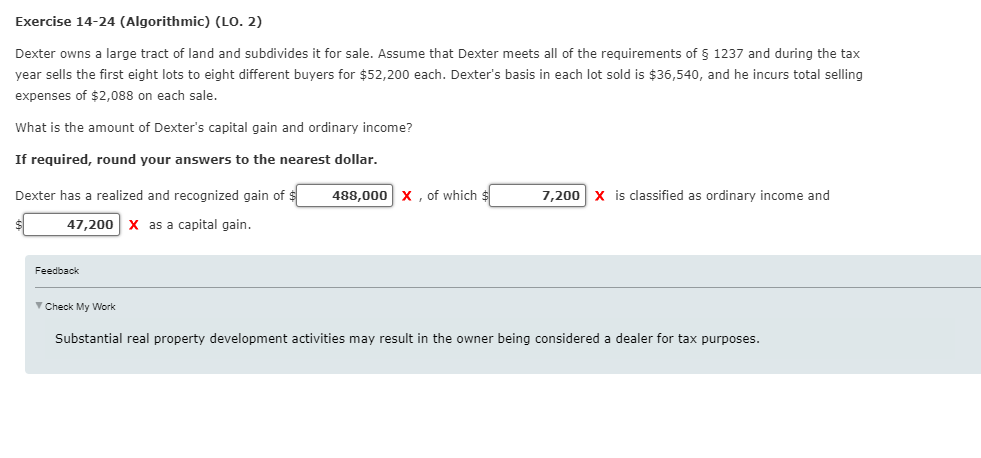

Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of § 1237 and during the tax year sells the first eight lots to eight different buyers for $52,200 each. Dexter's basis in each lot sold is $36,540, and he incurs total selling expenses of $2,088 on each sale. What is the amount of Dexter's capital gain and ordinary income? If required, round your answers to the nearest dollar. Dexter has a realized and recognized gain of $ 488,000 x , of which $ 7,200 x is classified as ordinary income and 47,200 x as a capital gain. Feedback

Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of § 1237 and during the tax year sells the first eight lots to eight different buyers for $52,200 each. Dexter's basis in each lot sold is $36,540, and he incurs total selling expenses of $2,088 on each sale. What is the amount of Dexter's capital gain and ordinary income? If required, round your answers to the nearest dollar. Dexter has a realized and recognized gain of $ 488,000 x , of which $ 7,200 x is classified as ordinary income and 47,200 x as a capital gain. Feedback

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 24CE

Related questions

Question

please help me resolve correctly

Transcribed Image Text:Exercise 14-24 (Algorithmic) (LO. 2)

Dexter owns a large tract of land and subdivides it for sale. Assume that Dexter meets all of the requirements of 5 1237 and during the tax

year sells the first eight lots to eight different buyers for $52,200 each. Dexter's basis in each lot sold is $36,540, and he incurs total selling

expenses of $2,088 on each sale.

What is the amount of Dexter's capital gain and ordinary income?

If required, round your answers to the nearest dollar.

Dexter has a realized and recognized gain of $

488,000 x , of which

7,200 x is classified as ordinary income and

47,200 x as a capital gain.

Feedback

Check My Work

Substantial real property development activities may result in the owner being considered a dealer for tax purposes.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT