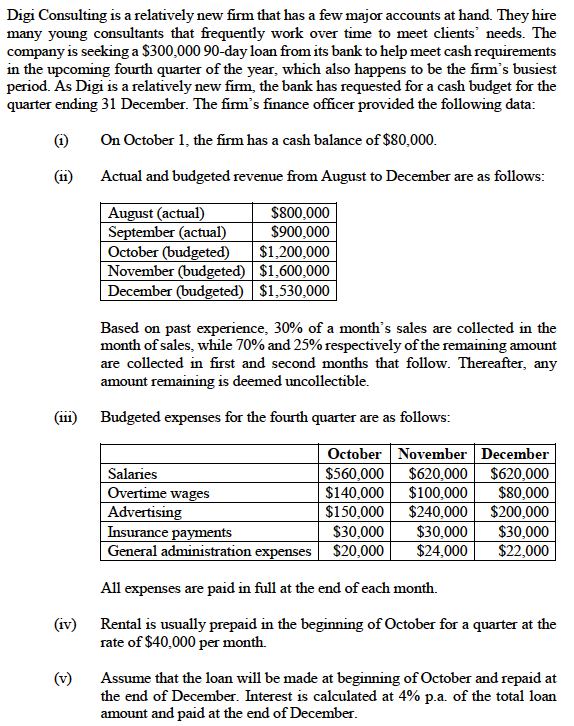

Digi Consulting is a relatively new firm that has a few major accounts at hand. They hire many young consultants that frequently work over time to meet clients' needs. The company is seeking a $300,000 90-day loan from its bank to help meet cash requirements in the upcoming fourth quarter of the year, which also happens to be the firm's busiest period. As Digi is a relatively new firm, the bank has requested for a cash budget for the quarter ending 31 December. The firm's finance officer provided the following data: (1) On October 1, the firm has a cash balance of $80,000. Actual and budgeted revenue from August to December are as follows: August (actual) $800,000 September (actual) $900,000 October (budgeted) $1,200,000 November (budgeted) $1,600,000 December (budgeted) $1,530,000 Based on past experience, 30% of a month's sales are collected in the month of sales, while 70% and 25% respectively of the remaining amount are collected in first and second months that follow. Thereafter, any amount remaining is deemed uncollectible. (iii) Budgeted expenses for the fourth quarter are as follows: (v) Salaries Overtime wages October November December $560,000 $620,000 $620,000 $140,000 $100,000 $80,000 $150,000 $240,000 $200,000 $30,000 $30,000 $24,000 $22,000 Advertising Insurance payments $30,000 General administration expenses $20,000 All expenses are paid in full at the end of each month. (iv) Rental is usually prepaid in the beginning of October for a quarter at the rate of $40,000 per month. Assume that the loan will be made at beginning of October and repaid at the end of December. Interest is calculated at 4% p.a. of the total loan amount and paid at the end of December.

Digi Consulting is a relatively new firm that has a few major accounts at hand. They hire many young consultants that frequently work over time to meet clients' needs. The company is seeking a $300,000 90-day loan from its bank to help meet cash requirements in the upcoming fourth quarter of the year, which also happens to be the firm's busiest period. As Digi is a relatively new firm, the bank has requested for a cash budget for the quarter ending 31 December. The firm's finance officer provided the following data: (1) On October 1, the firm has a cash balance of $80,000. Actual and budgeted revenue from August to December are as follows: August (actual) $800,000 September (actual) $900,000 October (budgeted) $1,200,000 November (budgeted) $1,600,000 December (budgeted) $1,530,000 Based on past experience, 30% of a month's sales are collected in the month of sales, while 70% and 25% respectively of the remaining amount are collected in first and second months that follow. Thereafter, any amount remaining is deemed uncollectible. (iii) Budgeted expenses for the fourth quarter are as follows: (v) Salaries Overtime wages October November December $560,000 $620,000 $620,000 $140,000 $100,000 $80,000 $150,000 $240,000 $200,000 $30,000 $30,000 $24,000 $22,000 Advertising Insurance payments $30,000 General administration expenses $20,000 All expenses are paid in full at the end of each month. (iv) Rental is usually prepaid in the beginning of October for a quarter at the rate of $40,000 per month. Assume that the loan will be made at beginning of October and repaid at the end of December. Interest is calculated at 4% p.a. of the total loan amount and paid at the end of December.

Chapter17: The Management Of Cash And Marketable Securities

Section: Chapter Questions

Problem 2P

Related questions

Question

100%

(a) Prepare a schedule of expected cash collections for October, November and December and for the quarter in total.

(b) Prepare a

(c) The company is considering a dividend payout of $300,000 to shareholders. If the company needs to maintain a minimum cash balance of $100,000 for operating purposes, propose and explain the month for which dividend payment should be planned.

please do not provide solution in image format thank you!

Transcribed Image Text:Digi Consulting is a relatively new firm that has a few major accounts at hand. They hire

many young consultants that frequently work over time to meet clients' needs. The

company is seeking a $300,000 90-day loan from its bank to help meet cash requirements

in the upcoming fourth quarter of the year, which also happens to be the firm's busiest

period. As Digi is a relatively new firm, the bank has requested for a cash budget for the

quarter ending 31 December. The firm's finance officer provided the following data:

On October 1, the firm has a cash balance of $80,000.

Actual and budgeted revenue from August to December are as follows:

August (actual)

$800,000

September (actual)

$900,000

October (budgeted)

(1)

(11)

$1,200,000

November (budgeted)

$1,600,000

December (budgeted) $1,530,000

(v)

Based on past experience, 30% of a month's sales are collected in the

month of sales, while 70% and 25% respectively of the remaining amount

are collected in first and second months that follow. Thereafter, any

amount remaining is deemed uncollectible.

Budgeted expenses for the fourth quarter are as follows:

October November December

$560,000 $620,000 $620,000

$100,000

$140,000

$80,000

$150,000 $240,000

$200,000

$30,000 $30,000 $30,000

$24,000

$22,000

Salaries

Overtime wages

Advertising

Insurance payments

General administration expenses $20,000

All expenses are paid in full at the end of each month.

(iv) Rental is usually prepaid in the beginning of October for a quarter at the

rate of $40,000 per month.

Assume that the loan will be made at beginning of October and repaid at

the end of December. Interest is calculated at 4% p.a. of the total loan

amount and paid at the end of December.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning