Prepare a statement of cash flows for the current year.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

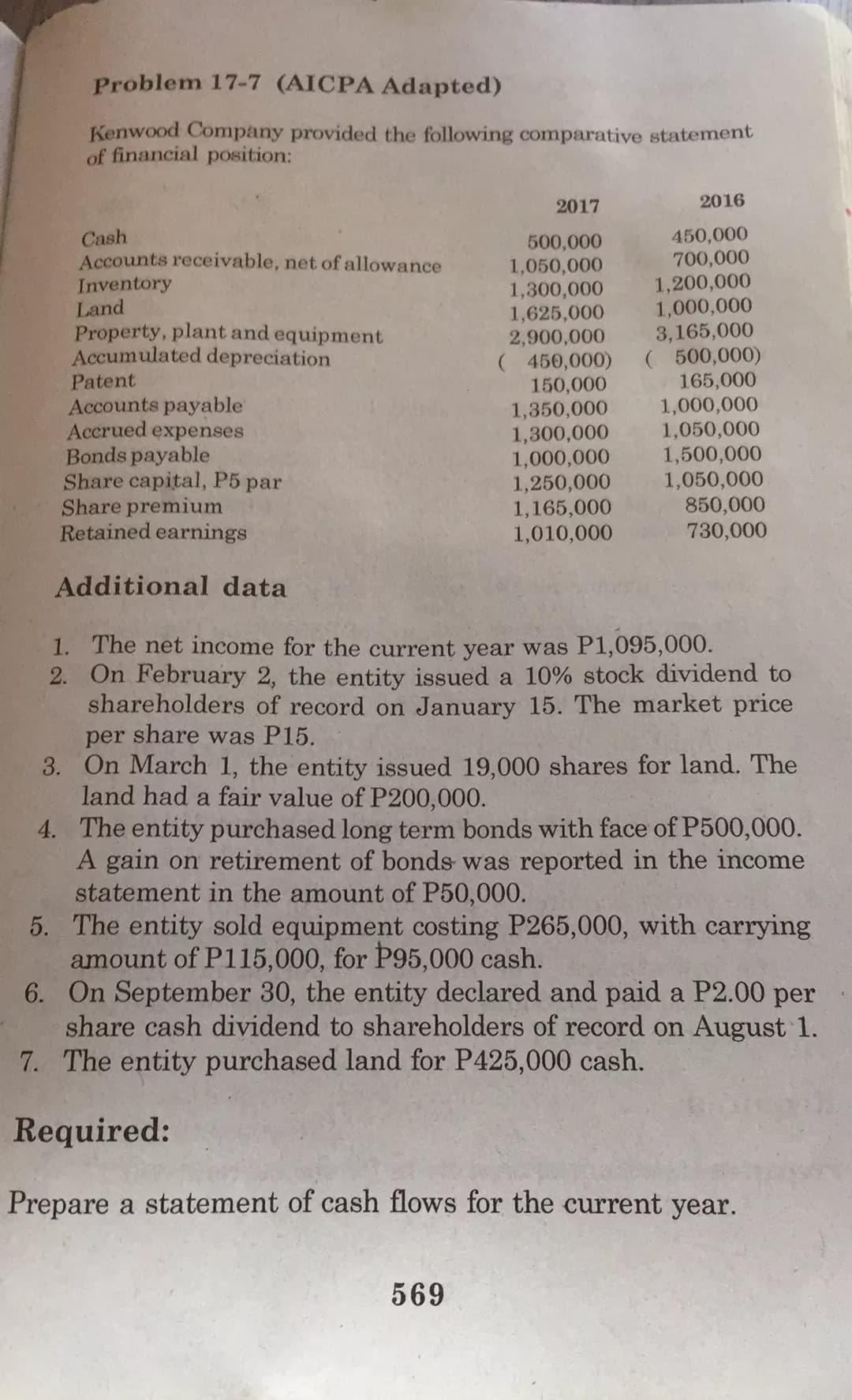

Transcribed Image Text:Problem 17-7 (AICPA Adapted)

Kenwood Company provided the following comparative statement

of financial position:

2017

2016

450,000

700,000

1,200,000

1,000,000

3,165,000

( 500,000)

165,000

1,000,000

1,050,000

1,500,000

1,050,000

850,000

730,000

Cash

Accounts receivable, net of allowance

Inventory

Land

Property, plant and equipment

Accumulated depreciation

500,000

1,050,000

1,300,000

1,625,000

2,900,000

( 450,000)

150,000

1,350,000

Patent

Accounts payable

Accrued expenses

Bonds payable

Share capital, P5 par

Share premium

Retained earnings

1,300,000

1,000,000

1,250,000

1,165,000

1,010,000

Additional data

1. The net income for the current year was P1,095,000.

2. On February 2, the entity issued a 10% stock dividend to

shareholders of record on January 15. The market price

per share was P15.

3. On March 1, the entity issued 19,000 shares for land. The

land had a fair value of P200,000.

4. The entity purchased long term bonds with face of P500,000.

A gain on retirement of bonds was reported in the income

statement in the amount of P50,000.

5. The entity sold equipment costing P265,000, with carrying

amount of P115,000, for P95,000 cash.

6. On September 30, the entity declared and paid a P2.00 per

share cash dividend to shareholders of record on August 1.

7. The entity purchased land for P425,000 cash.

Required:

Prepare a statement of cash flows for the current year.

569

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning