Determine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places) in each of the following cases. Use the tax tables to determine tax liability. Case 1: Married taxpayers, taxable income of $36,162: Case 2: Single taxpayer, taxable income of $66,829:

Determine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places) in each of the following cases. Use the tax tables to determine tax liability. Case 1: Married taxpayers, taxable income of $36,162: Case 2: Single taxpayer, taxable income of $66,829:

Chapter3: Computing The Tax

Section: Chapter Questions

Problem 37P

Related questions

Question

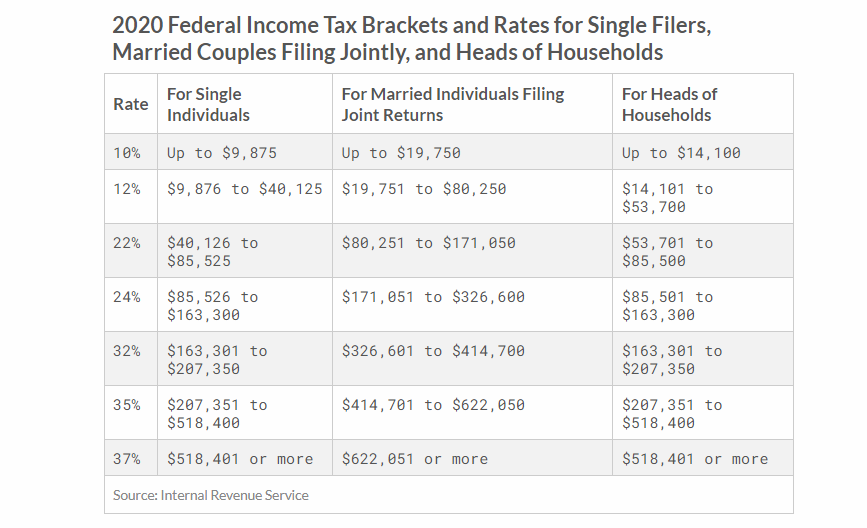

Determine the tax liability, marginal tax rate, and average tax rate (rounded to two decimal places) in each of the following cases. Use the tax tables to determine tax liability.

Case 1: Married taxpayers, taxable income of $36,162:

Case 2: Single taxpayer, taxable income of $66,829:

Transcribed Image Text:2020 Federal lIncome Tax Brackets and Rates for Single Filers,

Married Couples Filing Jointly, and Heads of Households

For Single

Individuals

For Married Individuals Filing

Joint Returns

For Heads of

Households

Rate

10%

Up to $9,875

Up to $19,75

Up to $14,100

$9,876 to $40,125 $19,751 to $80,250

$14,101 to

$53,700

12%

$40,126 to

$85, 525

$53,701 to

$85,500

22%

$80,251 to $171,050

$85, 526 to

$163,300

$171,051 to $326,600

$85, 501 to

$163,300

24%

$163,301 to

$207,350

$326, 601 to $414,700

32%

$163,301 to

$207,350

$207,351 to

$518,400

$414,701 to $622,050

$207,351 to

$518, 400

35%

37%

$518,401 or more

$622,051 or more

$518, 401 or more

Source: Internal Revenue Service

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning