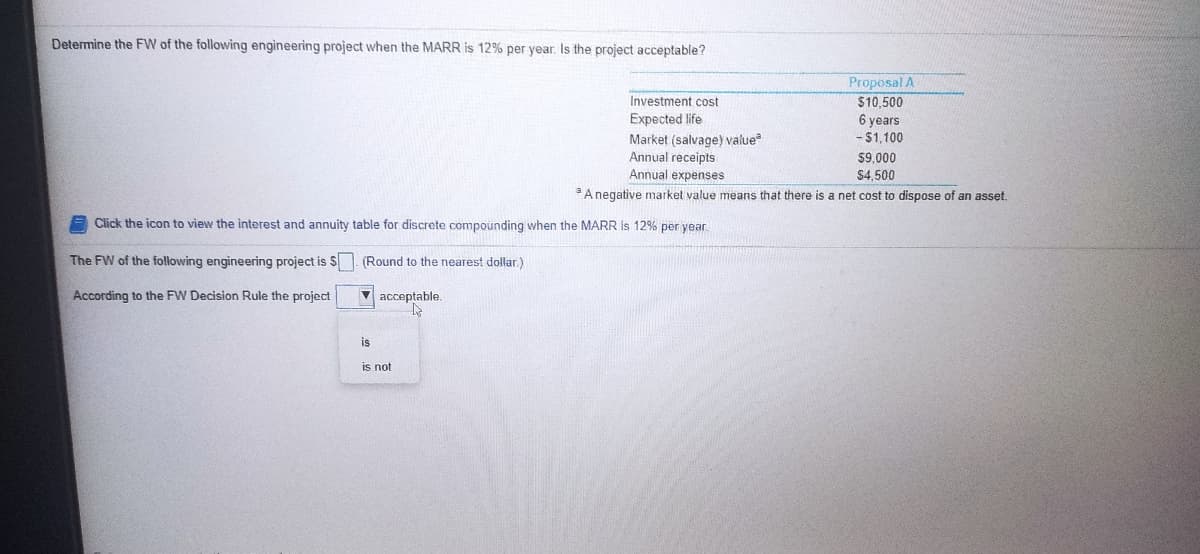

Determine the FW of the following engineering project when the MARR is 12% per year. Is the project acceptable? Proposal A $10,500 6 years - $1,100 Investment cost Expected life Market (salvage) value Annual receipts Annual expenses $9,000 $4.500 A negative market value means that there is a net cost to dispose of an asset. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The FW of the following engineering project is S (Round to the nearest dollar.) According to the FW Decision Rule the project v acceptable. is is not

Determine the FW of the following engineering project when the MARR is 12% per year. Is the project acceptable? Proposal A $10,500 6 years - $1,100 Investment cost Expected life Market (salvage) value Annual receipts Annual expenses $9,000 $4.500 A negative market value means that there is a net cost to dispose of an asset. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The FW of the following engineering project is S (Round to the nearest dollar.) According to the FW Decision Rule the project v acceptable. is is not

Economics (MindTap Course List)

13th Edition

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Roger A. Arnold

Chapter32: Building Theories To Explain Every Day Life: From Observations To Questions To Theories To Predictions

Section: Chapter Questions

Problem 11QP

Related questions

Question

100%

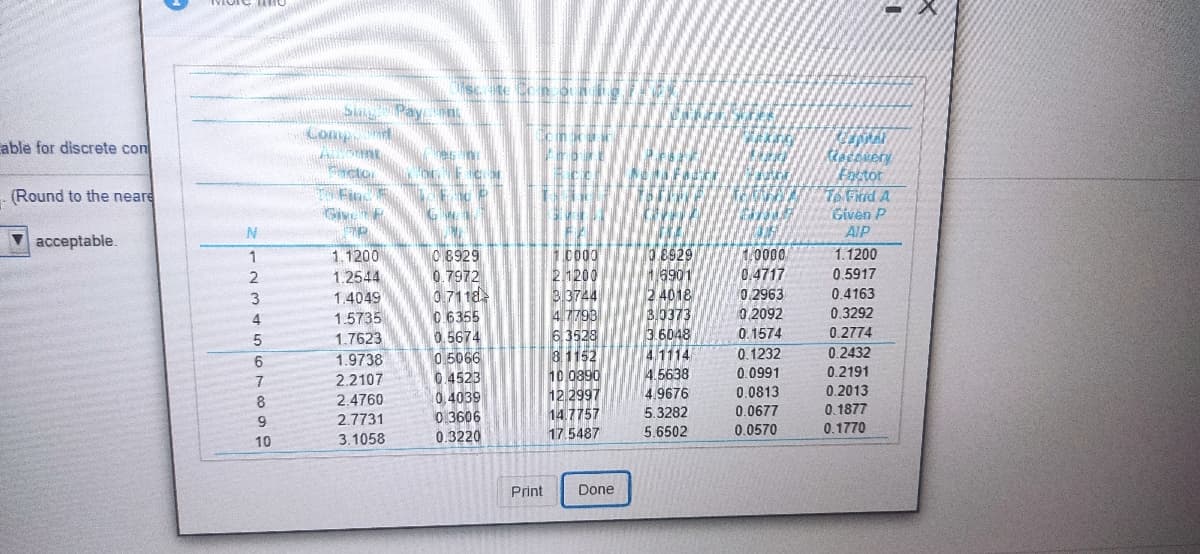

Transcribed Image Text:sc. te Con oa

S Payn

Comp

able for discrete con

cto . C

Enetor

76 Fiid A

Given P

(Round to the neare

T Find

AIP

acceptable.

O8929

0.7972

07118

0 6355

0.5674

0 5066

0.4523

0,4039

0 3606

10000

21200

O 8929

1.1200

0.5917

1

1.1200

1,0000

0.4717

16901

2 4018

1.2544

0 2963

0.4163

B3744

47798

1.4049

1.5735

1.7623

1.9738

3

30373

0.2092

0.3292

3.6048

4.1114

4.5638

0.2774

6.3528

8 1152

10.0390

12.2997

14 7757

0.1574

0.1232

0.0991

0.2432

6.

0.2191

7

2.2107

0.0813

0.2013

4.9676

5.3282

5.6502

8

2.4760

0.1877

0.1770

0.0677

6.

2.7731

0.3220

17.5487

0.0570

10

3.1058

Print

Done

Transcribed Image Text:Determine the FW of the following engineering project when the MARR is 12% per year. Is the project acceptable?

Proposal A

$10,500

Investment cost

Expected life

Market (salvage) value

Annual receipts

6 years

- $1,100

$9,000

$4,500

Annual expenses

A negative market value means that there is a net cost to dispose of an asset.

Click the icon to view the interest and annuity table for discrete compounding when the MARR Is 12% per year

The FW of the following engineering project is S (Round to the nearest dollar.)

According to the FW Decision Rule the project

V acceptable.

is

is not

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning