Determine the outstanding principal of the given mortgage. (Assume monthly interest payments and compounding periods.) HINT [See Example 7.] a $100,000, 25-year, 4.3% mortgage after 10 years

Determine the outstanding principal of the given mortgage. (Assume monthly interest payments and compounding periods.) HINT [See Example 7.] a $100,000, 25-year, 4.3% mortgage after 10 years

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

100%

![Determine the outstanding principal of the given mortgage. (Assume monthly interest payments and compounding periods.) HINT [See Example 7.]

a $100,000, 25-year, 4.3% mortgage after 10 years

Step 1

Note that this question asks us to find the outstanding principal, after the first 10 years, on a 25-year, $100,000 mortgage.

The present value formula can be used to calculate the outstanding principal on a mortgage, but to use this formula, the monthly payment on the mortgage must be known.

¡

P√ [₁=(₁^²+0²"]

¸1 − (1 + i)¯n¸

To calculate the monthly payment PMT on a mortgage valued at PV dollars for n periods at an int est rate of i per period, use the formula PMT = PV|

The given mortgage is $100,000, so PV = 100000

100,000

The 4.3% annual interest rate as a decimal is 0.043, so the monthly interest rate is i =

12

0.043

12

If the investment is for 25 years with monthly payments, then the number of pay periods is n = 25. 12 = 300

300](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fcde950f0-76bf-49b0-beb1-b0472364554b%2Faf88a969-e83b-4eed-a36d-cbeae331777a%2Flxbrnrs_processed.png&w=3840&q=75)

Transcribed Image Text:Determine the outstanding principal of the given mortgage. (Assume monthly interest payments and compounding periods.) HINT [See Example 7.]

a $100,000, 25-year, 4.3% mortgage after 10 years

Step 1

Note that this question asks us to find the outstanding principal, after the first 10 years, on a 25-year, $100,000 mortgage.

The present value formula can be used to calculate the outstanding principal on a mortgage, but to use this formula, the monthly payment on the mortgage must be known.

¡

P√ [₁=(₁^²+0²"]

¸1 − (1 + i)¯n¸

To calculate the monthly payment PMT on a mortgage valued at PV dollars for n periods at an int est rate of i per period, use the formula PMT = PV|

The given mortgage is $100,000, so PV = 100000

100,000

The 4.3% annual interest rate as a decimal is 0.043, so the monthly interest rate is i =

12

0.043

12

If the investment is for 25 years with monthly payments, then the number of pay periods is n = 25. 12 = 300

300

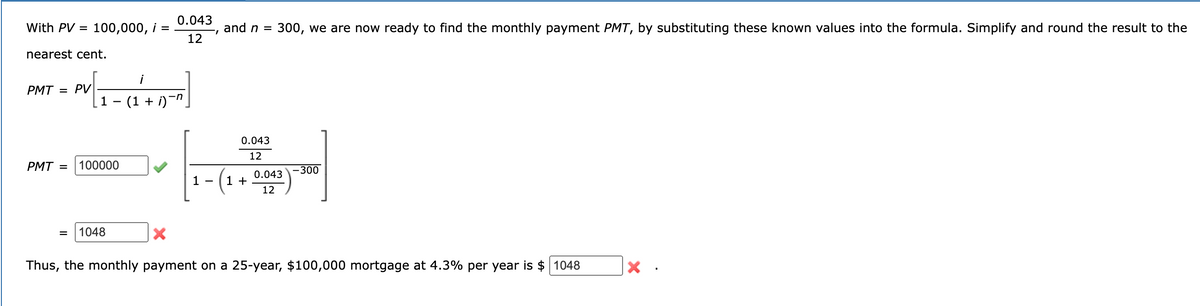

Transcribed Image Text:With PV = 100,000, i =

nearest cent.

PMT = PV

PMT =

1

100000

= 1048

0.043

12

i

-n

(1 + i)¬^

1

I

and n =

300, we are now ready to find the monthly payment PMT, by substituting these known values into the formula. Simplify and round the result to the

0.043

12

1 +

0.043

12

-300

X

Thus, the monthly payment on a 25-year, $100,000 mortgage at 4.3% per year is $ 1048

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,