Determine the total amount of assets expected to be converted into cash in one year or less. Determine the total amount of long term assets. Determine total current liabilities.

Determine the total amount of assets expected to be converted into cash in one year or less. Determine the total amount of long term assets. Determine total current liabilities.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter14: Financial Statement Analysis

Section: Chapter Questions

Problem 14.1BE: Horizontal analysis The comparative accounts payable and long-term debt balances for a company...

Related questions

Question

4.

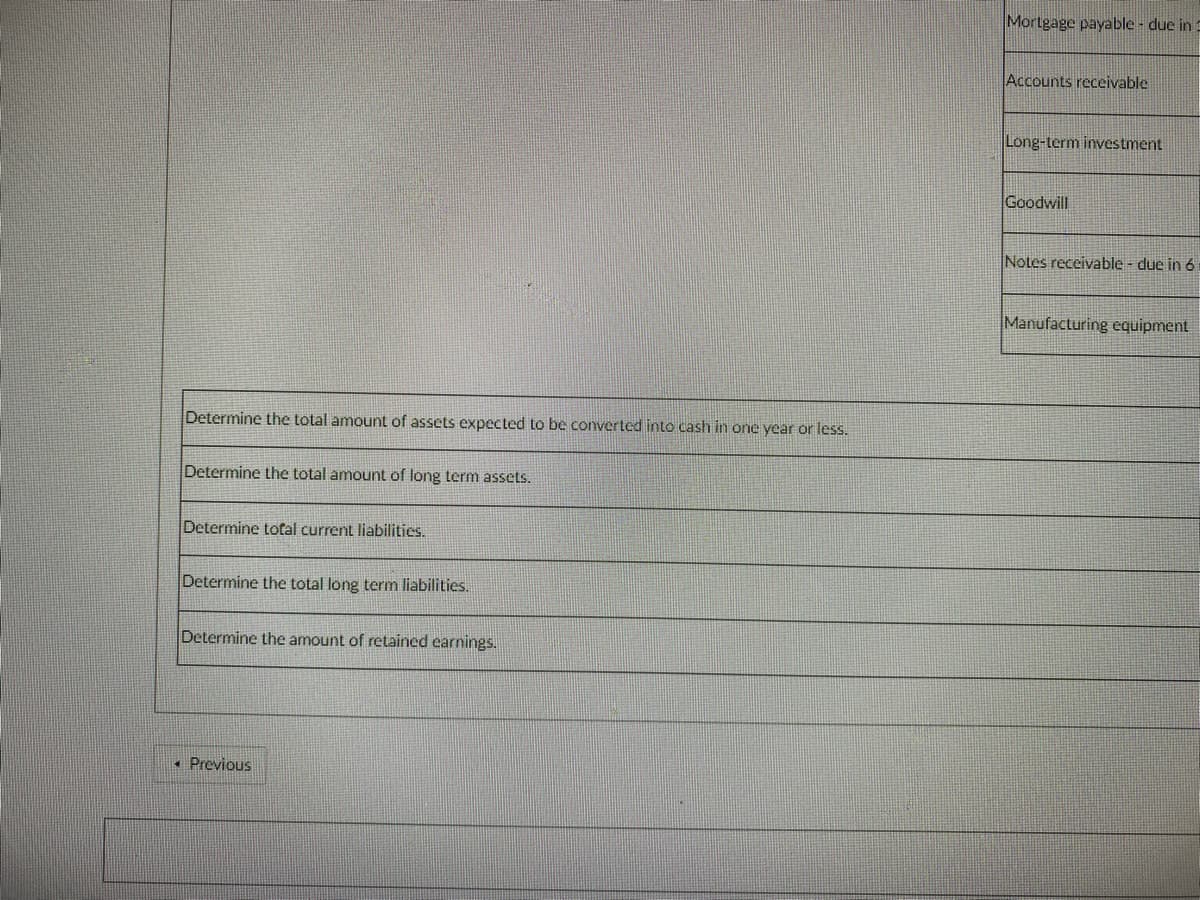

Transcribed Image Text:Mortgage payable - due in :

Accounts receivable

Long-term investment

Goodwill

Notes receivable - due in 6

Manufacturing equipment

Determine the total amount of assets expected to be converted into cash in one year or less.

Determine the total amount of long term assets.

Determine total current liabilities.

Determine the total long term liabilities.

Determine the amount of retained earnings.

• Previous

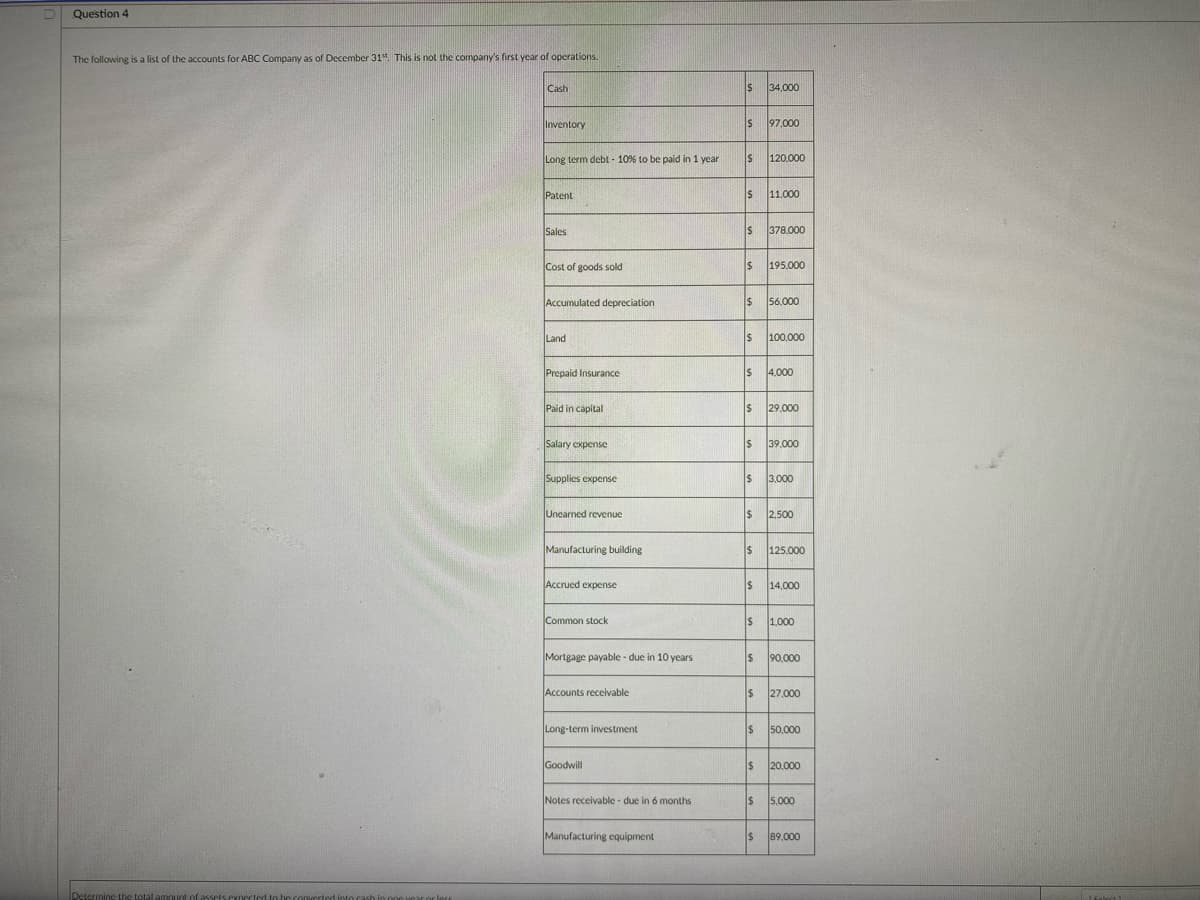

Transcribed Image Text:Question 4

The following is a list of the accounts for ABC Company as of December 31. This is not the company's first year of operations.

Cash

34,000

Inventory

97,000

Long term debt - 10% to be paid in 1 year

120000

Patent

S

11,000

Sales

IS

378.000

Cost of goods sold

195.000

Accumulated depreciation

56.000

Land

100,000

Prepaid Insurance

IS

4.000

Paid in capital

29.000

Salary expense

39.000

Supplies expense

3,000

Unearned revenue

2,500

Manufacturing building

IS

125.000

Accrued expense

14,000

Common stock

1.000

Mortgage payable - due in 10 years

IS

90.000

Accounts receivable

27.000

Long-term investment

24

50,000

Goodwill

24

20.000

Notes receivable - due in 6 months

24

5.000

Manufacturing cquipment

89,000

Determine the total amount of assels expected to be comverted into cash in one voar or lort

Saloct 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning