Q: Feng Seawater Desalination Systems has established a capital investment limit of $800,000 for next…

A: The following table shows the project cash flow.

Q: piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: Present worth (PV) measures the current worth of a measure of cash – or a surge of incomes – that is…

Q: Advanced Technologies, Inc. is evaluating two alternatives to produce its new plastic filament with…

A: Given both alternatives have negative or outflow of cashflow, we will compare both alternatives…

Q: The cost of upgrading a section of Grand Loop Road in Yellowstone National Park is $2.1 million.…

A:

Q: The PW of five independent projects have been calculated at an MARR of 12% per year. Select the best…

A: Given MARR = 12% Total number of projects = 5

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: The continual expenses incurred in the usual day-to-day operations of a business are known as…

Q: Don't use excel or any tables, compute by a conventional method. Completely solve to fill in Blank…

A: All blanks answers are solved below,

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: Investment cost = $2500000 Salvage value = $50000 Per year revenue = $500000 Time period = 15 years…

Q: The International Parcel Service has installed a new radio frequency identification system to help…

A: (Q) The International Parcel Service has installed a new radio frequency identification system to…

Q: Three mutually exclusive designs for a bypass are under consideration. The bypass has a 10-year…

A: To find the optimal range of MARR we need to find the IRR of all the three alternatives . IRR :…

Q: UPS Freight plans to spend $100 million on new long-haul tractor-trailers. Some of these vehicles…

A: Given: Cost=$100 million MARR=10%

Q: Determine the IROR and profitability index at 12% per year for an industrial smart-grid system that…

A: The value is established on an assessment of the asset's significance, or the value can be…

Q: For some years, Mel has contracted with several major pizza retailers for home delivery services. He…

A: Given, Two Delivery Services : Current Van and New VanMARR : 12% Current Van : Purchased 10 years…

Q: A government-funded wind-based electric power generation company in the southern part of the country…

A: First, find the present worth of benefits: In year zero benefit = $45000 In year 5 benefit = $30000…

Q: The cost of upgrading a section of Grand Loop Road in Yellowstone National Park is $2.4 million.…

A: Given: Cost of upgrading=$2.4 million Other maintenance every 5 years=$460000 Interest rate=11%

Q: An international textile company's North America Division must decide which type of fabric cutting…

A: Given information: The first cost of a Round Knife = -250000 Annual operating cost = -31000 Salvage…

Q: The International Parcel Service has installed a new radio frequency identification system to help…

A:

Q: A corporate jet costs $1,350,000 and will incur $200,000 per year in fixed costs (maintenance,…

A: Given; Cost of corporate jet=$1350000Fixed cost=$200000Variable cost=$277 per hourTotal operated…

Q: A company sells two products, A and B. The sale mix consists of a composite unit of 2 units of A for…

A: The composite breakeven point for a composite units company is calculated as shown below, by…

Q: For some years, Mel has contracted with several major pizza retailers for home delivery services. He…

A: Given, New Van :Cost : 137,500 with economic life of 6 yearsTrade in value : 45,000AOC of…

Q: Transformers for underground works were planned to be provided. Type A has an initial cost of…

A:

Q: A government-funded renewable energy electric power generation company has developed the following…

A: * SOLUTION :- (9) Given that , Benifit = 60000 in year 0, and 30000 in year 5. Government…

Q: A food processing plant has an estimated initial cost P15.5M with a net annual profit of P3M for the…

A: We are going to find the Present Value of Benefit and Present Value of Cost to identify BC ratio to…

Q: In order to provide drinking water as part of its 50-year plan, a west coast city is considering…

A:

Q: Schneeberger, Inc. is considering two alternatives to increase the acceleration of its linear motor…

A:

Q: If the average loaded cost (i.e., including benefits) of each employee is P100,000 per year,…

A:

Q: ABC Technologies,Inc is evaluating two alternatives to produce its new plastic filament with…

A: The answer is given below

Q: An estimated 6 billion gallons of clean drinking water disappear each day across the United States…

A: a. Table 1 shows the project cash flow:

Q: For the cash flows shown, use an annual worth comparison and a MARR of 10% per year to determine the…

A: AW method:When comparing alternatives, the AW method is commonly used.AW means that all incomes and…

Q: Ten noneconomic attributes are identified as A, B, C, ..., J. If they are rank-ordered in terms of…

A: Weightage (W) for B can be calculated as follows.

Q: For the cash flows shown, use the capitalized cost analyses and an interest rate of 8% per year and…

A: Annual Worth is defined as the the equivalent uniform annual worth of all the estimated income and…

Q: For some years, Mel has contracted with several major pizza retailers for home delivery services. He…

A: MARR of 12% per year in all business dealings. His current van: purchased 10 years ago for = $75,000…

Q: Polytec Chemical, Inc. must decide between two additives to improve the dry-weather stability of its…

A: Additive A will have an equipment and installation cost of $136,000 and an annual cost of $55,000.…

Q: Estimates for a proposed small public facility are as follows: Plan A has a first cost of $45,000, a…

A: Plan A Plan B First Cost 45,000 95,000 Annual Maintenance 1,000 7,000 for 15 years and 950 for…

Q: A piece of onboard equipment has a first cost of $600,000, an annual cost of $92,000, and a salvage…

A:

Q: Abel and Family Perfumes wants to add one or more of four new products to its current line of…

A: a. The comparison of the four different projects can be done by calculating the present worth of the…

Q: A total of $50,000 was allocated to a project to detect and reduce insider theft in the ZipCar auto…

A: Total money allocated = $50000 Given ROR = 15%

Q: The rate of return for alternative X is 18% per year and for alternative Y is 17% per year, with Y…

A: Rate of return: It is used as a measure of profit as a percentage of investment.

Q: Determine the capitalized cost of a permanent roadside historical marker that has a first cost of…

A: First cost (C) is $78,000 and a maintenance cost (M) is $3,500 once every five year. Time period (n)…

Q: A corporate jet costs $1,350,000 and will incur $200,000 per year in fixed cost (maintenance, ..)…

A: Given initial cost = $1350000 Annual fixed cost = $200000 per hour variable cost = $277

Q: Complete the decision rule for the IRR method. If then the project is economically justified.

A: IRR stands for internal rate of returns. IRR is the expected growth that an investment produces…

Q: The three elements namely incremental cash flow series, LCM, and multiple roots-are considered…

A: False In engineering economy, through using the analysis of the three elements to evaluate…

Q: In conducting a sensitivity analysis of a proposed project, the present worth values of $–10,000,…

A:

Q: A piece of new equipment has been proposed by engineers to increase the productivity of a certain…

A: A amount of money today is worth more than a sum of money in the future, according to the concept of…

Q: Six projects have been identified for possible implementation by a company that makes dry ice…

A: Budget limitation represents the funding amount unrestricted to stimulate someone to receive…

Q: A new municipal refuse-collection truck can be purchased for $84,000. Its expected useful life s six…

A: The devotion of an asset to achieve a gain in value through time is referred to as investment. The…

Q: Beaver, a city in the United States, is attempting to attract a professional soccer team. Beaver is…

A: Initial cost = $ 380million Maintenance cost = $730,000 Painting Cost = 76,000 at 9th year Period =…

Q: Bawal gumamit ng excel( Don't use Excel) A small company has P20,000 in surplus capital that it…

A: Given information

Q: Decision D6, which has three possible choices (X, Y, or Z), must be made in year 3 of a 6-year study…

A:

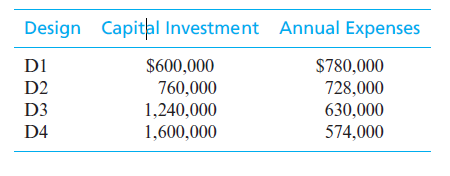

The Consolidated Oil Company must install antipollution equipment in a new refinery to meet federal clean-air standards. Four design alternatives are being considered, which will have capital investment and annual operating expenses as shown. Assuming a useful life of 8 years for each design, no market value, a desired MARR of 10% per year, determine which design should be selected on the basis of the PW method. Confirm your selection by using the FW and AW methods. Which rule applies? Why?

Step by step

Solved in 2 steps

- Initial Cost: ($300,000)The Study Period: 15 yearsSalvage (Market) Value of the Project: 12% of the initial costOperating Costs in the first year: ($7,500)Operating Costs increase by 5% per yearBenefits in the first year: $30,000 Benefit increase by 13% per yearMARR: 9% per year 1)Determine the NPW, AW, FW of the project. 2) Is the Project acceptable? WHY?An oil company plans to purchase a piece of vacant land at the corner of two busy streets for $50,000. On properties of this type, the company installs businesses of three different types. Each has an estimated useful life of 15 years. The salvage value for each is estimated to be the $50,000 land cost. Plan Cost (in addition to land cost) Type of business Net annual income A $ 83,000 Conventional gas station $ 26,500 B $ 195,000 Add automatic car wash $ 39,750 C $ 115,000 Add quick car wash $ 31,200 if the oil company expects a 10% rate of return on its investments, which plan (if any) should be selected? Use incremental analysis, before tax.CA fiscal year runs from Group of answer choices Oct 1, 2014- Sept 30, 2015 Apr 1, 2014 – Mar 31, 2015 Jan 1, 2014 - Dec 31, 2014 July 1, 2014 – June 30, 2015

- One company announced profits of 175000€ for year 1, 180,000€ for year 2, 190,000€ for year 3. The percentage change in net earnings from year 1 to year 3 is calculated as: a. 15000/175000 b. 25,000/175,000 c. 10,000/190,000 d. 25,000/190,000 e. None of the aboveDefine opportunity cost and explain its relevance in engineering project decision-making. Provide a real-world example of how considering opportunity cost can influence the choice between alternative projects or investments.An industrial engineering consulting firm usually observes a 90% learning curve rate in the installation of enterprise level software with its clients. If the first installation required 75 hours, estimate the time required for (a) the fifth, (b) the tenth, and (c) the twentieth installations. (d) Research the AMCF Code of Ethics. How are these similar to and different from engineering society ethics statements from your discipline?

- A manufacturer plans to introduce a new type of shirt based on the following information. The selling price is $57.00; variable cost per unit is $18.00; fixed costs are $7800.00; and capacity per period is 500 units. a) Calculate the break-even point (i) in units (ii) in dollars (2 decimal places) (iii) as a percent of capacity b) Draw a detailed break-even chart. (You do not have to submit this part; just draw it for your own practice.) c) Calculate the break-even point (in units) if fixed costs are reduced to $7020.00 d) Calculate the break-even point (in dollars) if the selling price is increased to $78.00YOUR QUESTION IS: 2. Three mutually exclusive design alternatives are being considered. The estimated sales and cost data for each alternative have been tabulated. The MARR is 20 per year. Annual revenues are based on the number of units sold and the selling price. Annual expenses are based on fixed and variable costs. Determine which selection is preferable based on F W. Confirm your selection by separately checking is preferable using PW. A B Cc Investment cost S 30 000 S 60 000 50 000 Est. units sold year 15 000 20 000 18 000 Unit selling price S 3.50 4.40 4.10 Unit variable cost S 1.00 1.40 1.15 Fixed annual expenses S 15 000 S 30 000 S 26 000 Market value 0 S 20 000 15 000 Useful life 10 yrs 10 yrs 10 yrsWhat does the term engineering economic decision refer to in all investment decisions relating to an engineering project?

- List the five main types of engineering economic decisions?The data below are estimated for a project study. i = 10% Plan A Initial Investment P 35,000 Annual Operating Cost P 6,450 Life 4 years Salvage Value none Annual Revenue 19,000 Plan B Initial Investment P 50,000 Annual Revenue P 25,000 Annual Disbursement P 13830BVM manufactured and sold 25,000 small statues this past year. At that volume, the firm was exactly in a breakeven situation in terms of profitability. BVM’s unit costs are expected to increase by 30% next year. What additional information is needed to determine how much the production volume/sales would have to increase next year to just break even in terms of profitability? (a) Costs per unit (b) Sales price per unit and costs per unit (c) Total fixed costs, sales price per unit, and costs per unit (d) No data is needed, the volume increase is 25, 000 + 25, 000(0.30) = 32, 500 units.