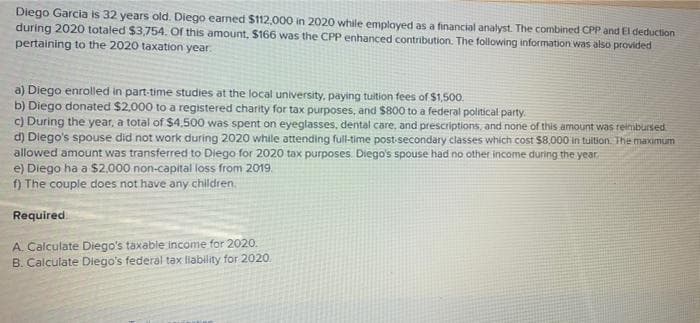

Diego Garcia is 32 years old. Diego earned $112,000 in 2020 while emplayed as a financial analyst. The combined CPP and El deduction during 2020 totaled $3,754. Of this amount, $166 was the CPP enhanced contribution. The following information was also provided pertaining to the 2020 taxation year. a) Diego enrolled in part-time studies at the local university, paying tuition fees of $1,500. b) Diego donated $2,000 to a registered charity for tax purposes, and $800 to a federal political party c) During the year, a total of S$4,500 was spent on eyeglasses, dental care, and prescriptions, and none of this amount was reimbursed d) Diego's spouse did not work during 2020 while attending full-time post-secondary classes which cost $8.000 in tuition. The maximum allowed amount was transferred to Diego for 2020 tax purposes. Diego's spouse had no other income during the year e) Diego ha a $2,000 non-capital loss from 2019. ) The couple does not have any children. Required A. Calculate Diego's taxable income for 2020. B. Calculate Diego's federal tax liability for 2020.

Diego Garcia is 32 years old. Diego earned $112,000 in 2020 while emplayed as a financial analyst. The combined CPP and El deduction during 2020 totaled $3,754. Of this amount, $166 was the CPP enhanced contribution. The following information was also provided pertaining to the 2020 taxation year. a) Diego enrolled in part-time studies at the local university, paying tuition fees of $1,500. b) Diego donated $2,000 to a registered charity for tax purposes, and $800 to a federal political party c) During the year, a total of S$4,500 was spent on eyeglasses, dental care, and prescriptions, and none of this amount was reimbursed d) Diego's spouse did not work during 2020 while attending full-time post-secondary classes which cost $8.000 in tuition. The maximum allowed amount was transferred to Diego for 2020 tax purposes. Diego's spouse had no other income during the year e) Diego ha a $2,000 non-capital loss from 2019. ) The couple does not have any children. Required A. Calculate Diego's taxable income for 2020. B. Calculate Diego's federal tax liability for 2020.

Chapter10: Deduct Ions And Losses: Certain Itemized Deduct Ions

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:Diego Garcia is 32 years old. Diego earned $112,000 in 2020 while emplayed as a financial analyst. The combined CPP and El deduction

during 2020 totaled $3,754. Of this amount, $166 was the CPP enhanced contribution. The following information was also provided

pertaining to the 2020 taxation year.

a) Diego enrolled in part-time studies at the local university, paying tuition fees of $1,500.

b) Diego donated $2.000 to a registered charity for tax purposes, and $800 to a federal political party.

c) During the year, a total of S4,500 was spent on eyeglasses, dental care, and prescriptions, and none of this amount was reimbursed

d) Diego's spouse did not work during 2020 while attending full-time post-secondary classes which cost $8.000 in tuition. The maximum

allowed amount was transferred to Diego for 2020 tax purposes Diego's spouse had no other income during the year.

e) Diego ha a $2,000 non-capital loss from 2019.

f) The couple does not have any children.

Required

A. Calculate Diego's taxable income for 2020.

B. Calculate Diego's federal tax liability for 2020.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT