million, which is sufficient for its present operations.

If the expansion is accepted, the company feels it should increase its year-end cash balance to $10 million because of the increased level of activities. For

planning purposes, assume no other cash flow changes for next year.

Calculate how much additional financing (if any) will be required if the company decides to go through with the expansion program. Enter your answer in

millions. For example, an answer of $1 million should be entered as 1, not 1,000,000. Round your answer to the nearest whole number.

2$

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College