Determine the present worth of the following cash flows if the interest rate is 4% per year: Year End Cash Flow ($) 0 1 2 3 4 - $11,000 - $23,000 $38,000 $50,000 - $2,000 Discrete Compounding; i = 4% Single Payment Uniform Series Compound Compound Amount Present Amount Factor Worth Factor Factor Present Worth Factor Sinking Fund Capital Recovery Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P N F/P P/F F/A P/A A/F A/P 1 1.0400 0.9615 1.0000 0.9615 1.0000 1.0400 2 1.0816 0.9246 2.0400 1.8861 0.4902 0.5302 3 1.1249 0.8890 3.1216 2.7751 0.3203 0.3603 4 1.1699 0.8548 4.2465 3.6299 0.2355 0.2755 5 1.2167 0.8219 5.4163 4.4518 0.1846 0.2246 6 1.2653 0.7903 6.6330 5.2421 0.1508 0.1908 7 1.3159 0.7599 7.8983 6.0021 0.1266 0.1666 8 1.3686 0.7307 9.2142 6.7327 0.1085 0.1485 9 1.4233 0.7026 10.5828 7.4353 0.0945 0.1345 10 1.4802 0.6756 12.0061 8.1109 0.0833 0.1233 11 1.5395 0.6496 13.4864 8.7605 0.0741 0.1141 12 1.6010 0.6246 15.0258 9.3851 0.0666 0.1066 13 1.6651 0.6006 16.6268 9.9856 0.0601 0.1001 14 1.7317 0.5775 18.2919 10.5631 0.0547 0.0947 15 1.8009 0.5553 20.0236 11.1184 0.0499 0.0899 676222222233245 16 1.8730 0.5339 21.8245 11.6523 0.0458 0.0858 17 1.9479 0.5134 23.6975 12.1657 0.0422 0.0822 18 2.0258 0.4936 25.6454 12.6593 0.0390 0.0790 19 2.1068 0.4746 27.6712 13.1339 0.0361 0.0761 20 2.1911 0.4564 29.7781 13.5903 0.0336 0.0736 21 2.2788 0.4388 31.9692 14.0292 0.0313 0.0713 2.3699 0.4220 34.2480 14.4511 0.0292 0.0692 2.4647 0.4057 36.6179 14.8568 0.0273 0.0673 2.5633 0.3901 39.0826 15.2470 0.0256 0.0656 2.6658 0.3751 41.6459 15.6221 0.0240 0.0640 30 3.2434 0.3083 56.0849 17.2920 0.0178 0.0578 3.9461 0.2534 73.6522 18.6646 0.0136 0.0536 40 4.8010 0.2083 95.0255 19.7928 0.0105 0.0505 5.8412 0.1712 121.0294 20.7200 0.0083 0.0483 50 7.1067 0.1407 152.6671 21.4822 0.0066 0.0466

Determine the present worth of the following cash flows if the interest rate is 4% per year: Year End Cash Flow ($) 0 1 2 3 4 - $11,000 - $23,000 $38,000 $50,000 - $2,000 Discrete Compounding; i = 4% Single Payment Uniform Series Compound Compound Amount Present Amount Factor Worth Factor Factor Present Worth Factor Sinking Fund Capital Recovery Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given P Given F Given A Given A Given F Given P N F/P P/F F/A P/A A/F A/P 1 1.0400 0.9615 1.0000 0.9615 1.0000 1.0400 2 1.0816 0.9246 2.0400 1.8861 0.4902 0.5302 3 1.1249 0.8890 3.1216 2.7751 0.3203 0.3603 4 1.1699 0.8548 4.2465 3.6299 0.2355 0.2755 5 1.2167 0.8219 5.4163 4.4518 0.1846 0.2246 6 1.2653 0.7903 6.6330 5.2421 0.1508 0.1908 7 1.3159 0.7599 7.8983 6.0021 0.1266 0.1666 8 1.3686 0.7307 9.2142 6.7327 0.1085 0.1485 9 1.4233 0.7026 10.5828 7.4353 0.0945 0.1345 10 1.4802 0.6756 12.0061 8.1109 0.0833 0.1233 11 1.5395 0.6496 13.4864 8.7605 0.0741 0.1141 12 1.6010 0.6246 15.0258 9.3851 0.0666 0.1066 13 1.6651 0.6006 16.6268 9.9856 0.0601 0.1001 14 1.7317 0.5775 18.2919 10.5631 0.0547 0.0947 15 1.8009 0.5553 20.0236 11.1184 0.0499 0.0899 676222222233245 16 1.8730 0.5339 21.8245 11.6523 0.0458 0.0858 17 1.9479 0.5134 23.6975 12.1657 0.0422 0.0822 18 2.0258 0.4936 25.6454 12.6593 0.0390 0.0790 19 2.1068 0.4746 27.6712 13.1339 0.0361 0.0761 20 2.1911 0.4564 29.7781 13.5903 0.0336 0.0736 21 2.2788 0.4388 31.9692 14.0292 0.0313 0.0713 2.3699 0.4220 34.2480 14.4511 0.0292 0.0692 2.4647 0.4057 36.6179 14.8568 0.0273 0.0673 2.5633 0.3901 39.0826 15.2470 0.0256 0.0656 2.6658 0.3751 41.6459 15.6221 0.0240 0.0640 30 3.2434 0.3083 56.0849 17.2920 0.0178 0.0578 3.9461 0.2534 73.6522 18.6646 0.0136 0.0536 40 4.8010 0.2083 95.0255 19.7928 0.0105 0.0505 5.8412 0.1712 121.0294 20.7200 0.0083 0.0483 50 7.1067 0.1407 152.6671 21.4822 0.0066 0.0466

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

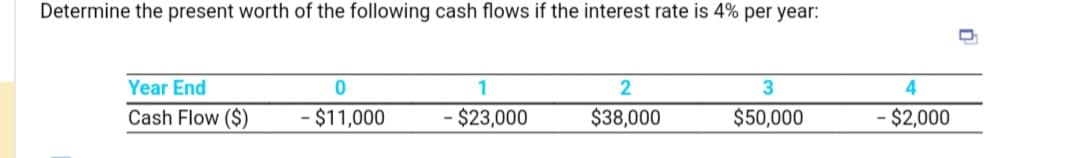

Determine the present worth of the following cash flows if the interest rate is 4% per year:

Transcribed Image Text:Determine the present worth of the following cash flows if the interest rate is 4% per year:

Year End

Cash Flow ($)

0

1

2

3

4

- $11,000

- $23,000

$38,000

$50,000

- $2,000

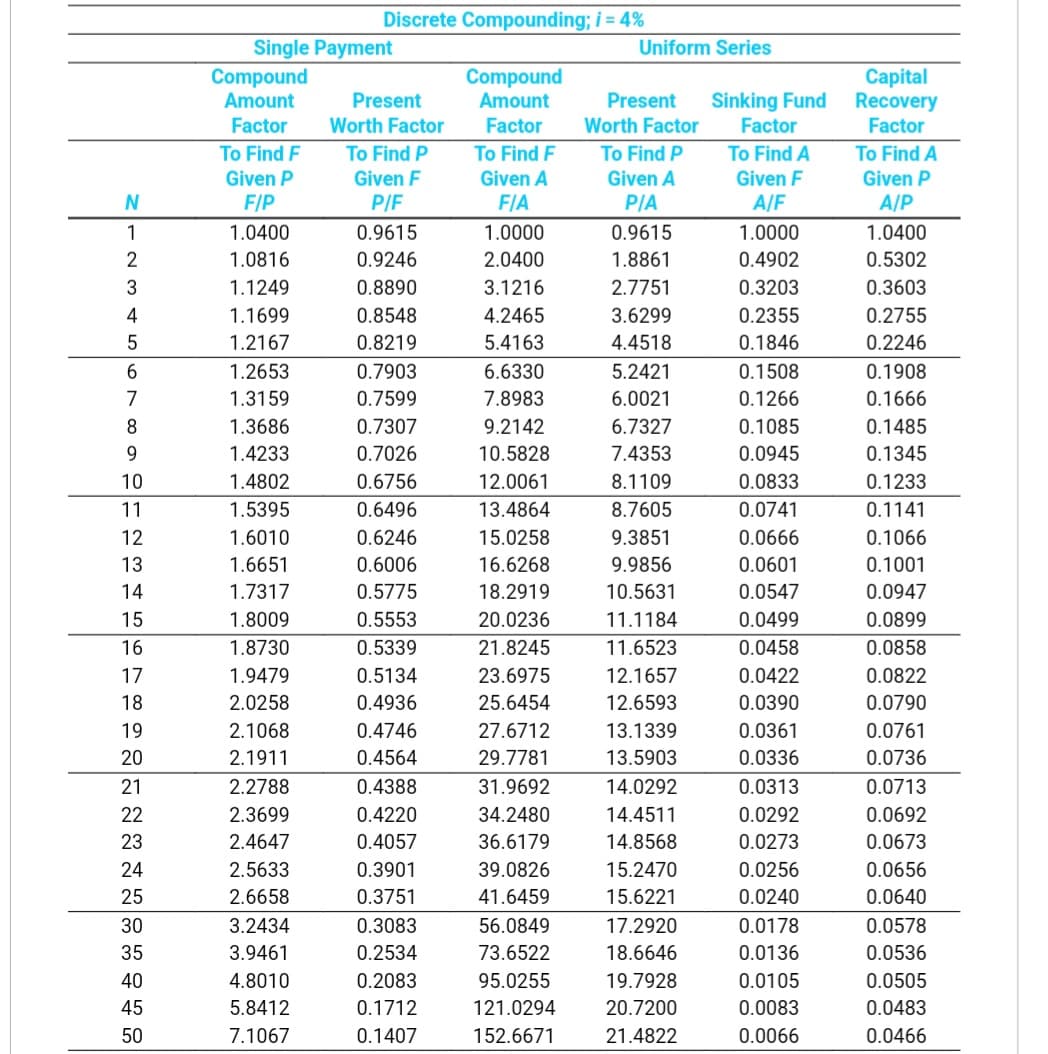

Transcribed Image Text:Discrete Compounding; i = 4%

Single Payment

Uniform Series

Compound

Compound

Amount

Present

Amount

Factor

Worth Factor

Factor

Present

Worth Factor

Sinking Fund

Capital

Recovery

Factor

Factor

To Find F

To Find P

To Find F

To Find P

To Find A

To Find A

Given P

Given F

Given A

Given A

Given F

Given P

N

F/P

P/F

F/A

P/A

A/F

A/P

1

1.0400

0.9615

1.0000

0.9615

1.0000

1.0400

2

1.0816

0.9246

2.0400

1.8861

0.4902

0.5302

3

1.1249

0.8890

3.1216

2.7751

0.3203

0.3603

4

1.1699

0.8548

4.2465

3.6299

0.2355

0.2755

5

1.2167

0.8219

5.4163

4.4518

0.1846

0.2246

6

1.2653

0.7903

6.6330

5.2421

0.1508

0.1908

7

1.3159

0.7599

7.8983

6.0021

0.1266

0.1666

8

1.3686

0.7307

9.2142

6.7327

0.1085

0.1485

9

1.4233

0.7026

10.5828

7.4353

0.0945

0.1345

10

1.4802

0.6756

12.0061

8.1109

0.0833

0.1233

11

1.5395

0.6496

13.4864

8.7605

0.0741

0.1141

12

1.6010

0.6246

15.0258

9.3851

0.0666

0.1066

13

1.6651

0.6006

16.6268

9.9856

0.0601

0.1001

14

1.7317

0.5775

18.2919

10.5631

0.0547

0.0947

15

1.8009

0.5553

20.0236

11.1184

0.0499

0.0899

676222222233245

16

1.8730

0.5339

21.8245

11.6523

0.0458

0.0858

17

1.9479

0.5134

23.6975

12.1657

0.0422

0.0822

18

2.0258

0.4936

25.6454

12.6593

0.0390

0.0790

19

2.1068

0.4746

27.6712

13.1339

0.0361

0.0761

20

2.1911

0.4564

29.7781

13.5903

0.0336

0.0736

21

2.2788

0.4388

31.9692

14.0292

0.0313

0.0713

2.3699

0.4220

34.2480

14.4511

0.0292

0.0692

2.4647

0.4057

36.6179

14.8568

0.0273

0.0673

2.5633

0.3901

39.0826

15.2470

0.0256

0.0656

2.6658

0.3751

41.6459

15.6221

0.0240

0.0640

30

3.2434

0.3083

56.0849

17.2920

0.0178

0.0578

3.9461

0.2534

73.6522

18.6646

0.0136

0.0536

40

4.8010

0.2083

95.0255

19.7928

0.0105

0.0505

5.8412

0.1712

121.0294

20.7200

0.0083

0.0483

50

7.1067

0.1407

152.6671

21.4822

0.0066

0.0466

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 1 steps

Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education