Prepare the statement of cash flows for the year ended 31 December 2020, using the indirect method.

Prepare the statement of cash flows for the year ended 31 December 2020, using the indirect method.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 90PSB

Related questions

Question

help

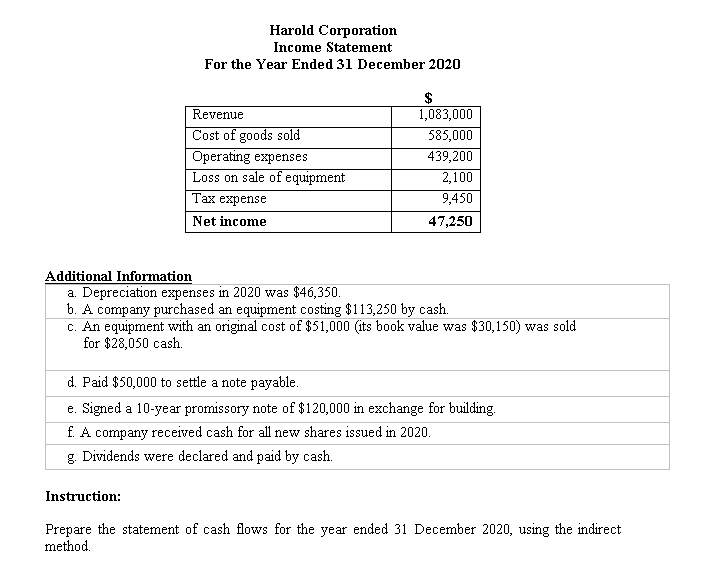

Transcribed Image Text:Harold Corporation

Income Statement

For the Year Ended 31 December 2020

$

1,083,000

Revenue

Cost of goods sold

Operating expenses

Loss on sale of equipment

Тах еxpense

585,000

439,200

2,100

9,450

Net income

47,250

Additional Information

a. Depreciation expenses in 2020 was $46,350.

b. A company purchased an equipment costing $113,250 by cash.

c. An equipment with an original cost of $51,000 (its book value was $30,150) was sold

for $28,050 cash.

d. Paid $50,000 to settle a note payable.

e. Signed a 10-year promissory note of $120,000 in exchange for building.

f. A company received cash for all new shares issued in 2020.

g. Dividends were declared and paid by cash.

Instruction:

Prepare the statement of cash flows for the year ended 31 December 2020, using the indirect

method.

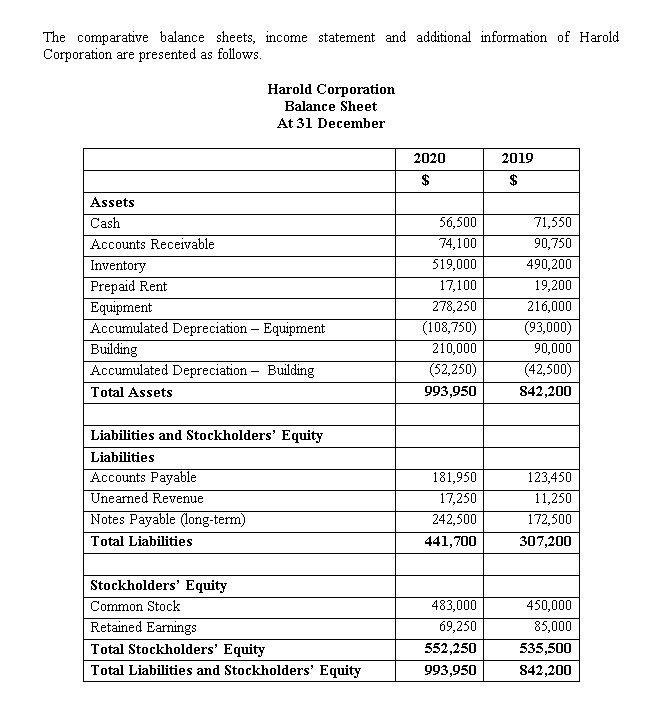

Transcribed Image Text:The comparative balance sheets, income statement and additional information of Harold

Corporation are presented as follows.

Harold Corporation

Balance Sheet

At 31 December

2020

2019

$

Assets

Cash

56,500

71,550

Accounts Receivable

74,100

90,750

Inventory

519,000

490,200

Prepaid Rent

Equipment

Accumulated Depreciation – Equipment

Building

Accumulated Depreciation - Building

17,100

19,200

278,250

(108,750)

216,000

(93,000)

90,000

(42,500)

210,000

(52,250)

Total Assets

993,950

842,200

Liabilities and Stockholders' Equity

Liabilities

Accounts Payable

Unearned Revenue

181,950

123,450

17,250

11,250

Notes Payable (long-term)

242,500

172,500

Total Liabilities

441,700

307,200

Stockholders' Equity

Common Stock

Retained Earnings

483,000

450,000

69,250

85,000

Total Stockholders' Equity

552,250

535,500

Total Liabilities and Stockholders' Equity

993,950

842,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning