The following needs to explain further the steps in determining the income tax. Jse the space provided for your answer. Step 1 is to identity the taxpaying party or "entity to which the tax computation formula applies. Step 2 is to determine the taxpayer's "gross income". Step 3 is to determine the expenses and certain other items that can be "deducted" in computing the taxpayer's "taxable income". Step 4 is to apply the appropriate "tax rate" to the taxpayer's taxable income to find the "tax due". Step 5 is to subtract any applicable "tax credits/payments" from the taxpayer's tax due in finding the "tax payable". Step 6 is to increase the tax by "penalties and interests" to obtain the "total amount payable".

The following needs to explain further the steps in determining the income tax. Jse the space provided for your answer. Step 1 is to identity the taxpaying party or "entity to which the tax computation formula applies. Step 2 is to determine the taxpayer's "gross income". Step 3 is to determine the expenses and certain other items that can be "deducted" in computing the taxpayer's "taxable income". Step 4 is to apply the appropriate "tax rate" to the taxpayer's taxable income to find the "tax due". Step 5 is to subtract any applicable "tax credits/payments" from the taxpayer's tax due in finding the "tax payable". Step 6 is to increase the tax by "penalties and interests" to obtain the "total amount payable".

Chapter16: Tax Research

Section: Chapter Questions

Problem 41P

Related questions

Question

Explain further the steps in determining the income tax.

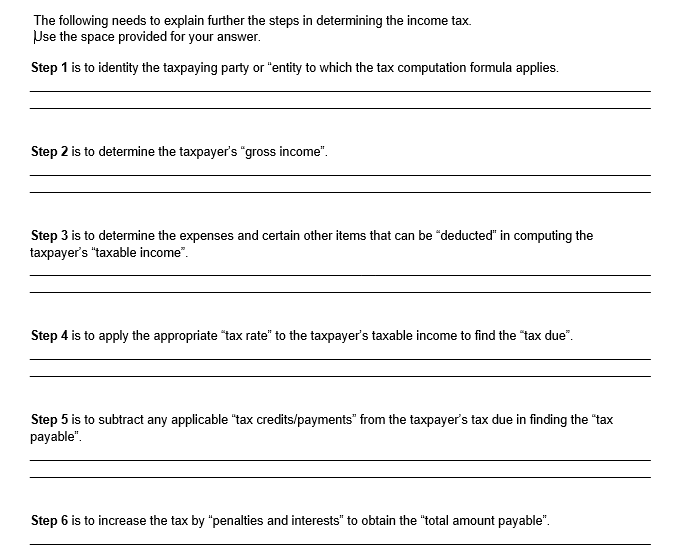

Transcribed Image Text:The following needs to explain further the steps in determining the income tax.

Use the space provided for your answer.

Step 1 is to identity the taxpaying party or "entity to which the tax computation formula applies.

Step 2 is to determine the taxpayer's "gross income".

Step 3 is to determine the expenses and certain other items that can be "deducted" in computing the

taxpayer's "taxable income".

Step 4 is to apply the appropriate "tax rate" to the taxpayer's taxable income to find the "tax due".

Step 5 is to subtract any applicable "tax credits/payments" from the taxpayer's tax due in finding the "tax

payable".

Step 6 is to increase the tax by "penalties and interests" to obtain the "total amount payable".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT