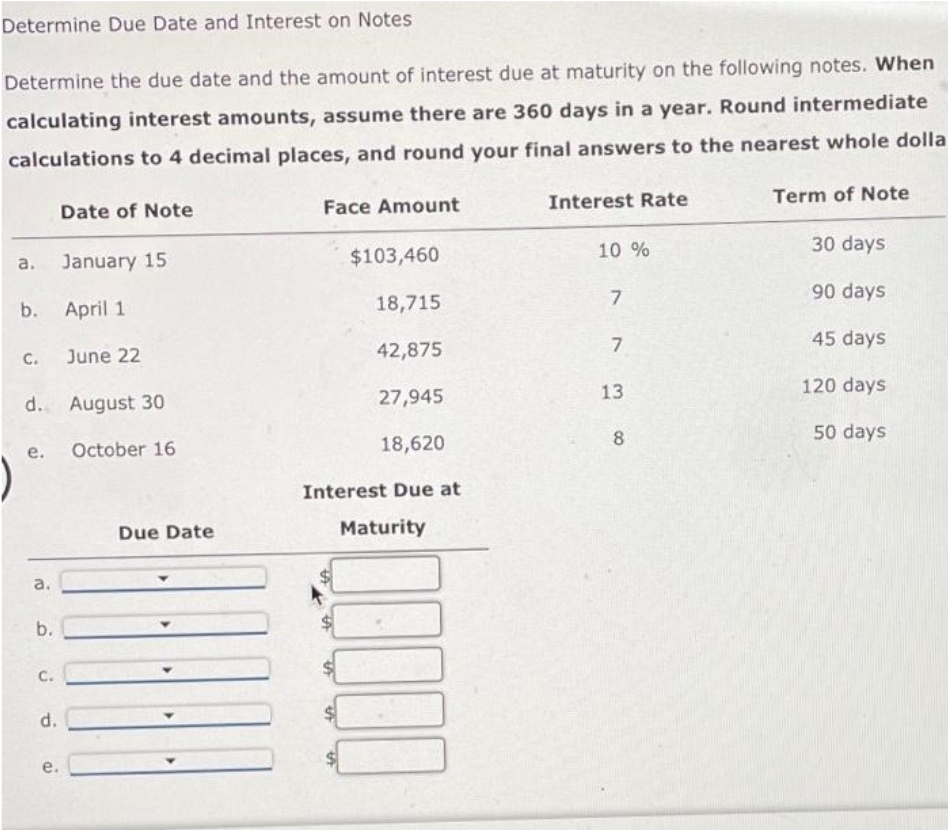

Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes. When calculating interest amounts, assume there are 360 days in a year. Round intermediate calculations to 4 decimal places, and round your final answers to the nearest whole dolla a. C. b. April 1 e. a. d. August 30 October 16 b. C. Date of Note d. January 15 e. June 22 Due Date Face Amount $103,460 18,715 42,875 27,945 18,620 Interest Due at Maturity 10000 Interest Rate 10 % 7 7 3 13 8 Term of Note 30 days 90 days 45 days 120 days 50 days

Determine Due Date and Interest on Notes Determine the due date and the amount of interest due at maturity on the following notes. When calculating interest amounts, assume there are 360 days in a year. Round intermediate calculations to 4 decimal places, and round your final answers to the nearest whole dolla a. C. b. April 1 e. a. d. August 30 October 16 b. C. Date of Note d. January 15 e. June 22 Due Date Face Amount $103,460 18,715 42,875 27,945 18,620 Interest Due at Maturity 10000 Interest Rate 10 % 7 7 3 13 8 Term of Note 30 days 90 days 45 days 120 days 50 days

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter17: Accounting For Notes And Interest

Section: Chapter Questions

Problem 6SEA: JOURNAL ENTRIES (ACCRUED INTEREST RECEIVABLE) At the end of the year, the following interest is...

Related questions

Question

Gg.101.

Transcribed Image Text:Determine Due Date and Interest on Notes

Determine the due date and the amount of interest due at maturity on the following notes. When

calculating interest amounts, assume there are 360 days in a year. Round intermediate

calculations to 4 decimal places, and round your final answers to the nearest whole dolla

a.

C.

b. April 1

e.

a.

d. August 30

October 16

b.

C.

Date of Note

d.

January 15

e.

June 22

Due Date

Face Amount

$103,460

18,715

42,875

27,945

18,620

Interest Due at

Maturity

10000

Interest Rate

10 %

7

7

13

8

Term of Note

30 days

90 days

45 days

120 days

50 days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT