a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales. 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense g. Cost of goods sold. Required: 1. Compute the tax effects and after-tax amounts of the three items labeled pretax. Loss from operating a discontinued segment Correction of overstatement of prior year's sales Pretax 19,250 17,000 40% Tax Effect 7,700 6.800 Debit $ 35,000 26,850 107,400 19,250 53,000 17,000 24,750 2 492,500 After-Tax 11,550 10 2001 Credit $ 15,000 45,000 72,600 45,000 176,500 30,120 1,008,500 39,000 Check my work

a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation-Equipment g. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings i. Loss from operating a discontinued segment (pretax) j. Gain on insurance recovery of tornado damage k. Net sales. 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretax) n. Gain on sale of discontinued segment's assets (pretax) o. Loss from settlement of lawsuit p. Income tax expense g. Cost of goods sold. Required: 1. Compute the tax effects and after-tax amounts of the three items labeled pretax. Loss from operating a discontinued segment Correction of overstatement of prior year's sales Pretax 19,250 17,000 40% Tax Effect 7,700 6.800 Debit $ 35,000 26,850 107,400 19,250 53,000 17,000 24,750 2 492,500 After-Tax 11,550 10 2001 Credit $ 15,000 45,000 72,600 45,000 176,500 30,120 1,008,500 39,000 Check my work

Chapter9: Adjusting Entries

Section: Chapter Questions

Problem 1M

Related questions

Question

Please do not give solution in image format ? And Fast Answering Please ? And Explain Proper Step by Step.

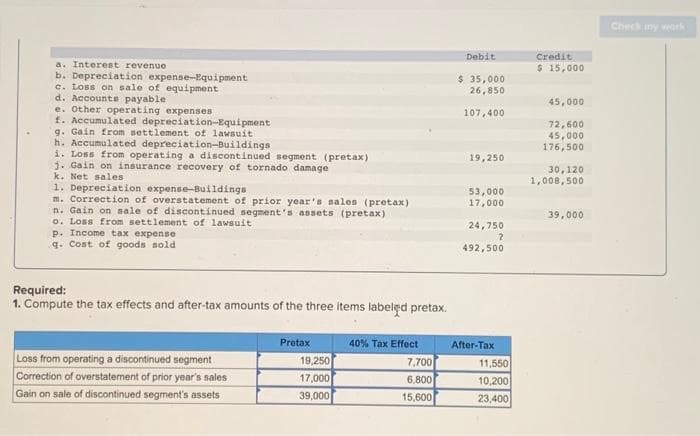

Transcribed Image Text:a. Interest revenue

b. Depreciation expense-Equipment

c. Loss on sale of equipment

d. Accounts payable.

e. Other operating expenses

f. Accumulated depreciation-Equipment

g. Gain from settlement of lawsuit

h. Accumulated depreciation-Buildings

i. Loss from operating a discontinued segment (pretax)

j. Gain on insurance recovery of tornado damage

k. Net sales.

1. Depreciation expense-Buildings

m. Correction of overstatement of prior year's sales (pretax)

n. Gain on sale of discontinued segment's assets (pretax)

o. Loss from settlement of lawsuit

p. Income tax expense

g. Cost of goods sold

Required:

1. Compute the tax effects and after-tax amounts of the three items labeled pretax.

Loss from operating a discontinued segment

Correction of overstatement of prior year's sales

Gain on sale of discontinued segment's assets

Pretax

19,250

17,000

39,000

40% Tax Effect

7,700

6,800

15,600

Debit

$ 35,000

26,850

107,400

19,250

53,000

17,000

24,750

2

492,500

After-Tax

11,550

10,200

23,400

Credit

$ 15,000

45,000

72,600

45,000

176,500

30,120

1,008,500

39,000

Check my work

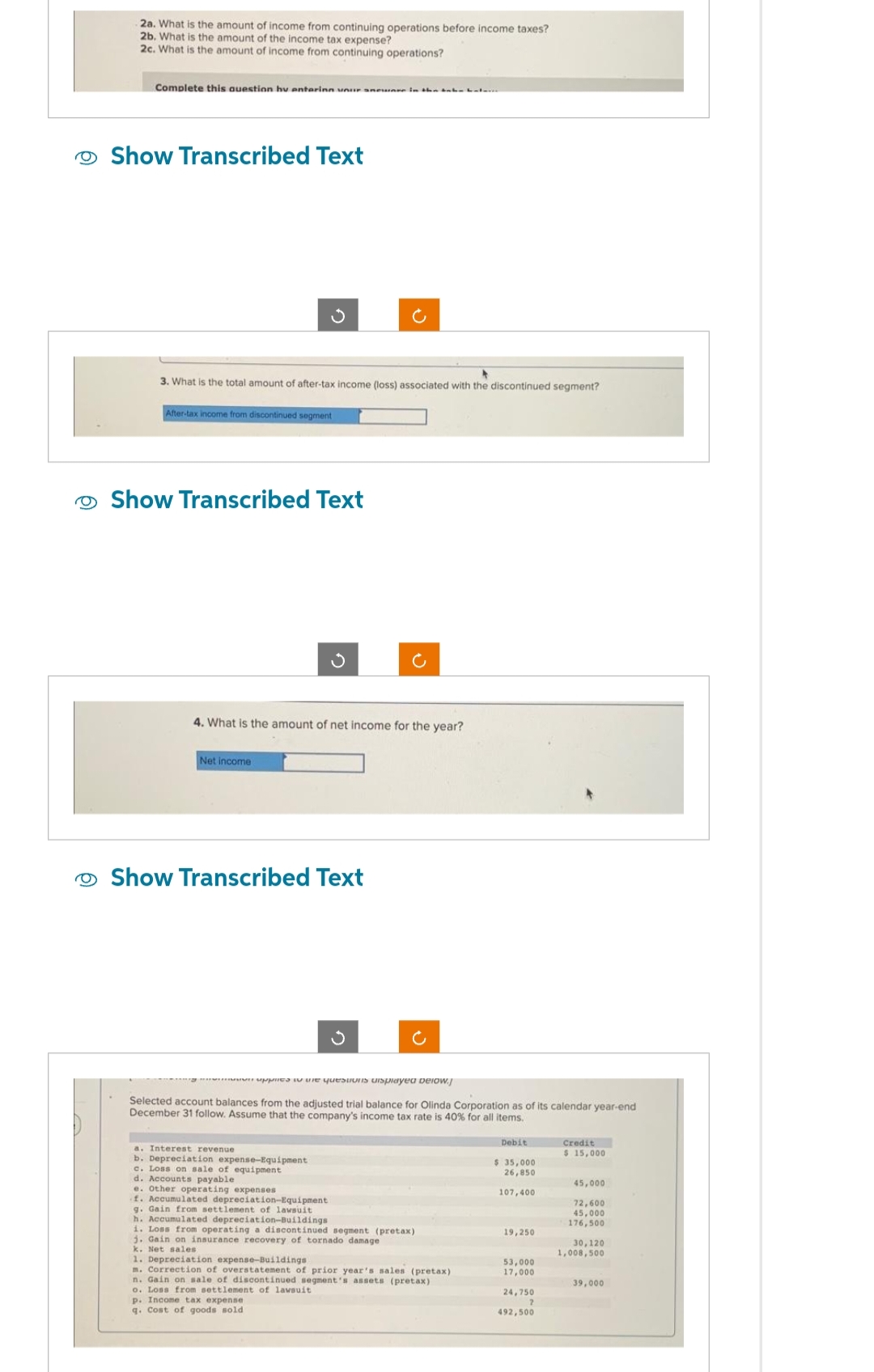

Transcribed Image Text:2a. What is the amount of income from continuing operations before income taxes?

2b. What is the amount of the income tax expense?

2c. What is the amount of income from continuing operations?

Complete this question hy entering your aneware in the babe hat...

Show Transcribed Text

3. What is the total amount of after-tax income (loss) associated with the discontinued segment?

After-tax income from discontinued segment

Show Transcribed Text

4. What is the amount of net income for the year?

Net income

Show Transcribed Text

supplied to the customis displayed below.

Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end

December 31 follow. Assume that the company's income tax rate is 40% for all items.

a. Interest revenue

b. Depreciation expense-Equipment

c. Loss on sale of equipment

d. Accounts payable.

e. Other operating expenses

f. Accumulated depreciation-Equipment

g. Gain from settlement of lawsuit

h. Accumulated depreciation-Buildings

i. Loss from operating a discontinued segment (pretax)

j. Gain on insurance recovery of tornado damage

k. Net sales

1. Depreciation expense-Buildings.

m. Correction of overstatement of prior year's sales (pretax)

n. Gain on sale of discontinued segment's assets (pretax)

o. Lons from settlement of lawsuit

p. Income tax expense

q. Cost of goods sold

Debit

$ 35,000

26,850

107,400

19,250

53,000

17,000

24,750

2

492,500

Credit

$ 15,000

45,000

72,600

45,000

176,500

30,120

1,008,500

39,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning