If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17%, calculate the amount of tax liability for 2018 for all taxpayers. How does this amount differ from the actual liability?

If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17%, calculate the amount of tax liability for 2018 for all taxpayers. How does this amount differ from the actual liability?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 42BE: Accrued Income Taxes Nolan Inc. had taxable income of $400,000 in 2019. Its effective tax rate is...

Related questions

Question

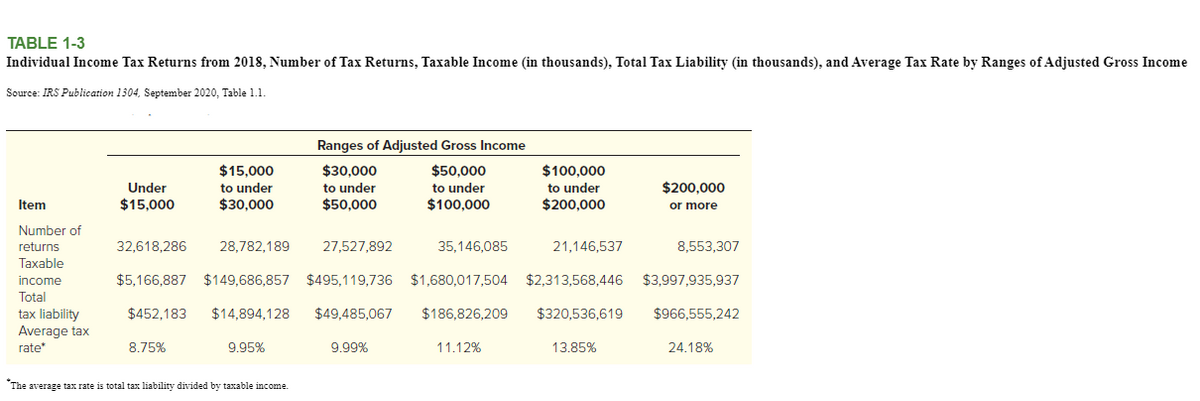

Use the information in Table 1-3. If the federal tax system was changed to a proportional tax rate structure with a tax rate of 17%, calculate the amount of tax liability for 2018 for all taxpayers. How does this amount differ from the actual liability?

Graded on the following: Calculates tax liability for yearly taxpayers indicating how amounts differ from the actual liability.

Transcribed Image Text:TABLE 1-3

Individual Income Tax Returns from 2018, Number of Tax Returns, Taxable Income (in thousands), Total Tax Liability (in thousands), and Average Tax Rate by Ranges of Adjusted Gross Income

Source: IRS Publication 1304, September 2020, Table 1.1

Ranges of Adjusted Gross Income

$15,000

$30,000

$50,000

$100,000

to under

$200,000

Under

to under

to under

to under

$200,000

Item

$15,000

$30,000

$50,000

$100,000

or more

Number of

returns

Taxable

32,618,286

28,782,189

27,527,892

35,146,085

21,146,537

8,553,307

income

$5,166,887 $149,686,857 $495,119,736

$1,680,017,504

$2,313,568,446

$3,997,935,937

Total

$966,555,242

tax liability

Average tax

rate

$452.183

$14,894,128

$49,485,067

$186,826,209

$320,536,619

8.75%

9.95%

9.99%

11.12%

13.85%

24.18%

The average tax rate is total tax liability divided by taxable income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT